Eli Lilly 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

LETTER TO SHAREHOLDERS

To Our Shareholders

Eli Lilly and Company delivered outstanding results in

2007, highlighted by 14 percent pro forma sales growth,

17 percent growth in pro forma adjusted net income, and

the movement of no fewer than 16 new molecules into

clinical testing. Measured more broadly by the growth

of our recently launched products in diverse markets,

the success of our business development efforts, and the

progress of discoveries through our development pipe-

line, 2007 was one of the most thoroughly successful

years in Lilly’s history.

Just as importantly in 2007, we asserted a new vision

of the company—dedicated to improving outcomes for in-

dividual patients—and we accelerated the transformation

of Lilly to realize this aspiration.

In this letter, we look forward to reporting on all of

these accomplishments in more detail.

Leadership Transition

Near the end of 2007, we announced a leadership

transition between us that had been carefully planned

for some time. Sidney Taurel will retire as chief executive

offi cer at the end of March 2008, turning over that role to

John Lechleiter. Taurel will remain chairman of the board

until the end of 2008.

Lechleiter assumes his new role as well prepared as any

of his nine predecessors at the helm of Eli Lilly and Com-

pany. A Ph.D. chemist who joined Lilly in 1979 in process

research and development (R&D), Lechleiter will redouble

Lilly’s commitment to develop fi rst-in-class and best-in-class

products. He also brings extensive experience in product

development, regulatory affairs, and global operations.

Already, he has held the reins as operational leader of Lilly

for more than two years, a period of solid sales growth and

steady performance in R&D, manufacturing, and marketing.

Our partnership in leading Lilly during the past two

years has been close and fruitful, and the nature of our

transition demonstrates a broader unity of purpose inside

the company. Lilly’s vision of delivering optimal outcomes

for individual patients is not “Sidney’s” or “John’s.” It is a

vision that we share and one that embodies the promise

of new science, the realities of the external environment,

and the aspirations of our Lilly colleagues worldwide.

We also share a belief that the Lilly CEO’s most im-

portant role is to continuously strengthen the company’s

founding values of excellence, integrity, and respect for

people. In view of the expectations and scrutiny directed at

our industry today, it has never been more important for ev-

eryone at Lilly to live up to these standards, demonstrating

their best performance as well as conduct beyond reproach.

Financial Results

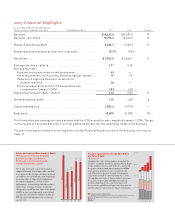

In 2007, Lilly sales increased 19 percent on a reported

basis, to $18.634 billion. On a pro forma basis, which as-

sumes we owned ICOS in both 2006 and 2007, our sales

increased 14 percent, to $18.706 billion. Our sales growth

outpaced the overall pharmaceutical sector in each of the

world’s largest markets—the U.S., Europe, and Japan—

and we achieved a 7 percent increase in sales volume

worldwide on a pro forma basis.

Demonstrating our continued commitment to grow

sales faster than operating expenses, pro forma adjusted

net income and earnings per share (EPS) both grew by

17 percent in 2007, to $3.863 billion and $3.54, respec-

tively. On a reported basis, the growth was 11 percent, to

$2.953 billion and $2.71. The pro forma adjusted results

assume we owned ICOS for both years and also adjust for

product liability expenses, asset impairments, and restruc-

turing in both years as well as for charges related to the

acquisition of compounds in development in 2007 (for a

reconciliation, see page 1).

Product Performance

Lilly’s top-selling product, Zyprexa, is beginning

to face competition from generic formulations in some

countries—notably Canada and Germany—but overall

demand for this neuroscience therapy grew in markets

outside the United States during 2007, helping to drive

worldwide sales up 9 percent to $4.761 billion. In the

U.S., a longstanding downward trend in Zyprexa’s share

of new retail prescriptions continued to slow in 2007,

in spite of new competitive products, label changes, and

negative advertising by trial lawyers.

Wider loss of patent protection on Zyprexa and other

products early in the next decade heightens the impor-

tance of strong sales growth among our newer products—

and they have risen to the challenge. Pro forma sales of

Lilly products launched in this decade collectively grew

by 33 percent in 2007 and represented 32 percent of our

total sales, up from 28 percent in 2006.

Cymbalta remains of particular importance to Lilly’s

overall performance in the years ahead, and we are

pleased that its success in 2007 is essentially unquali-

EgdYjXihAVjcX]ZYI]^h9ZXVYZ8dcig^WjiZY

+#%7^aa^dc^cHVaZh9jg^c\'%%,

*À^ÒSÍÄÊ:ÒSg^ÊÍÄÊ^gS:^gÊSÒ^gÊÛJ:Í:[Ê

-ÍÀ:ÍÍgÀ:[ÊÍ:[ÊÀÍg[Ê6zÀÄ[Ê:Ä[Ê

-ÛJÛ:Ú[ÊÛgÍÍ:[Ê:^Ê7gÍÀgØg®Ê.gÄgʨÀ^ÒSÍÄÊ

SÍÀJÒÍg^ÊdÈ®ßÊJÊÍÊgÍÊÄ:gÄÊ:^Ê

SÍÒg^ÊÍÊ^ØgÀÄsÛÊÒÀʨÀÍs®Ê.Í:Ê

ÙÀ^Ù^gÊ:ÄʨÀ^ÒSÍÊÄ:gÄÊ:ÀgÊSÒ^g^Ê

ÄSgÊÒÀÊ:Ò:ÀÛÊÑ[ÊÑßßÇÊ:SµÒÄÍÊsÊ!-®

EgdYjXihAVjcX]ZYI]^h9ZXVYZ

OnegZmV

6aaDi]Zg

'%%,

'%%+

)-

'-

')

)'

'+

('