Eli Lilly 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Eli Lilly and Company

2007 Annual Report

Notice of 2008

Annual Meeting

Proxy Statement

Table of contents

-

Page 1

Eli Lilly and Company 2007 Annual Report Notice of 2008 Annual Meeting Proxy Statement -

Page 2

... Audit Committee Matters Compensation Committee Matters Executive Compensation Ownership of Company Stock Items of Business To Be Acted Upon at the Meeting Other Matters Corporate Information 124 126 127 Senior Management and Board of Directors Corporate Information Annual Meeting Admission Ticket -

Page 3

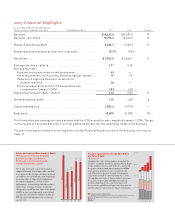

... Financial Highlights ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions, except per-share data) Year Ended December 31 2007 2006 Change % Net sales ...Net sales-pro forma1 ...Research and development ...Research and development as a percent of net sales ...Net income ...Earnings per share... -

Page 4

...'s share of new retail prescriptions continued to slow in 2007, in spite of new competitive products, label changes, and negative advertising by trial lawyers. Wider loss of patent protection on Zyprexa and other products early in the next decade heightens the importance of strong sales growth among... -

Page 5

... than Cymbalta's ability to address important medical needs. The patient on the cover of this annual report is one of the many people whose health has improved with the help of Cymbalta. Cymbalta also beneï¬ted in 2007 from the approval of new indications. The U.S. Food and Drug Administration (FDA... -

Page 6

... pharmaceutical network-or "FIPNET." In the new model, we draw on a broad range of resources outside our company's walls-to increase our effective capacity and access to external capabilities, to reduce our level of risk and accelerate development, and ultimately to help lower our average cost... -

Page 7

... are used. We can help to improve patients' access to our products and to build understanding of our business practices through transparency. And we can take on more responsibility for the health care challenges facing society as a whole, as our corporate social responsibility report (see page... -

Page 8

... PE LI N E Innovation at Lilly: The Portfolio and the Pipeline Major Marketed Products (Dates indicate the year of first global launch) 2005 Byetta® for type 2 diabetes for use in combination with a thiazolidinedione (2007) (in collaboration with Amylin Pharmaceuticals, Inc.) for major depressive... -

Page 9

... syndrome (1997) for idiopathic short stature (2003) for type 1 and type 2 diabetes 1987 Humatrope® 1983 Humulin® New Drug Applications Submitted For Review to the U.S. Food and Drug Administration Duloxetine Olanzapine Olanzapine LAI Olanzapine-Fluoxetine Pemetrexed disodium Prasugrel for... -

Page 10

...in collaboration with Glenmark Pharmaceuticals) Information is current as of January 31, 2008. The search for new drugs is risky and uncertain, and there are no guarantees. Remaining scientific and regulatory hurdles may cause pipeline compounds to be delayed or even to fail to reach the market. 8 -

Page 11

... in products for patient assistance programs and international humanitarian causes. Our total 2007 giving represents about 6 percent of our adjusted income before taxes and has positioned Lilly once again as one of the most charitable companies in the world. We also launched a new employee volunteer... -

Page 12

... investments in marketing and selling expenses in support of key products, primarily Cymbalta® and the diabetes care products, contributed to this sales growth and enabled us to increase our investment in research and development 11 percent in 2007. While cost of sales and operating expenses in... -

Page 13

... currently being studied in the PROTÉGÉ trial, a global pivotal Phase II/III clinical trial for individuals with recent-onset type 1 diabetes. In June, we completed the acquisition of Ivy Animal Health, Inc., a privately held applied research and pharmaceutical product development company focused... -

Page 14

...Health and Human Services to negotiate drug prices within Medicare Part D directly with pharmaceutical manufacturers. Additionally, various proposals have been introduced that would increase the rebates we pay on sales to Medicaid patients. We expect pricing pressures at the federal and state levels... -

Page 15

... of Lilly ICOS LLC (North America, excluding Puerto Rico, and Europe). Our share of the joint-venture territory sales, net of expenses and income taxes, is reported in other income-net in our consolidated income statement. Subsequent to the acquisition, all Cialis product sales are reported in... -

Page 16

... Statements of Income ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions, except per-share data) Year Ended December 31 2007 2006 2005 Net sales ...Cost of sales ...Research and development ...Marketing, selling, and administrative ...Acquired in-process research and development... -

