Eversource 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 0 1 0 A N N U A L R E P O R T

a legacy of leadership. a promise of growth.

Table of contents

-

Page 1

a legacy of leadership. a promise of growth. 2010 ANNUAL REPORT -

Page 2

... merge with Boston-based NSTAR to ensure our position as New England's leading regional energy company, poised to better serve our customers by delivering on a promise of future growth. TABLE OF CONTENTS Financial Highlights Chairman's Message Trustees and Officers Form 10-K Shareholder Information... -

Page 3

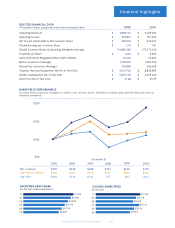

... Common Shares Outstanding (Weighted Average) Dividends per Share Sales of Electricity (Regulated Retail, KWH-millions) Electric Customers (Average) Natural Gas Customers (Average) Property, Plant and Equipment, Net (As of Year End) Market Capitalization (As of Year End) Share Price (As of Year End... -

Page 4

...m dn For Northeast Utilities (NU), 2010 was a year of significant achievement as we continued to successfully execute our strategic plan. Our performance has again demonstrated the strength of our strategy and our ability to excel under even the most challenging economic conditions. Shouldering the... -

Page 5

... shareholders by successfully completing multiple-year rate cases for The Connecticut Light and Power Company (CL&P), Public Service Company of New Hampshire (PSNH) and Western Massachusetts Electric Company (WMECo). And we delivered on our promise of value for Yankee Gas Services Company (Yankee... -

Page 6

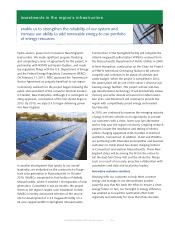

... solutions for the energy issues challenging our region. In 2010, we successfully reached key milestones for the Northern Pass project, a high-voltage, direct-current transmission line that will bring 1,200 megawatts of low-carbon, primarily northedst utilities 2010 dnnudl report | four -

Page 7

... authorization WMECo received from the Massachusetts Department of Public Utilities in 2009. In New Hampshire, construction on the Clean Air Project at PSNH's Merrimack Generating Station is 82 percent complete and continues to be ahead of schedule and under budget. When the project is completed... -

Page 8

...our electric operating companies received the Environmental Protection Agency's 2010 ENERGY STAR® Sustained Excellence Award as part of the Northeast Retail Products Initiative. Our region is our home Across the NU family of companies, whether in Connecticut, western Massachusetts or New Hampshire... -

Page 9

... we work to achieve future success. Sincerely, In addition, our operating companies and the Northeast Utilities Foundation provided $4.7 million in grants to nonprofit organizations and worthwhile regional activities across our tri-state service area in 2010. Positioning NU for the future 2010 was... -

Page 10

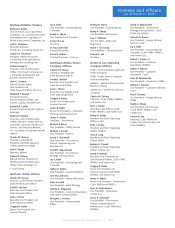

... The Connecticut Light and Power Company PSNH - Public Service Company of New Hampshire WMECo - Western Massachusetts Electric Company Yankee Gas - Yankee Gas Services Company Charles W. Shivery Chairman, CL&P, PSNH, WMECo and Yankee Gas Leon J. Olivier Chief Executive Officer, CL&P, PSNH, WMECo and... -

Page 11

...; Address; and Telephone Number NORTHEAST UTILITIES (a Massachusetts voluntary association) One Federal Street Building 111-4 Springfield, Massachusetts 01105 Telephone: (413) 785-5871 THE CONNECTICUT LIGHT AND POWER COMPANY (a Connecticut corporation) 107 Selden Street Berlin, Connecticut 06037... -

Page 12

... filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one): Large Accelerated Filer Northeast Utilities The Connecticut Light and Power Company Public Service Company of New Hampshire Western Massachusetts Electric Company 9 9 9 9 Accelerated Filer Non-accelerated Filer No No -

Page 13

... 30, 2010. Northeast Utilities holds all of the 6,035,205 shares, 301 shares, and 434,653 shares of the outstanding common stock of The Connecticut Light and Power Company, Public Service Company of New Hampshire and Western Massachusetts Electric Company, respectively. Indicate the number of shares... -

Page 14

... of NU Enterprises Western Massachusetts Electric Company Yankee Energy System, Inc. Yankee Gas Services Company PSNH Regulated companies RRR SECI Select Energy SESI WMECO Yankee Yankee Gas REGULATORS: CDEP DOE EPA DPU DPUC FERC MA DEP NHPUC SEC USDEP OTHER: 2010 Healthcare Act 2010 Tax Act... -

Page 15

... Default Energy Service Employee Stock Ownership Plan Employee Stock Purchase Plan Financial Accounting Standards Board Fitch Ratings Federally Mandated Congestion Charge Financial Transmission Rights Accounting principles generally accepted in the United States of America Greenhouse Gas Generation... -

Page 16

... Cost Adjustment Mechanism Transmission Service Agreement The United Illuminating Company Variable interest entity The construction of a 16-mile gas pipeline between Waterbury and Wallingford, Connecticut and the increase of vaporization output of Yankee Gas' LNG plant Yankee Atomic Electric Company... -

Page 17

NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY 2010 Form 10-K Annual Report Table of Contents Part I Item 1. Business Page 2 14 19 19 20 22 Item 1A. Risk Factors Item 1B. Unresolved Staff Comments Item 2. ... -

Page 18

NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 References in this Annual Report on Form 10-K to "NU," "we," "our," and "us" ... -

Page 19

NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY PART I Item 1. Business Please refer to the Glossary of Terms for definitions of defined terms and abbreviations used in this Annual Report on Form 10-K. ... -

Page 20

... electricity in Connecticut, New Hampshire and western Massachusetts, respectively, plus PSNH's regulated electric generation business and WMECO's solar generation. The following table shows the sources of 2010 electric franchise retail revenues for NU's electric distribution companies, collectively... -

