Eli Lilly 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

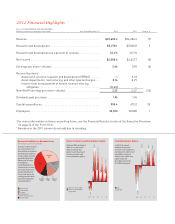

Revenue Growth Across Business Areas

($ millions, percent growth)

Revenue in Neuroscience

decreased 22 percent

due to the loss of patent

protection for Zyprexa

in most major markets,

partially offset by a

20 percent increase

in Cymbalta.

Excluding Zyprexa,

Neuroscience revenue

increased 15 percent.

Animal Health grew

21 percent driven by

strong growth in both

food and companion

animal products.

Neuroscience

Endocrinology

Oncology

Cardiovascular

Other Pharmaceutical

Animal Health

$266.8

-1%

$6,810.9

0%

$2,632.5

+6%

$7,575.1

-22% $3,281.6

-1%

$2,036.5

+21%

13.4%

31.4%

12.3%

27.8%

-7.5%

-16.3%

Return on Assets and Shareholders’ Equity

08 09 10 11 12

15.8%

51.0%

ROA and ROE declined in

2012 as a result of the

Zyprexa patent loss,

offset in part by growth

in other products and

cost-containment efforts.

Return on Assets (ROA)

Return on Shareholders’

Equity (ROE)

17.7%

46.1%

24.9%

2.1%

24.0%

16.3%

-21.4%

-36.9%

Total Shareholder Return

08 09 10 11 12

-6.1% 26.4%

In 2012, the steady

dividend stream and

increase in the stock price

contributed to Lilly’s total

shareholder return of

24.0 percent, which once

again compared

favorably against the

S&P 500 benchmark.

Lilly

S&P 500

3.7%

15.0%

2012 Financial Highlights

ELI LILLY AND COMPANY AND SUBSIDIARIES

(Dollars in millions, except per-share data) Year Ended December 31 2012 2011 Change %

Revenue.................................................... $22,603.4 $24,286.5 (7)

Research and development ................................... $5,278.1 $5,020.8 5

Research and development as a percent of revenue............... 23.4% 20.7%

Net income ................................................. $4,088.6 $4,347.7 (6)

Earnings per share—diluted................................... 3.66 3.90 (6)

Reconciling items1:

Acquired in-process research and development (IPR&D) ...... — 0.23

Asset impairments, restructuring, and other special charg

es ... 0.16 0.29

Income from early payment of Amylin revenue-sharing

obligation ........................................... (0.43) —

Non-GAAP earnings per share—diluted......................... 3.39 4.412 (23)

Dividends paid per share...................................... 1.96 1.96

Capital expenditures ......................................... 905.4 672.0 35

Employees ................................................. 38,350 38,080 1

1 For more information on these reconciling items, see the Financial Results section of the Executive Overview

on page 24 of the Form 10-K.

2 Numbers in the 2011 column do not add due to rounding.