Page 17

...was due to increases in discovery research and late-stage clinical trial costs. We continued to be a leader in our industry peer group by investing approximately 19 percent of our sales into research and development during 2007. Marketing, selling, and administrative expenses increased 25 percent in... -

Page 18

... key products, primarily Cymbalta and the diabetes care products, and continued our commitment to research and development, investing approximately 20 percent of our sales during 2006. Our results also beneï¬ted from continued growth in proï¬tability of the Lilly ICOS joint venture as well as cost... -

Page 19

... our sales into research and development during 2006. Marketing, selling, and administrative expenses increased 9 percent in 2006, to $4.89 billion. This increase was largely attributable to increased marketing and selling expenses in support of key products, primarily Cymbalta and the diabetes care... -

Page 20

...ï¬cient to fund our normal operating needs, including debt service, capital expenditures, costs associated with product liability litigation, dividends, and taxes in 2008. We believe that amounts accessible through existing commercial paper markets should be adequate to fund short-term borrowings... -

Page 21

... and Shareholders' Equity Current Liabilities Short-term borrowings and current maturities of long-term debt (Note 6) ...Accounts payable ...Employee compensation ...Sales rebates and discounts...Dividends payable ...Income taxes payable (Note 11) ...Other current liabilities (Note 8) ...Total... -

Page 22

... Flows ELI LILLY AND COMPANY AND SUBSIDIARIES (Dollars in millions) Year Ended December 31 2007 2006 2005 Cash Flows From Operating Activities Net income ...Adjustments To Reconcile Net Income To Cash Flows From Operating Activities Depreciation and amortization ...Change in deferred taxes ...Stock... -

Page 23

... in development. Milestone payments may be required contingent upon the successful achievement of an important point in the development life cycle of the pharmaceutical product (e.g., approval of the product for marketing by the appropriate regulatory agency or upon the achievement of certain sales... -

Page 24

...to change materially over time as new contracts are initiated and existing contracts are completed, terminated, or modiï¬ed. levels). If required by the arrangement, we may have to make royalty payments based upon a percentage of the sales of the pharmaceutical product in the event that regulatory... -

Page 25

...term-care, hospital, patient assistance programs, and various other government programs. We base these accruals primarily upon our historical rebate/discount payments made to our customer segment groups and the provisions of current rebate/discount contracts. The largest of our sales rebate/discount... -

Page 26

.... If the 2007 discount rate for the U.S. deï¬ned beneï¬t pension and retiree health beneï¬t plans (U.S. plans) were to be changed by a quarter percentage point, income before income taxes would change by approximately $32 million. If the 2007 expected return on plan assets for U.S. plans were to... -

Page 27

... (the Drug Price Competition and Patent Term Restoration Act of 1984): • Barr Laboratories, Inc. (Barr), submitted an Abbreviated New Drug Application (ANDA) in 2002 seeking permission to market a generic version of Evista prior to the expiration of our relevant U.S. patents (expiring in 2012-2017... -

Page 28

.... We have received challenges to Zyprexa patents in a number of countries outside the U.S.: • In Canada, several generic pharmaceutical manufacturers have challenged the validity of our Zyprexa compound and method-of-use patent (expiring in 2011). In April 2007, the Canadian Federal Court ruled... -

Page 29

... beneï¬t manager covering Axid®, Evista, Humalog, Humulin, Prozac, and Zyprexa. The inquiry includes a review of our Medicaid best price reporting related to the product sales covered by the rebate agreements. In June 2005, we received a subpoena from the Ofï¬ce of the Attorney General, Medicaid... -

Page 30

... communications, remuneration of health care professionals, managed care arrangements, and Medicaid best price reporting comply with applicable laws and regulations. Product Liability and Related Litigation We have been named as a defendant in a large number of Zyprexa product liability lawsuits... -

Page 31

... District of New York in 2006 on similar grounds. In 2007, The Pennsylvania Employees Trust Fund brought claims in state court in Pennsylvania as insurer of Pennsylvania state employees, who were prescribed Zyprexa on similar grounds as described in the New York cases. As with the product liability... -

Page 32

... 31, 2007 . Animal health products are sold primarily to wholesale distributors . Our business segments are distinguished by the ultimate end user of the product: humans or animals . Performance is evaluated based on profit or loss from operations before income taxes . The accounting policies of... -

Page 33

...First Net sales ...Cost of sales ...Operating expenses ...Asset impairments, restructuring, and other special charges ...Other income-net...Income before income taxes...Net income ...Earnings per share-basic ...Earnings per share-diluted...Dividends paid per share...Common stock closing prices High... -