Page 21

... to competitive energy suppliers. Because this customer migration is only for energy supply service, it has no impact on CL&P's delivery business or its operating income. Distribution Rates: On June 30, 2010, the DPUC issued a final order in CL&P's most recent retail rate case approving annualized... -

Page 22

... of securities, standards of service, management efficiency and construction and operation of facilities. PSNH's ES rate recovers its generation and purchased power costs from customers on a current basis and allows for an ROE of 9.81 percent on its generation investment. Under New Hampshire... -

Page 23

... competitive New England wholesale power market. PSNH expects to meet its load requirements in 2011 in a similar manner. WESTERN MASSACHUSETTS ELECTRIC COMPANY - DISTRIBUTION WMECO's distribution business consists primarily of the purchase, delivery and sale of electricity to residential, commercial... -

Page 24

... constructed solar generation) and purchases its energy requirements from a variety of competitive sources through periodic RFPs. For basic service power supply, WMECO issues RFPs periodically, consistent with DPU regulations. REGULATED GAS DISTRIBUTION - YANKEE GAS SERVICES COMPANY Yankee Gas... -

Page 25

...Fuel Gas Supply Corporation, Transcontinental Gas Pipeline Company, and Texas Eastern Transmission, L.P. pipelines. Yankee Gas considers such transportation arrangements adequate for its needs. ELECTRIC TRANSMISSION General CL&P, PSNH and WMECO and most other New England utilities, generation owners... -

Page 26

... placed in service in late 2013 at a cost of approximately $795 million. CL&P is designing and building the Interstate Reliability Project in coordination with National Grid USA, whose segment of this phase will interconnect with CL&P's at the Connecticut-Rhode Island border. In August 2010, ISO-NE... -

Page 27

... by price differences between the cost of natural gas with respect to home heating oil, natural gas supply, new home construction, road reconstruction, regulatory mandates and business requirements. Excluding non-recurring major projects, NU expects that approximately 28 percent of Yankee Gas... -

Page 28

... in the long-term storage of their spent nuclear fuel. Each Yankee Company collects decommissioning and closure costs through wholesale FERC-approved rates charged under power purchase agreements with CL&P, PSNH and WMECO and several other New England utilities. These companies in turn recover these... -

Page 29

... CL&P is permitted to pass any costs incurred in complying with RPS on to customers through rates. Massachusetts' RPS program required electricity suppliers to meet a one percent renewable energy standard in 2003 and has a goal of 15 percent by 2015. For 2010, the requirement was five percent. WMECO... -

Page 30

... hydroelectric generating stations with a current claimed capability representing winter rates of approximately 71 MW, eight of which are licensed by the FERC under long-term licenses that expire on varying dates from 2017 through 2047. PSNH and its hydroelectric projects are subject to conditions... -

Page 31

... and are covered by 11 union agreements. INTERNET INFORMATION Our website address is www.nu.com. We make available through our website a link to the SEC's EDGAR website (http://www.sec.gov/edgar/searchedgar/companysearch.html), at which site NU's, CL&P's, WMECO's and PSNH's Annual Reports on Form 10... -

Page 32

... Massachusetts, the DPU has required WMECO to adopt full decoupling in its January 31, 2011 rate decision. At this time it is uncertain what impact these decoupling mechanisms will have on our companies. As a way to promote self-generation and reduce energy costs, Connecticut, Massachusetts, and New... -

Page 33

... electric or gas rate relief and/or by requiring surcharges to customer bills to support state programs not related to the utilities or energy policy. Such increases could pressure overall rates to our customers and our routine requests to regulators for rate relief. In addition, CL&P and WMECO... -

Page 34

... at this time. The impact of these additional costs to customers could lead to a further reduction in energy consumption resulting in a decline in electricity and gas sales in our service territories, which would have an adverse impact on our business and financial position, results of operations or... -

Page 35

...the company's interests. These conditions or changes could also delay or increase the cost of the merger or limit the net income or financial prospects of the combined company. We will be subject to business uncertainties and contractual restrictions while the merger is pending. The work required to... -

Page 36

.... As of December 31, 2010, WMECO owned the following electric generating plant: Number of Units 1 unit Year Installed 2010 Claimed Capability** (kilowatts) 1,800,000 Type of Plant Total - Solar Fixed Tilt, Photovoltaic ** Claimed capability represents the direct current nameplate capacity of the... -

Page 37

... territories and issued a report to the Massachusetts Legislature recommending against, in this regard, any changes to the restructuring legislation. Yankee Gas. Yankee Gas holds valid franchises to sell gas in the areas in which Yankee Gas supplies gas service, which it acquired either directly... -

Page 38

...CL&P and Yankee Gas (the NU Companies) filed a complaint against UGI Utilities, Inc. (UGI) in the U.S. District Court for the District of Connecticut seeking past and future remediation costs related to historic MGP operations on thirteen sites currently or formerly owned by the NU Companies (Yankee... -

Page 39

...* David R. McHale Leon J. Olivier James B. Robb* Charles W. Shivery Age 41 53 59 50 62 50 65 Title Vice President - Accounting and Controller. Senior Vice President and General Counsel. Vice President - Human Resources of NUSCO. Executive Vice President and Chief Financial Officer of NU. Executive... -

Page 40

...Board of Trustees declared a dividend of 23.75 cents per share, payable on March 31, 2009 to shareholders of record as of March 1, 2009. Information with respect to dividend restrictions for us, CL&P, PSNH, and WMECO is contained in Item 7, Management's Discussion and Analysis of Financial Condition... -

Page 41

...for Long-Term Debt. Market price information reflects closing prices as reflected by the New York Stock Exchange. Common Shareholders' Equity adjusted for goodwill and intangibles divided by total common shares outstanding. Net Income divided by the average change in Common Shareholders' Equity. The... -

