Eli Lilly 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

rst-line Alimta plus cisplatin for locally advanced or

metastatic nonsquamous non-small cell lung cancer. We

gained new indications for Cymbalta, Zyprexa, Strattera®,

and Erbitux in Japan. And the EC approved Cialis® for

once-daily use for benign prostatic hyperplasia (BPH), or

enlarged prostate.

In addition, the U.S. Court of Appeals upheld Alimta’s

compound patent expiring January

2017, and we gained an additional

six months of market exclusivity for

Cymbalta in the U.S.—to December

2013—after meeting the FDA’s

requirements for pediatric exclusivity.

A further source of revenue

growth came from three important

growth areas—emerging markets,

Japan, and Elanco Animal Health.

In 2012, China led emerging mar-

kets with growth of 27 percent, mostly

from increased volume. Overall,

emerging markets revenue declined

4 percent—following 10 percent

growth in 2011—due mainly to patent

expirations in key countries like Brazil

and Mexico. Excluding generic entry

and the impact of foreign exchange,

emerging markets growth was

11 percent.

In Japan, revenue grew 7 percent in 2012—despite

government-mandated price cuts that trimmed our

revenue growth by 7 percent.

Elanco revenue increased by 21 percent—growing

at more than three times the rate of the animal health

industry—and crossed $2 billion in revenue for the

rst time. Five key acquisitions over the past ve years,

including Janssen Animal Health in 2011 and ChemGen

in 2012, have augmented strong internal growth, while

serving to expand our presence in Europe and establish a

foothold in vaccines.

Increasing Productivity

The negative impact of our patent expirations, coupled

with challenging market conditions, requires us to

address our cost structure, both to weather YZ and to

position our company for long-term success.

After cutting projected costs by more than $1 billion

between 2009 and 2011, we aim to reduce our costs

further and to improve productivity across the enterprise.

We’ve taken signicant steps to rein in discretionary

spending and to change the way we operate—includ-

ing, for example, reorganizing our business in Europe

in 2012. We’ll continue to use Six Sigma—which has

produced a cumulative value of $3 billion since 2005—

and other tools to drive further eciencies.

In 2012, as a result of our cost-containment eorts,

total operating expenses—the sum of R&D and market-

ing, selling, and administrative (MS&A) expenses—

declined 1 percent. A reduction of 5 percent in MS&A

expenses oset increased R&D expenses, which rose

5 percent to 23 percent of total

revenue due to late-stage clinical trial

costs.

Following the YZ period, we

expect to return to levels of R&D

spending more consistent with our

historical averages, in the range of

18 percent to 20 percent of revenue.

Further, within a few years after 2014,

we expect that MS&A expenses will

move more into line with industry

averages, in the range of 28 to 30

percent of revenue.

Advancing the Pipeline

Even as we focus on generating new

revenue and controlling expenses to

compensate for patent losses, our top

priority is advancing our pipeline. We

continue to make good progress. (See

page 10.)

In 2005, we had a total of seven assets in Phase II

and Phase III. Today, we have 13 molecules in Phase III

alone—11 of which originate in our own laboratories,

including ImClone—and nearly two dozen additional

molecules in Phase II, comprising a good mix of both

small molecules and biologics.

Our Phase III portfolio includes:

• two candidates in neuroscience—solanezumab

and edivoxetine—after Phase III development of

pomaglumetad methionil for schizophrenia was

terminated in midyear;

• four in diabetes—dulaglutide, empagliozin, our new

insulin glargine product, and our novel basal insulin;

• three in oncology—ramucirumab, necitumumab, and

enzastaurin;

• three autoimmune candidates—the oral JAK1/JAK2

inhibitor baricitinib, which moved into Phase III in

late 2012, along with ixekizumab and tabalumab;

• and evacetrapib, our CETP inhibitor, for which a

Phase III trial in high-risk vascular disease was initi-

ated in 2012.

Let me briey review progress in 2012 for several of

these potential medicines:

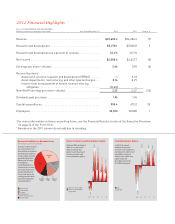

Key Growth Contributors to 2012 Revenue

($ in millions represent growth in revenue,

percent growth)

Four products and a product

line—Cymbalta, Forteo,

Effient, Alimta, and Animal

Health—generated revenue

growth of approximately

$1.7 billion during 2012 over

2011. This growth was driven

primarily by volume increases.

Cymbalta

Total Animal Health

Forteo

Effient

Alimta

$154.7 +51%

$201.2 +21%

$832.3 +20%

$357.6 +21%

$133.2 +5%