Page 34

... 3,223.9 2,675.1 Research and development ...3,486.7 3,129.3 3,025.5 2,691.1 2,350.2 Marketing, selling, and administrative ...6,095.1 4,889.8 4,497.0 4,284.2 4,055.4 Other ...926.1 707.4 931.1 716.8 240.1 Income before income taxes and cumulative effect of a change in accounting principle ...3,876... -

Page 35

... in stock price, status of projects in development, near-term prospects of the issuer, the length of time the value has been depressed, and the ï¬nancial condition of the industry. We do not evaluate cost-method investments for impairment unless there is an indicator of impairment. We review these... -

Page 36

...on earnings is included in cost of sales. We may enter into foreign currency forward contracts and currency swaps as fair value hedges of ï¬rm commitments. Forward and option contracts generally have maturities not exceeding 12 months. In the normal course of business, our operations are exposed to... -

Page 37

... life cycle of the pharmaceutical product. Milestone payments earned by us are generally recorded in other income-net. Research and development: We recognize as incurred the cost of directly acquiring assets to be used in the research and development process that have not yet received regulatory... -

Page 38

... Statement No. 2 to Business Combinations Accounted for by the Purchase Method, and now requires the capitalization of research and development assets acquired in a business combination at their acquisition-date fair values, separately from goodwill. SFAS No. 109, Accounting for Income Taxes, was... -

Page 39

... ï¬nancial position or results of operations. In June 2007, the FASB ratiï¬ed the consensus reached by the EITF on Issue No. 07-3 (EITF 07-3), Accounting for Nonrefundable Advance Payments for Goods or Services Received for Use in Future Research and Development Activities. Pursuant to EITF 07... -

Page 40

... quarter of 2007, we acquired all of the outstanding stock of both Hypnion, Inc. (Hypnion), a privately held neuroscience drug discovery company focused on sleep disorders, and Ivy Animal Health, Inc. (Ivy), a privately held applied research and pharmaceutical product development company focused... -

Page 41

...deductible for tax purposes, and was included as expense in the fourth quarter of 2007. In October 2007, we entered into a global strategic alliance with MacroGenics, Inc. (MacroGenics) to develop and commercialize teplizumab, a humanized anti-CD3 monoclonal antibody, as well as other potential next... -

Page 42

...the U.S. Management also made the decision to stop construction of a planned insulin manufacturing plant in the U.S. in an effort to increase productivity in research and development operations and to reduce excess manufacturing capacity. These decisions, as well as other strategic changes, resulted... -

Page 43

.... Wholesale distributors of life-sciences products and managed care organizations account for a substantial portion of trade receivables; collateral is generally not required. The risk associated with this concentration is mitigated by our ongoing credit review procedures and insurance. We... -

Page 44

..., short-term borrowings included $18.6 million and $8.6 million, respectively, of notes payable to banks and commercial paper. At December 31, 2007, we have $1.24 billion of unused committed bank credit facilities, $1.20 billion of which backs our commercial paper program. Compensating balances and... -

Page 45

...ï¬,ow in the consolidated statements of cash ï¬,ows. At December 31, 2007, additional stock options, PAs, SVAs, or restricted stock grants may be granted under the 2002 Lilly Stock Plan for not more than 46.6 million shares. Performance Award Program Performance awards (PAs) are granted to ofï¬cers... -

Page 46

...the time of grant. The model incorporates exercise and post-vesting forfeiture assumptions based on an analysis of historical data. The expected life of the 2006 and 2005 grants is derived from the output of the lattice model. The weighted-average fair values of the individual options granted during... -

Page 47

... 31, 2007 and 2006, no preferred stock has been issued . We have funded an employee benefit trust with 40 million shares of Lilly common stock to provide a source of funds to assist us in meeting our obligations under various employee benefit plans . The funding had no net impact on shareholders... -

Page 48

... or earning power after a Distribution Date, generally each holder of a right (other than the Acquiring Person) will have the right to purchase at the exercise price the number of shares of common stock of the acquiring company that have a value of two times the exercise price. At any time after an... -

Page 49

...composition of income taxes attributable to income before cumulative effect of a change in accounting principle: 2007 2006 2005 Current Federal ...Foreign ...State ...Deferred Federal ...Foreign ...State ...Unremitted earnings to be repatriated due to change in tax law ...Income taxes... $489.5 412... -