Page 42

...116,200 14,264 2010 2009 2008 2007 2006 Operating Revenues Net Income Cash Dividends on Common Stock Property, Plant and Equipment, Net Total Assets Rate Reduction Bonds Long-Term Debt (a) Obligations Under Capital Leases (a) WMECO Selected Consolidated Financial Data (Unaudited) (Thousands of... -

Page 43

... in a tax-free exchange. The post-transaction company will provide electric and natural gas energy delivery service to approximately 3.5 million electric and natural gas customers through six regulated electric and natural gas utilities in Connecticut, Massachusetts and New Hampshire, representing... -

Page 44

... competitive businesses are factored into the NU parent and other companies' results. This projection assumes we will operate on a stand-alone basis in 2011, although our proposed merger with NSTAR is expected to close in the second half of 2011. We project a compound average annual EPS growth rate... -

Page 45

... availability on our revolving credit lines, as compared to $702.8 million as of December 31, 2009. We issued $145 million of new long-term debt in 2010, consisting of $95 million by WMECO and $50 million by Yankee Gas. Additionally, CL&P remarketed $62 million of tax-exempt PCRBs. In 2011, in... -

Page 46

...: 2010 (Millions of Dollars, except per share amounts) Net Income Attributable to Controlling Interests (GAAP) Regulated Companies Competitive Businesses NU Parent and Other Companies Non-GAAP Earnings Non-Recurring Tax Settlements Merger-Related Costs (after-tax) Litigation Charge (after-tax) Net... -

Page 47

... its authorized regulatory ROE of 10.1 percent. For the distribution segment of our Regulated companies, a summary of changes in CL&P, PSNH and WMECO retail electric GWh sales and Yankee Gas firm natural gas sales for 2010 as compared to 2009 on an actual and weather normalized basis (using a 30year... -

Page 48

...Competitive Businesses: NU Enterprises, which continues to manage to completion Select Energy's remaining wholesale marketing contracts and to manage its electrical contracting business and other operating and maintenance services contracts, earned $8.3 million, or $0.05 per share, in 2010, compared... -

Page 49

... rate on these short-term borrowings as of December 31, 2010 was 2.85 percent, which is based on a variable rate plus an applicable margin based on NU parent's credit ratings. Our credit facilities and indentures require that NU parent and certain of its subsidiaries, including CL&P, PSNH and WMECO... -

Page 50

... respective operating cash flows in 2011 when compared to 2010. A summary of the current credit ratings and outlooks by Moody's, S&P and Fitch for senior unsecured debt of NU parent and WMECO and senior secured debt of CL&P and PSNH is as follows: Moody's Current Outlook Current S&P Outlook Current... -

Page 51

... at PSNH and Yankee Gas, and an increase in Other of $26.9 million primarily related to technology and facility projects at NUSCO, one of our corporate service companies. These increases were offset by a $46.8 million decrease in transmission segment capital expenditures primarily by CL&P. Business... -

Page 52

... would connect with enhancements National Grid USA is designing in Rhode Island and Massachusetts. In August 2010, ISO-NE reaffirmed the need for the Interstate Reliability Project, which is now expected to be placed in service in late 2015. This in-service date assumes that siting applications are... -

Page 53

...Green Communities Act, to install 6 MW of solar energy generation in its service territory at an estimated cost of $41 million by the end of 2012. In October 2010, WMECO completed construction of a 1.8 MW solar generation facility on a site in Pittsfield, Massachusetts. The full cost of this project... -

Page 54

... Total WMECO distribution Subtotal electric distribution PSNH generation: Clean air project Other Total PSNH generation WMECO generation Subtotal generation Yankee Gas distribution: Basic business Aging infrastructure Load growth WWL project Total Yankee Gas distribution Corporate service companies... -

Page 55

...heating oil, natural gas supply, new home construction, road reconstruction, regulatory mandates and business requirements. Actual capital expenditures could vary from the projected amounts for the companies and periods above. Economic conditions in the northeast could impact the timing of our major... -

Page 56

... of non-recoverable costs. In addition, as a result of the elimination of the tax deduction in 2010, NU was not able to recognize approximately $2 million of net annual benefits. On September 27, 2010, President Obama signed into law the Small Business Jobs and Credit Act of 2010, which extends the... -

Page 57

... pre-tax charge (approximately $3.5 million net of tax) was recorded in the 2008 earnings of CL&P, and an obligation to refund the $5.8 million to customers was established as of December 31, 2008. CL&P filed an appeal of this decision on February 26, 2009. On February 4, 2010, the Connecticut... -

Page 58

...cents per KWh and rates for large commercial and industrial customers decreased to 7.405 cents per KWh. The fixed price increased by 0.063 cents per KWh for street lighting customers to 5.822 cents per KWh. Transition Cost Reconciliation: On May 12, 2010, WMECO filed its 2009 cost reconciliation for... -

Page 59

... long-term salary growth rate, which impacts the estimated benefits that pension plan participants receive in the future. We used a compensation/progression rate of 3.5 percent and 4.0 percent as of December 31, 2010 and 2009, respectively. The 3.5 percent rate reflects our current expectation... -

Page 60

... and PBOP Plan's reported cost as a result of a change in the following assumptions by 50 basis points (in millions): As of December 31, Pension Plan Cost Postretirement Plan Cost 2010 2009 2010 2009 Assumption Change Lower long-term rate of return Lower discount rate Higher compensation increase... -

Page 61

... on external market conditions. The discount rate decreased in 2010, as compared to 2009, as a result of lower beta and risk-free treasury rates. Income Taxes: Income tax expense is estimated annually for each of the jurisdictions in which we operate. This process involves estimating current and... -

Page 62

...term debt maturities (c) Estimated interest payments on existing debt (d) Capital leases (e) Operating leases (e) (j) Funding of pension obligations (e) Funding of other postretirement benefit obligations (f) Estimated future annual companies costs (e) (h) Other purchase commitments (g) (i) Total CL... -