Page 50

...to income before income taxes and cumulative effect of a change in accounting principle: 2007 2006 2005 United States federal statutory tax rate ...Add (deduct) International operations, including Puerto Rico ...Non-deductible acquired in-process research and development ...General business credits... -

Page 51

... 31 to develop the change in beneï¬t obligation, change in plan assets, funded status, and amounts recognized in the consolidated balance sheets at December 31 for our deï¬ned beneï¬t pension and retiree health beneï¬t plans, which were as follows: Deï¬ned Beneï¬ t Pension Plans 2007 2006... -

Page 52

... due to overall market conditions in 2001 and 2002, our 10- and 20-year annualized rates of return on our U.S. deï¬ned beneï¬t pension plans and retiree health beneï¬t plan were approximately 8.9 percent and 11.3 percent, respectively, as of December 31, 2007. Health-care-cost trend rates were... -

Page 53

...recognized in other comprehensive income in 2007: Deï¬ned Beneï¬ t Pension Plans Retiree Health Beneï¬ t Plans Total Plan amendments during period ...Amortization of prior service cost (beneï¬t) included in net income ...Net change in unrecognized prior service cost (beneï¬t) not recognized in... -

Page 54

... (the Drug Price Competition and Patent Term Restoration Act of 1984): • Barr Laboratories, Inc. (Barr), submitted an Abbreviated New Drug Application (ANDA) in 2002 seeking permission to market a generic version of Evista prior to the expiration of our relevant U.S. patents (expiring in 2012-2017... -

Page 55

... beneï¬t manager covering Axid, Evista, Humalog, Humulin, Prozac, and Zyprexa. The inquiry includes a review of our Medicaid best price reporting related to the product sales covered by the rebate agreements. In June 2005, we received a subpoena from the Ofï¬ce of the Attorney General, Medicaid... -

Page 56

... communications, remuneration of health care professionals, managed care arrangements, and Medicaid best price reporting comply with applicable laws and regulations. Product Liability and Related Litigation We have been named as a defendant in a large number of Zyprexa product liability lawsuits... -

Page 57

...payments for their members or insured patients being prescribed Zyprexa. These actions have now been consolidated into a single lawsuit, which is brought under certain state consumer protection statutes, the federal civil RICO statute, and common law theories, seeking a refund of the cost of Zyprexa... -

Page 58

... above are net of income taxes. The income taxes associated with the unrecognized losses and prior service costs (Note 12) were an expense of $292.1 million for 2007. The income taxes related to the other components of comprehensive income were not signiï¬cant, as income taxes were not provided for... -

Page 59

... in their responsibilities and operate under a code of conduct and the highest level of ethical standards. Management's Report on Internal Control Over Financial Reporting-Eli Lilly and Company and Subsidiaries Management of Eli Lilly and Company and subsidiaries is responsible for establishing... -

Page 60

Report of Independent Registered Public Accounting Firm Board of Directors and Shareholders Eli Lilly and Company We have audited the accompanying consolidated balance sheets of Eli Lilly and Company and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements of income... -

Page 61

... of the Public Company Accounting Oversight Board (United States), the 2007 consolidated ï¬nancial statements of Eli Lilly and Company and subsidiaries and our report dated February 8, 2008, expressed an unqualiï¬ed opinion thereon. FI N A N C I A L S Indianapolis, Indiana February 8, 2008... -

Page 62

....com/investor/annual_report/lillyar2007.pdf Notice of Annual Meeting of Shareholders April 21, 2008 The annual meeting of shareholders of Eli Lilly and Company will be held at the Lilly Center Auditorium, Lilly Corporate Center, Indianapolis, Indiana, on Monday, April 21, 2008, at 11:00 a.m. EDT... -

Page 63

... as of the close of business on February 15, 2008 (the record date) may vote at the annual meeting. You have one vote for each share of common stock you held on the record date, including shares: • held directly in your name as the shareholder of record • held for you in an account with a broker... -

Page 64

...5112. Please make sure you give us the control number from the e-mail message that you received notifying you of the electronic availability of these materials, along with your name and mailing address. By telephone. Shareholders in the United States, Puerto Rico, and Canada may vote by telephone by... -

Page 65

.... How do I contact the board of directors? You may send written communications to one or more members of the board, addressed to: Presiding Director, Board of Directors Eli Lilly and Company c/o Corporate Secretary Lilly Corporate Center Indianapolis, Indiana 46285 All such communications will be... -

Page 66

...wish to receive a separate copy of the 2007 annual report and 2008 proxy statement, or if you wish to receive separate copies of future annual reports and proxy statements, please call 1-800-542-1061 or write to: Householding Department, 51 Mercedes Way, Edgewood, New York 11717. We will deliver the... -

Page 67

...the UPS board of directors. Mr. Eskew began his UPS career in 1972 as an industrial engineering manager and held various positions of increasing responsibility, including time with UPS's operations in Germany and with UPS Airlines. In 1993, Mr. Eskew was named corporate vice president for industrial... -

Page 68

...of pharmaceutical products and corporate development in 2001 . He was named executive vice president of pharmaceutical operations, in 2004 . He is a member of the American Chemical Society . In 2004, Dr . Lechleiter was appointed to the Visiting Committee of Harvard Business School and to the Health... -

Page 69

...head of global sales and marketing for Engineering Polymers. In 1998, he was appointed vice president of Corporate Plans and Business Development. Mr. Fyrwald serves on the boards of CropLife International, the Des Moines Art Center, and United Way of Iowa. Ellen R. Marram Age 61 Director since 2002... -

Page 70

... Mayo Medical School since 1975. Dr. Prendergast serves on the board of trustees of the Mayo Foundation and the Mayo Clinic Board of Governors. Kathi P. Seifert Age 58 Director since 1995 Retired Executive Vice President, Kimberly-Clark Corporation Ms. Seifert served as executive vice president for... -

Page 71

...direct compensation from Lilly other than for service as a non-executive employee. • a director who is employed (or whose immediate family member is employed as an executive ofï¬cer) by another company where any Lilly executive ofï¬cer serves on the compensation committee of that company's board... -

Page 72

...from Lilly in a single ï¬scal year exceeding the greater of $1 million or 2 percent of that organization's gross revenues in a single ï¬scal year. Members of the audit, compensation, and directors and corporate governance committees must meet all applicable independence tests of the New York Stock... -

Page 73

... a comprehensive code of ethical and legal business conduct applicable to all employees worldwide and to our board of directors • the company's Code of Ethical Conduct for Lilly Financial Management, a supplemental code for our chief executive ofï¬cer, chief operating ofï¬cer, and all members of... -

Page 74

... company's corporate secretary. The audit committee and public policy and compliance committee assist in the board's oversight of compliance programs with respect to matters covered in the code of ethics. V. Functioning of the Board Executive Session of Directors The independent directors meet alone... -

Page 75

..., to which other directors and executive ofï¬cers are invited. We also afford directors the opportunity to attend external director education programs. Director Access to Management and Independent Advisers Independent directors have direct access to members of management whenever they deem it... -

Page 76

... and objectives • reviews new developments, technologies, and trends in pharmaceutical research and development. Membership and Meetings of the Board and Its Committees PROX Y S TATE M E NT In 2007, each director attended more than 88 percent of the total number of meetings of the board and the... -

Page 77

... 17, 2007. Stock option grants were established using the same procedure for timing and price as is used for employees. 4 This column includes amounts donated by the Eli Lilly and Company Foundation, Inc. under its matching gift program, which is generally available to U.S. employees as well as the... -

Page 78

... Lilly stock. In addition, the annual award of shares to each director noted above (2,840 shares in 2007) is credited to this account on a pre-set annual date. Funds in this account are credited as hypothetical shares of Lilly stock based on the market price of the stock at the time the compensation... -

Page 79

...or sales international business medicine and science government and public policy health care environment information technology. PROX Y S TATE M E NT The board delegates the screening process to the directors and corporate governance committee, which receives direct input from other board members... -

Page 80

of the directors and corporate governance committee, in care of the corporate secretary, at Lilly Corporate Center, Indianapolis, Indiana 46285. The candidate must meet the selection criteria described above and must be willing and expressly interested in serving on the board. Under Section 1.9 of ... -

Page 81

... to the performance of the audit or reviews of the ï¬nancial statements -2007 and 2006: primarily related to employee beneï¬t plan and other ancillary audits, and due diligence services on possible acquisition in 2007 Tax Fees • 2007 and 2006: primarily related to compliance services outside the... -

Page 82

...chairperson. • Role of Executive Ofï¬cers and Management. With the oversight of the CEO, chief operating ofï¬cer, and the senior vice president of human resources, the company's global compensation group formulates recommendations on matters of compensation philosophy, plan design, and the speci... -