Page 63

...the plan's liabilities and long-term discount rates, and are subject to change. (j) RRB amounts are non-recourse to us, have no required payments over the next five years and are not included in this table. The Regulated companies' standard offer service contracts and default service contracts are... -

Page 64

RESULTS OF OPERATIONS - NORTHEAST UTILITIES AND SUBSIDIARIES The following table provides the amounts and variances in operating revenues and expense line items for the consolidated statements of income for NU included in this Annual Report on Form 10-K for the years ended December 31, 2010, 2009 ... -

Page 65

... of ES customer migration to third party electric suppliers, partially offset by higher retail sales at PSNH Lower basic/default service supply costs at WMECO Lower prices on purchased natural gas, partially offset by a lower net underrecovery in 2010 at Yankee Gas Increased competitive businesses... -

Page 66

... Increase/ 2009 2008 (Decrease) Percent (Millions of Dollars) Operating Revenues Operating Expenses: Fuel, Purchased and Net Interchange Power Other Operating Expenses Maintenance Depreciation Amortization of Regulatory Assets, Net Amortization of Rate Reduction Bonds Taxes Other Than Income Taxes... -

Page 67

...Lower prices on purchased natural gas at Yankee Gas An increased level of ES customer migration to third party electric suppliers and lower retail sales, partially offset by higher forward energy market prices at PSNH Lower basic/default service supply costs at WMECO Increased competitive businesses... -

Page 68

... segment expenses ($68 million). NU parent and other companies' expenses were lower by $49 million in 2009 due primarily to the absence of the $49.5 million payment resulting from the settlement of litigation made in 2008 ($29.8 million after-tax). Competitive businesses' expenses were lower by... -

Page 69

... with the implementation of a new customer service system (C2) completed in October 2008. [Results of Operations for each of CL&P, PSNH and WMECO are omitted from this report but are set forth in the Annual Report on Form 10-K for 2010 filed on a combined basis with NU with the SEC on February... -

Page 70

... our variable interest rate, annual interest expense would have increased by a pre-tax amount of $3.3 million. As of December 31, 2010, we maintained a fixed-to-floating interest rate swap at NU parent associated with $263 million of its fixed-rate long-term debt. Credit Risk Management: Credit risk... -

Page 71

... Counterparty Deposits," to the consolidated financial statements. Additional quantitative and qualitative disclosures about market risk are set forth in Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, included in this Annual Report on Form 10... -

Page 72

...[Page numbers reference the Annual Report on Form 10-K for 2010 filed on a combined basis with NU with the SEC on February 25, 2011.] NU Company Report on Internal Controls Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Financial Statements CL&P Company... -

Page 73

... of the accompanying consolidated financial statements of Northeast Utilities and subsidiaries (NU or the Company) and of other sections of this annual report. NU's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing... -

Page 74

... opinions. A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other... -

Page 75

...Fuel, Materials and Supplies Marketable Securities Derivative Assets Prepayments and Other Current Assets Total Current Assets Property, Plant and Equipment, Net Deferred Debits and Other Assets: Regulatory Assets Goodwill Marketable Securities Derivative Assets Other Long-Term Assets Total Deferred... -

Page 76

NORTHEAST UTILITIES AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS As of December 31, (Thousands of Dollars) LIABILITIES AND CAPITALIZATION Current Liabilities: Notes Payable to Banks Long-Term Debt - Current Portion Accounts Payable Obligations to Third Party Suppliers Accrued Taxes Accrued Interest ... -

Page 77

... Operating Expenses: Fuel, Purchased and Net Interchange Power Other Operating Expenses Maintenance Depreciation Amortization of Regulatory Assets, Net Amortization of Rate Reduction Bonds Taxes Other Than Income Taxes Total Operating Expenses Operating Income Interest Expense: Interest on Long-Term... -

Page 78

... Dollars) 2010 For the Years Ended December 31, 2009 2008 Net Income Other Comprehensive Income/(Loss), Net of Tax: Qualified Cash Flow Hedging Instruments Changes in Unrealized Gains/(Losses) on Other Securities Change in Funded Status of Pension, SERP and Other Postretirement Benefit Plans Other... -

Page 79

...of Benefits - ESOP ESOP Benefits from Treasury Shares Change in Restricted Shares, Net Change in Treasury Stock Tax Deduction for Stock Options Exercised and Employee Stock Purchase Plan Disqualifying Dispositions Capital Stock Expenses, Net Other Comprehensive Income Balance as of December 31, 2010... -

Page 80

... Purchases of Marketable Securities Other Investing Activities Net Cash Flows Used in Investing Activities Financing Activities: Issuance of Common Shares Cash Dividends on Common Shares Cash Dividends on Preferred Stock Increase/(Decrease) in Short-Term Debt Issuance of Long-Term Debt Retirements... -

Page 81

... notes are an integral part of these consolidated financial statements. [The 2010 financial statements for CL&P, PSNH and WMECO are omitted from this report but are set forth in the Annual Report on Form 10-K for 2010 filed on a combined basis with NU with the SEC on February 25, 2011. Such... -

Page 82

...of equals in a tax-free exchange. The post-transaction company will provide electric and natural gas energy delivery service to approximately 3.5 million electric and natural gas customers through six regulated electric and natural gas utilities in Connecticut, Massachusetts and New Hampshire. Under... -

Page 83

... Department of Public Service and the Maine Public Utilities Commission for PSNH, and the DPU for WMECO). Regulated Companies: CL&P, PSNH and WMECO furnish franchised retail electric service in Connecticut, New Hampshire and Massachusetts, respectively. Yankee Gas owns and operates Connecticut... -