Page 83

... the overall cost of our equity program in 2007-while maintaining its competitiveness and motivational impact-by eliminating stock options in favor of shareholder value awards and by lowering total equity grant values for most positions. • A balanced program fosters employee achievement, retention... -

Page 84

... grant value, and resulting total direct compensation. Mr. Cook develops a range of recommendations for any change in the CEO's base salary, annual incentive target, and equity grant value and mix. Mr. Cook's recommendations for target CEO pay take into account the peer competitive pay analysis... -

Page 85

... 2007 program consisted of base salary, a cash incentive bonus award, and two forms of performance-based equity grants-performance awards and shareholder value awards (SVAs). Executives also received the company employee beneï¬t package. This program balances the mix of cash and equity compensation... -

Page 86

...bonus sizes. Bonus targets (expressed as a percentage of base salary) were based on job responsibilities, internal relativity, and peer group data. Consistent with our compensation objectives, as executives assume greater responsibilities, more of their pay is linked to company performance. For 2007... -

Page 87

... bonus multiple See page 87 for a reconciliation of 2007 reported and pro forma sales and reported and pro forma adjusted EPS. Equity Incentives-Total Equity Program In 2007, we employed two forms of equity incentives granted under the 2002 Lilly Stock Plan: performance awards and shareholder value... -

Page 88

... employee interests with long-term shareholder return. For the 2007 grants, the committee considered the following: • Target grant size. As described above, the committee reduced target grant sizes for most job levels and established a 50/50 split between performance awards and SVAs. • Company... -

Page 89

...committee adjusted the results on which 2007 bonuses and performance awards were determined to eliminate the effect of certain unusual income or expense items. The adjustments are intended to: • align award payments with the underlying growth of the core business • avoid volatile, artiï¬cial in... -

Page 90

... Post-Employment Beneï¬ts The company offers core employee beneï¬ts coverage in order to: • provide our global workforce with a reasonable level of ï¬nancial support in the event of illness or injury • enhance productivity and job satisfaction through programs that focus on work/life balance... -

Page 91

... on the surviving company's EPS. Likewise, if Lilly is not the surviving entity, a portion of the shareholder value awards are paid out, based on time worked up to the change in control and the merger price for Lilly stock. • Covered terminations. Employees are eligible for payments if, within two... -

Page 92

... new roles. • Mr. Taurel. As chairman, Mr. Taurel will remain an employee of the company until his retirement on December 31, 2008. Effective April 1, 2008, his base salary will be reduced by half. Under the terms of the Eli Lilly and Company Bonus Plan, his non-equity incentive award opportunity... -

Page 93

...44 of our annual report. 3 Payment for 2007 performance made in March 2008 under the Eli Lilly and Company Bonus Plan. 4 The amounts in this column are the change in pension value for each individual. No named executive ofï¬cer received preferential or above-market earnings on deferred compensation... -

Page 94

... plan, and the 2002 Lilly Stock Plan, which provides for performance awards, shareholder value awards, stock options, restricted stock grants, and stock units. Grants of Plan-Based Awards During 2007 Estimated Possible Payouts Under Non-Equity Incentive Plan Awards 1 Name Mr. Taurel Compensation... -

Page 95

... or the executive's retirement. Mr. Taurel's shares will vest upon his retirement from the company on December 31, 2008. Our shareholder value awards granted in 2007 will pay out at the end of the three-year performance period according to the grid as shown on page 87 of the Compensation Discussion... -

Page 96

Outstanding Equity Awards at December 31, 2007 Option Awards Stock Awards Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) 68,426 3 Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not ... -

Page 97

...June 1, 2007. Retirement Beneï¬ts We maintain two programs to provide retirement income to all eligible U.S. employees, including executive ofï¬cers: • The Lilly Employee 401(k) Plan, a deï¬ned contribution plan qualiï¬ed under sections 401(a) and 401(k) of the Internal Revenue Code. Eligible... -

Page 98

... of annual pension that can be paid from a tax-qualiï¬ed plan ($180,000 in 2007) as well as on the amount of annual earnings that can be used to calculate a pension beneï¬t ($225,000). However, since 1975 the company has maintained a non-tax-qualiï¬ed retirement plan that pays eligible employees... -

Page 99

... the timing or amount of his unreduced beneï¬ts (shown in the Pension Beneï¬ts in 2007 table on page 96). A grant of additional years of service credit to any employee must be approved by the compensation committee of the board of directors. Nonqualiï¬ed Deferred Compensation in 2007 Executive... -

Page 100

...terminating executive ofï¬cer (other than following a change in control) would be at the discretion of the compensation committee. Potential Payments Upon Termination of Employment Acceleration and Continuation of Continuation of Equity Awards Incremental Medical / Welfare (unamortized Pension Bene... -

Page 101

... in 2007 table on pages 97-98 for information about the 401(k) plan, the deferred compensation plan, and the nonqualiï¬ed savings plan. • The value of accelerated vesting of certain unvested equity grants upon retirement. Under the company's stock plans, employees who terminate employment while... -

Page 102

the change in control; or (vi) relocation of the executive by more than ï¬fty (50) miles. • Cash severance payment. Represents the CIC Program beneï¬t of two times the 2007 annual base salary plus two times cash bonus for 2007 under the Eli Lilly and Company Bonus Plan. • Incremental pension ... -

Page 103

...Employee 401(k) Plan, shares credited to the accounts of outside directors in the Lilly Directors' Deferral Plan, and total shares beneï¬cially owned by each individual, including the shares in the respective plans. In addition, the table shows shares that may be purchased pursuant to stock options... -

Page 104

... of Class 12.1% Name and Address Lilly Endowment, Inc. (the "Endowment") 2801 North Meridian Street Indianapolis, Indiana 46208 Capital World Investors 333 South Hope Street Los Angeles, California 90071 Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 7.1% 6.0% The... -

Page 105

...Amended Articles of Incorporation. Background of Proposal The proposal is a result of ongoing review of corporate governance matters by the board. The board, assisted by the directors and corporate governance committee, considered the advantages and disadvantages of maintaining the classiï¬ed board... -

Page 106

... the 2002 Lilly Stock Plan Stock incentive plans have been an integral part of the company's compensation programs for more than 50 years. These plans enable the company to attract and retain top talent and focus employees on creating and sustaining shareholder value through increased employee stock... -

Page 107

... shareholder value awards, restricted stock grants and stock units to employees. The Board may grant stock options under the Plan to nonemployee directors. The Plan is designed to maximize the deductibility of stock options and performance awards under section 162(m) of the Internal Revenue Code... -

Page 108

... income • corporate or divisional net sales • EVA® (after-tax operating proï¬t less the annual total cost of capital) • Market Value Added (the difference between a company's fair market value, as reï¬,ected primarily in its stock price, and the economic book value of capital employed... -

Page 109

... price, (ii) allow the grant of stock options at an option price below fair market value of Lilly stock on the date of grant, (iii) increase the number of shares authorized for issuance or transfer, or (iv) increase any of the various maximum limits established for stock options, performance awards... -

Page 110

... to grant stock options to nonmanagement employees worldwide. The plan is administered by the senior vice president responsible for human resources. The stock options are nonqualiï¬ed for U.S. tax purposes. The option price cannot be less than the fair market value at the time of grant. The options... -

Page 111

In January 2006, Business Week reported that "[i]ncreasingly, Lilly is moving its research and development, including clinical trials, to China, India, and the former Soviet bloc."1 Then, the August 21, 2007 issue of The Wall Street Journal reported that Eli Lilly had entered into a partnership with... -

Page 112

..., and procedures for stock issuance. Like many other Indiana corporations, Lilly has adopted the default provision under Indiana law, which states that unless the articles of incorporation provide otherwise, the bylaws may be amended only by the directors. The board of directors has ï¬duciary... -

Page 113

... improve the company's corporate governance or lead to better performance. In fact, a 2004 study by Lawrence D. Brown and Marcus L. Caylor of Georgia State University 1 found that companies that permit shareholders to amend the bylaws performed no better or worse than those who reserve that power to... -

Page 114

... intended to preserve and maximize the value of Lilly stock for all shareholders by protecting against short-term, self-interested actions by one or a few large shareholders. These provisions help ensure that important corporate governance rules are not changed without the clear consensus of... -

Page 115

... similar payments made to any tax exempt organization that is used for an expenditure or contribution if made directly by the corporation would not be deductible under Section 162 (e)(1)(B) of the Internal Revenue Code. The report shall include the following: a. An accounting of the Company's funds... -

Page 116

... speciï¬c to business and pharmaceutical industry interests, such as PhRMA (Pharmaceutical Research and Manufacturers Association), BIO (Biotechnology Association), Healthcare Leadership Conference, and Business Roundtable. In our 2007 Report of Political Financial Support, to be published... -