Page 84

..., Net on the accompanying consolidated balance sheets, was as follows: (Millions of Dollars) As of December 31, 2010 2009 NU CL&P PSNH WMECO $ 39.8 17.2 6.8 6.0 $ 55.3 26.1 5.1 7.2 The DPUC allows CL&P and Yankee Gas to accelerate the recovery of uncollectible hardship accounts receivable... -

Page 85

NU, CL&P, PSNH and WMECO have established credit policies regarding counterparties to minimize overall credit risk. These policies require an evaluation of potential counterparties, financial condition, collateral requirements and the use of standardized agreements that allow for the netting of ... -

Page 86

... Net Interchange Power on the consolidated statements of income. For further information regarding derivative contracts of NU, CL&P, PSNH and WMECO and their accounting, see Note 4, "Derivative Instruments," to the consolidated financial statements. K. Marketable Securities NU Supplemental Benefit... -

Page 87

... certain costs as incurred. The tracking mechanisms allow for rates to be changed periodically, with overcollections refunded to customers or undercollections collected from customers in future periods. The Regulated companies record monthly, day ahead and real time energy purchases and sales net in... -

Page 88

... that NU recovers all of CL&P's, PSNH's and WMECO's regional and local revenue requirements as prescribed in the ISO-NE Tariff. Both the RNS and Schedule 21 - NU rates provide for the annual reconciliation and recovery/refund of estimated (or projected) costs to actual costs. The financial impacts... -

Page 89

... and $0.6 million, respectively, for NU (de minimis amounts for CL&P, PSNH and WMECO for all periods presented). The EIA incentives relate to incentives earned by Connecticut regulated companies from the construction of distributed generation, new large-scale generation and implementation of C&LM... -

Page 90

... services for NU, including CL&P, PSNH and WMECO. NUSCO provides centralized accounting, administrative, engineering, financial, information technology, legal, operational, planning, purchasing, and other services to NU's companies. RRR and Properties, Inc., two other NU subsidiaries, construct... -

Page 91

... as payables in December 2010 ($0.6 million for CL&P, $0.2 million for PSNH and $0.1 million for WMECO). NU did not make any contributions to the NU Foundation in 2009 and 2008. 2. REGULATORY ACCOUNTING The Regulated companies continue to be rate-regulated on a cost-of-service basis, therefore... -

Page 92

... to a major storm cost reserve. PSNH expects to request recovery of both the Medicare asset and the 2010 winter storm costs in 2011. Deferred Benefit Costs: NU's Pension, SERP, and PBOP Plans are accounted for in accordance with accounting guidance on defined benefit pension and other postretirement... -

Page 93

.... PSNH recovers the cost of C&LM programs and C&LM overcollections totaled $3.4 million and $4.4 million as of December 31, 2010 and 2009, respectively. WMECO Tracker Deferrals: The basic service rate allows WMECO to recover the costs of the procurement of energy for basic service. Basic service... -

Page 94

... The following tables summarize the NU, CL&P, PSNH, and WMECO investments in utility plant: As of December 31, 2010 2009 NU NU (Millions of Dollars) Distribution - Electric Distribution - Natural Gas Transmission Generation Electric and Natural Gas Utility Other (1) Total Property, Plant and... -

Page 95

... for the several classes of utility plant-in-service are equivalent to composite rates as follows: (Percent) 2010 2009 2008 NU CL&P PSNH WMECO 4. 2.7 2.7 2.8 2.8 DERIVATIVE INSTRUMENTS 2.9 3.0 2.7 2.9 3.0 3.1 2.7 2.8 The costs and benefits of derivative contracts that meet the definition of... -

Page 96

... sheets. WMECO mitigates the risks associated with the volatility of the prices of energy and energy-related products in procuring energy supply for its customers through the use of basic service contracts, which fix the price of electricity purchased for customers for periods of time ranging from... -

Page 97

...Related Price Price and Interest Required by and Supply Risk Supply Risk Rate Risk Regulation Management Management Management (Millions of Dollars) Collateral and Netting Net Amount Recorded as Derivative Asset/(Liability) Current Derivative Assets: Level 2: NU Parent Level 3: NU Enterprises CL... -

Page 98

... Price and Interest Required by Risk Supply Risk Rate Risk Regulation Management Management Management Collateral and Netting Net Amount Recorded as Derivative Asset/(Liability) Current Derivative Assets: Level 2: NU Parent Level 3: CL&P (3) PSNH Other Total Current Derivative Assets Long-Term... -

Page 99

...and manage price risk of its electricity delivery service obligations. These contracts are settled monthly. PSNH also has two energy call options that it received in exchange for assigning its transmission rights in a direct current transmission line. The options give PSNH the right to purchase a de... -

Page 100

... PSNH's electricity procurement contracts and NU Enterprises' electricity sourcing contracts, contain credit risk contingent features. These features require these companies or, in NU Enterprises' case, NU parent, to maintain investment grade credit ratings from the major rating agencies and... -

Page 101

... timing and likelihood of scheduled payments and also reflect nonperformance risk, including credit, using the default probability approach based on the counterparty's credit rating for assets and the company's credit rating for liabilities. Other Commodity Price and Supply Risk Management contracts... -

Page 102

... of Dollars) Amortized Cost Fair Value NU Supplemental Benefit Trust U.S. Government Issued Debt Securities (Agency and Treasury) Corporate Debt Securities Asset Backed Debt Securities Municipal Bonds Money Market Funds and Other Total NU Supplemental Benefit Trust WMECO Spent Nuclear Fuel Trust... -

Page 103

... for the NU supplemental benefit trust or WMECO spent nuclear fuel trust. Factors considered in determining whether a credit loss exists include the duration and severity of the impairment, adverse conditions specifically affecting the issuer, and the payment history, ratings and rating changes of... -

Page 104

... WMECO As of As of December 31, 2010 December 31, 2009 Level 1: Exchange Traded Funds High Yield Bond Fund Money Market Funds Total Level 1 Level 2: U.S. Government Issued Debt Securities (Agency and Treasury) Corporate Debt Securities Asset Backed Debt Securities Municipal Bonds Other Fixed Income... -

Page 105

...if an event occurs or circumstances change that would indicate that goodwill might be impaired, NU management would test the goodwill between the annual testing dates. Goodwill impairment is deemed to exist if the net book value of a reporting unit exceeds its estimated fair value and if the implied... -

Page 106

... as current liabilities as Notes Payable to Banks on the accompanying consolidated balance sheets, as management anticipates that all borrowings under these credit facilities will be outstanding for no more than 364 days at one time. Pool: NU Parent, CL&P, PSNH, WMECO, Yankee Gas and certain of NU... -

Page 107

... Tax Exempt, due 2028 One-Year Fixed Rate Tax Exempt, due 2031 (1) Total Pollution Control Notes Total First Mortgage Bonds and Pollution Control Notes Fees and Interest due for Spent Nuclear Fuel Disposal Costs Less Amounts due Within One Year (1) Unamortized Premiums and Discounts, Net Long-Term... -

Page 108

...satisfied by the deposit of cash or bonds. Essentially all utility plant of CL&P, PSNH and Yankee Gas is subject to the lien of each company's respective first mortgage bond indenture. The CL&P, PSNH and WMECO tax-exempt bonds contain call provisions providing call prices ranging between 100 percent... -

Page 109

... agent. The weighted average effective interest rate on PSNH's Series A variable-rate PCRBs was 0.34 percent in 2010 and 0.25 percent for 2009. NU's, including CL&P, PSNH and WMECO, long-term debt agreements provide that NU and certain of its subsidiaries must comply with certain financial and non... -

Page 110

...service requirements. For current employees and certain retirees, the total benefit is limited to two times the 1993 per st retiree health care cost. These costs are charged to expense over the estimated work life of the employee. NU uses a December 31 measurement date for the PBOP Plan. NU annually... -

Page 111

...: Pension Benefits 2010 2009 SERP Benefits 2010 2009 (Millions of Dollars) NU CL&P PSNH WMECO $ 2,512.2 864.9 395.8 177.0 $ 2,034.7 725.8 312.4 146.4 $ 38.9 3.4 2.1 0.4 $ 36.9 3.3 1.9 0.3 The Company amortizes the prior service cost on an individual subsidiary basis and unrecognized net... -

Page 112

... Benefit Costs Recorded as Regulatory Assets $ The estimates of the above amounts that are expected to be recognized as portions of net periodic benefit expense in 2011 are as follows: NU (Millions of Dollars) Pension Estimated Expense in 2011 SERP PBOP Net Actuarial Loss Prior Service Credit... -

Page 113

... actuarial assumptions were used in calculating the plans' year end funded status: As of December 31, Pension Benefits and SERP PBOP Benefits 2010 2009 2010 2009 Balance Sheets Discount Rate Compensation/Progression Rate Health Care Cost Trend Rate 5.57 % 3.50 % N/A 5.98 % 4.00 % N/A 5.28... -

Page 114

...effect on the amounts reported for the health care plans. The effect of changing the assumed health care cost trend rate by one percentage point for the year ended December 31, 2010 would have the following effects: (Millions of Dollars) NU One Percentage Point Increase One Percentage Point Decrease... -

Page 115

... are recorded at the net asset value provided by the asset manager, which is based on the market prices of the underlying equity securities. Swaps are valued using pricing models that incorporate interest rates and equity and fixed income index closing prices to determine a net present value of the... -

Page 116

... year's benefit payments. Contributions: Currently, NU's policy is to annually fund the Pension Plan in an amount at least equal to an amount that will satisfy the requirements of ERISA and the Internal Revenue Code. Due to the underfunded balance as of January 1, 2009, PSNH made a contribution... -

Page 117

..., as applicable, for shares issued or sold to NU, CL&P, PSNH, and WMECO employees and officers, as well as the allocation of costs associated with shares issued or sold to NUSCO employees and officers that support CL&P, PSNH, and WMECO. In accordance with accounting guidance for share-based payments... -

Page 118

...tax expense in excess of compensation expense totaling $0.9 million, $0.9 million and $1.6 million, respectively, increased cash flows from financing activities. NU Incentive Plan: Under the NU Incentive Plan, in which CL&P, PSNH and WMECO participate, NU is authorized to grant up to 4.5 million new... -

Page 119

... million. The tax benefit realized from stock options exercised totaled $0.4 million for the year ended December 31, 2010. Employee Share Purchase Plan: NU maintains an ESPP for all eligible NU, CL&P, PSNH, and WMECO employees, which allows for NU common shares to be purchased by employees at six... -

Page 120

E. Other Retirement Benefits NU provides benefits for retirement and other benefits for certain current and past company officers of NU, including CL&P, PSNH and WMECO. The actuarially-determined liability for these benefits, which is included in Other Long-Term Liabilities on the accompanying ... -

Page 121

...of Energy Contracts Allowance for Uncollectible Accounts and Other Total Deferred Tax Assets - Current Net Deferred Tax Assets - Current Deferred Tax Liabilities - Long-Term: Accelerated Depreciation and Other Plant-Related Differences Regulatory Amounts: Securitized Contract Termination Costs Other... -

Page 122

... Current Deferred Tax Liabilities - Current: Derivative Assets and Change in Fair Value of Energy Contracts Property Tax Accruals and Other Total Deferred Tax Liabilities - Current Net Deferred Tax Liabilities/(Assets) - Current Deferred Tax Assets - Long-Term: Regulatory Deferrals Employee Benefits... -

Page 123

... table summarizes NU, CL&P, PSNH and WMECO's tax years that remain subject to examination by major tax jurisdictions as of December 31, 2010: Description Tax Years Federal Connecticut New Hampshire Massachusetts 2009-2010 2005-2010 2007-2010 2007-2010 While tax audits are currently ongoing, it... -