Page 117

... connection with the receipt of performance award shares by his wife, a former Lilly employee. Upon discovery, this matter was promptly reported. Certain Legal Matters In April 2007, the company received demands from two shareholders that the board of directors cause the company to take legal action... -

Page 118

... Corporation, exclusive of directors who may be elected by the holders of any one or more series of Preferred Stock pursuant to Article 7(b) (the "Preferred Stock Directors"), shall not be less than nine, the exact number to be ï¬xed from time to time solely by resolution of the Board of Directors... -

Page 119

... with Stock Option Grants to Nonemployee Directors. 2. Grants. Incentives under the 2002 Plan shall consist of incentive stock options or other forms of tax-qualiï¬ ed stock options under the Code, nonqualiï¬ed stock options, performance awards, stock appreciation rights, stock unit awards, and... -

Page 120

... Plans (the "Prior Shareholder-Approved Plans") which, after the effective date of the 2002 Plan,: a. are not purchased or awarded under a Stock Option or Performance Award due to termination, lapse, or forfeiture, or which are forfeited under a Restricted Stock Grant; are not issued or transferred... -

Page 121

...all of the Performance Award in cash in lieu of issuing or transferring Performance Shares. The cash payment shall be based on the fair market value of Lilly Stock on the date of payment (subject to Section 6(f)). The Company shall promptly notify each Grantee of the number of Performance Shares and... -

Page 122

.... (e) Total Number of Shares Granted. Not more than 3,000,000 shares of Lilly Stock may be issued or transferred under the 2002 Plan in the form of Restricted Stock Grants and Stock Unit Awards, considered together. 8. Stock Option Grants to Nonemployee Directors The Board may grant Stock Options to... -

Page 123

...settlement of the right by having the Company withhold shares of Lilly Stock having a fair market value equal to the amount of the withholding tax. 10. Stock Unit Awards to Eligible Employees. The Committee may grant Stock Unit Awards to Eligible Employees. A Stock Unit Award is an award of a number... -

Page 124

... a majority of the Board of Directors of the Company (or which would have such voting power but for the application of the Indiana Control Share Statute) ("Voting Stock"); provided, however, that an acquisition of Voting Stock directly from the Company shall not constitute a Change in Control; (ii... -

Page 125

...with the laws of the State of Indiana, regardless of the laws that might otherwise govern under applicable Indiana conï¬,ict-of-laws principles. (j) Effective Date of the Amended 2002 Plan. The amended 2002 Plan is effective upon its approval by the Company's shareholders at the annual meeting to be... -

Page 126

... Animal Health Sharon L. Sullivan Executive Director, Bioproduct Research and Development 3 Michael C. Heim Vice President, Human Resources, Global Compensation and HR Services Lorenzo Tallarigo, M.D.. Vice President, Biotech Discovery Research and President, Applied Molecular Evolution Bryce... -

Page 127

... and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics, Mayo Medical School; Director, Mayo Clinic Center for Individualized Medicine; and Director Emeritus, Mayo Clinic Cancer Center Kathi P. Seifert Retired Executive Vice President, Kimberly-Clark Corporation... -

Page 128

... services Dividend reinvestment and stock purchase plan Eli Lilly and Company common stock is listed on the New York, London, and Swiss stock exchanges. NYSE ticker symbol: LLY. Most newspapers list the stock as "Lilly (Eli) and Co." CEO and CFO certiï¬cations The company's chief executive... -

Page 129

... Admission Ticket Eli Lilly and Company 2008 Annual Meeting of Shareholders Monday, April 21, 2008 11 a.m. EDT Lilly Center Auditorium Lilly Corporate Center Indianapolis, Indiana 46285 The top portion of this page will be required for admission to the meeting. Please write your name and address in... -

Page 130

... of this page with you to the meeting. Detach here Detach here Eli Lilly and Company Annual Meeting of Shareholders April 21, 2008 Complimentary Parking Lilly Corporate Center Please place this identiï¬er on the dashboard of your car as you enter Lilly Corporate Center so it can be clearly seen... -

Page 131

...is a trademark of Cardinal Health. All trademarks listed above are trademarks of Eli Lilly and Company unless otherwise noted. For More Information Lilly corporate responsibility and report of political ï¬nancial support . . www.lilly.com/about/citizenship/index.html Lilly clinical trials registry... -

Page 132

Eli Lilly and Company Lilly Corporate Center Indianapolis, Indiana 46285 USA www.lilly.com