Page 124

... by several factors, including new information concerning either the level of contamination at the site, the extent of NU, CL&P, PSNH, and WMECO's responsibility or the extent of remediation required, recently enacted laws and regulations or a change in cost estimates due to certain economic factors... -

Page 125

... PSNH, and 2 for WMECO) for which there are unasserted claims; however, any related site assessment or remediation costs are not probable or estimable at this time. HWP: HWP, a subsidiary of NU, continues to investigate the potential need for additional remediation at a river site in Massachusetts... -

Page 126

... VYNPC Supply/Stranded Cost Contracts/Obligations Renewable Energy Contracts Peaker CfDs Natural Gas Procurement Contracts Wood, Coal and Transportation Contracts PNGTS Pipeline Commitments Transmission Support Commitments Yankee Companies Billings Select Energy Purchase Agreements Clean Air Project... -

Page 127

... commitments related to CL&P's standard or last resort service or WMECO's default service, both of which represent contractual commitments that are conditional upon CL&P and WMECO customers' use of energy, and PSNH's short-term power supply management. Renewable Energy Contracts: CL&P has entered... -

Page 128

... long-term storage of their spent fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including CL&P, PSNH and WMECO. These companies in turn recover these costs from... -

Page 129

... competitive generation business. These included indemnifications for compliance with tax and environmental laws, and various claims for which the maximum exposure was not specified in the sale agreements. In October 2010, NU issued a guaranty for the benefit of Hydro Renewable Energy under which NU... -

Page 130

... payments excluding executory costs, such as property taxes, state use taxes, insurance, and maintenance, under long-term noncancelable leases, as of December 31, 2010 are as follows: Capital Leases (Millions of Dollars) NU CL&P PSNH 2011 2012 2013 2014 2015 Thereafter Future minimum lease payments... -

Page 131

...Stock, Long-Term Debt and Rate Reduction Bonds: The fair value of CL&P's preferred stock is based upon pricing models that incorporate interest rates and other market factors, valuations or trades of similar securities and cash flow projections. The fair value of fixed-rate long-term debt securities... -

Page 132

... income/(loss), net of tax, is as follows: (Millions of Dollars) NU December 31, 2008 2009 Change December 31, 2009 2010 Change December 31, 2010 Qualified Cash Flow Hedging Instruments Unrealized Gains/(Losses) on Other Securities Pension, SERP and PBOP Benefits Accumulated Other Comprehensive... -

Page 133

... 31, 2010, NU, CL&P, PSNH, WMECO and Yankee Gas were in compliance with all such provisions of its credit agreement that may restrict the payment of dividends. 18. COMMON SHARES The following table sets forth the NU common shares and the shares of CL&P, PSNH and WMECO common stock authorized and... -

Page 134

... compensation cost to be recognized, cash proceeds that would be received upon exercise, and a theoretical tax benefit. The theoretical tax benefit is calculated as the tax impact of the intrinsic value of the stock options (the difference between the market value of the average stock options... -

Page 135

... and Yankee Energy Financial Services Company) and the remaining operations of HWP that were not exited as part of the sale of the competitive generation business in 2006 and the sale of its transmission business to WMECO in December 2008. Regulated companies' revenues from the sale of electricity... -

Page 136

..., Net Income Tax (Expense)/Benefit Net Income Net Income Attributable to Noncontrolling Interests Net Income Attributable to Controlling Interests Cash Flows for Total Investments in Plant For the Year Ended December 31, 2008 Regulated Companies Distribution Natural NU Electric Gas Transmission... -

Page 137

... 2008 and 2010 major storm costs over five years and recovery of certain hardship costs. The DPU did not approve WMECO's request for rate recovery of increased reliability infrastructure investment averaging approximately $20 million per year. The decision clarified which customer hardship balances... -

Page 138

...2009 $ 258.6 39.9 15.8 $ 238.3 43.4 21.6 $ 277.0 49.8 28.8 $ 259.5 43.1 23.9 Operating Revenues Operating Income Net Income WMECO Consolidated Statements of Quarterly Financial Data (Millions of Dollars) 2010 $ 307.7 36.1 17.5 March 31, $ 262.9 31.2 16.6 $ 275.1 34.1 16.2 $ 263.9 33... -

Page 139

...accumulated and communicated to management, including the principal executive officers and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. There have been no changes in internal controls over financial reporting for NU, CL&P, PSNH and WMECO during... -

Page 140

.... McHale served as Senior Vice President and Chief Financial Officer of NU, CL&P, PSNH and WMECO from January 1, 2005 to December 31, 2008 and Vice President and Treasurer of NU, WMECO and PSNH from July 1998 to December 31, 2004. Leon J. Olivier. Mr. Olivier was elected Executive Vice President and... -

Page 141

... NU, CL&P, PSNH and WMECO has adopted a Code of Ethics for Senior Financial Officers (Chief Executive Officer, Chief Financial Officer and Controller) and the Standards of Business Conduct, which are applicable to all Trustees, directors, officers, employees, contractors and agents of NU, CL&P, PSNH... -

Page 142

... Annual Report on Form 10-K for 2010 filed on a combined basis with NU with the SEC on February 25, 2011. Such report is also available at the Investors section on www.nu.com.] SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS The following table sets forth the number of NU common... -

Page 143

... 14 for CL&P, PSNH and WMECO is omitted from this report but is set forth in the Annual Report on Form 10-K for 2010 filed on a combined basis with NU with the SEC on February 25, 2011. Such report is also available at the Investors section on www.nu.com.] Principal Accountant Fees and Services 126 -

Page 144

... Northeast Utilities (Parent) Statements of Cash Flows for the Years Ended December 31, 2010, 2009 and 2008 II. Valuation and Qualifying Accounts and Reserves for NU, CL&P, PSNH and WMECO for 2010, 2009 and 2008 All other schedules of the companies for which inclusion is required in the applicable... -

Page 145

...undersigned, thereunto duly authorized. NORTHEAST UTILITIES (Registrant) By /s/ Charles W. Shivery Charles W. Shivery Chairman of the Board, President and Chief Executive Officer (Principal Executive Officer) Date February 25, 2011 Pursuant to the requirements of the Securities Exchange Act of 1934... -

Page 146

/s/ Kenneth R. Leibler Kenneth R. Leibler /s/ Dennis R. Wraase Dennis R. Wraase Trustee February 25, 2011 Trustee February 25, 2011 129 -

Page 147

THIS PAGE INTENTIONALLY LEFT BLANK. -

Page 148

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT BALANCE SHEETS AS OF DECEMBER 31, 2010 AND 2009 (Thousands of Dollars) 2010 ASSETS Current Assets: Cash Notes Receivable from Affiliated Companies Accounts Receivable Accounts Receivable from Affiliated Companies Taxes ... -

Page 149

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008 (Thousands of Dollars, Except Share Information) 2010 Operating Revenues Operating Expenses: Other Operating Loss Interest Expense Other Income, Net:... -

Page 150

... Receivables Accounts Payable, Including Affiliate Payables Taxes Receivable/Accrued Other Current Assets and Liabilities Net Cash Flows Provided by Operating Activities Investing Activities: Capital Contributions to Subsidiaries Return of Investment in Subsidiaries Decrease/(Increase) in NU Money... -

Page 151

... than those of customers. Amounts written off, net of recoveries. The DPUC issued an order allowing CL&P and Yankee Gas to accelerate the recovery of uncollectible hardship accounts receivable outstanding for greater than 90 days. As of December 31, 2010, CL&P, WMECO and Yankee Gas had uncollectible... -

Page 152

THIS PAGE INTENTIONALLY LEFT BLANK. -

Page 153

..., Arrangement, Liquidation or Succession Northeast Utilities 2.1 Agreement and Plan of Merger By and Among Northeast Utilities, NU Holding Energy 1 LLC, NU Holding Energy 2 LLC and NSTAR dated as of October 16, 2010 (Exhibit 2.1 Current Report on Form 8-K filed October 18, 2010, File No. 001-05324... -

Page 154

... Bank of New York Trust Company N.A., as Trustee, dated as of June 1, 2008, relating to $250 million of Senior Notes, Series C, due 2013, (Exhibit 4.1, NU Current Report on Form 8-K filed June 10, 2008, File No. 001-05324) 4.1.2 4.2 Credit Agreement between NU, the Banks Named Therein, Union Bank... -

Page 155

...Credit Agreement between CL&P, WMECO, Yankee Gas and PSNH, the Banks Named Therein, and Citicorp N.A., as Administrative Agent dated September 24, 2010 (Exhibit 10, CL&P Form 10-Q for the Quarter Ended September 30, 2010 filed November 8, 2010, File No. 000-00404) (C) Public Service Company of New... -

Page 156

... and The Bank of New York Trust Company, N.A., as Trustee, dated as of March 1, 2010 (Exhibit 4.1, WMECO Current Report on Form 8-K filed March 10, 2010, File No. 000-07624) 4.2 4.2.2 4.2.3 4.2.4 4.2.5 4.3 Credit Agreement between CL&P, WMECO, Yankee Gas and PSNH, the Banks Named Therein, and... -

Page 157

... and Northeast Utilities Service Company dated as of April 14, 1992 with respect to the Berlin, Connecticut headquarters (Exhibit 10.29.1, 1992 NU Form 10-K, File No. 001-05324) Indenture of Mortgage and Deed of Trust between Yankee Gas Services Company and the Connecticut National Bank, as Trustee... -

Page 158

(B) NU, CL&P, PSNH and WMECO 10.1 Form of Service Contract between each of NU, CL&P and WMECO and Northeast Utilities Service Company (NUSCO) dated as of July 1, 1966 (Exhibit 10.20, 1993 NU Form 10-K filed March 25, 1994, File No. 001-05324) 10.1.1 10.2 Form of Renewal of Service Contract (Exhibit... -

Page 159

...62, 2001 WMECO Form 10-K filed March 22, 2002, File No. 000-07624) 10.2 10.3 *12 (A) (B) (C) (D) *21 *23 Ratio of Earnings to Fixed Charges Northeast Utilities The Connecticut Light and Power Company Public Service Company of New Hampshire Western Massachusetts Electric Company Subsidiaries of the... -

Page 160

...the Sarbanes-Oxley Act of 2002, dated February 25, 2011 31.1 (D) Western Massachusetts Electric Company 31 Certification of Leon J. Olivier, Chief Executive Officer of WMECO required by Rule 13a - 14(a)/15d - 14(a) of the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section... -

Page 161

(D) Western Massachusetts Electric Company 32 Certification of Leon J. Olivier, Chief Executive Officer of Western Massachusetts Electric Company and David R. McHale, Executive Vice President and Chief Financial Officer of Western Massachusetts Electric Company, pursuant to 18 U.S.C. Section 1350 ... -

Page 162

... and responsiveness to co-workers, customers, shareholders and the public, by establishing specific objectives and measurable targets that promote continuous improvement and by reporting our environmental performance; and • practice stewardship by managing our operations with genuine care and by... -

Page 163

... public utility companies: The Connecticut Light and Power Company, Public Service Company of New Hampshire, Western Massachusetts Electric Company and Yankee Gas Services Company. Dividend Reinvestment Plan Northeast Utilities offers a dividend reinvestment plan called BuyDIRECT. This plan is... -

Page 164

NORTHEAST UTILITIES | 2050 ANNUAL REPORT P.O. Box 270 Hautfoud, Connecticut 06545-0270 5-800-286-5000 www.nu.com