Electrolux 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

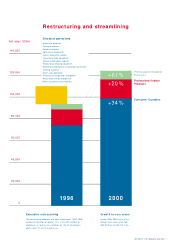

Value drivers

Components Activities

Sales growth Organic growth Customer care

Customer mix Product management, R&D

Acquisitions New brand policy

Marketing

Territory management

Cost reductions SG&A costs

Improved product mix New pan-European structure

Demand flow/supply chain

New products/

product platforms

Asset efficiency Group structure Divestments

Asset turnover Rationalization

Asset mix Make or buy

Reduce working capital

Higher operating

margin/lower cost

6REPORT BY THE PRESIDENT AND CEO

We have used a model for value creation internally since 1998 and are

measuring performance by sector, product line and region.

The goal is to achieve average annual growth in value

created of at least SEK 1 billion for the period 2000–2002.

The best way to create value is to increase sales without increasing

the assets employed in operations. That is why we focus on growth.

But we also have to drive down costs, improve the rate of capital

turnover, and rationalize assets that don’t generate sufficient returns.

The improvement in value creation that we want to achieve up to

year-end 2002 has to be driven mainly by greater internal efficiency,

which will generate higher margin.

EBIT = Earnings before interest and taxes,

excluding items affecting comparability.

WACC = Weighted Average Cost of Capital.

The WACC for 2000 and 2001 is 14%.

In 1997–2000 the Group achieved average annual

growth in value created of slightly more than SEK 1

billion.

We have reversed the trend

Value creation

Value creation is our measure of

performance within the Group.

–2,000

–1,000

0

1,000

2,000

3,000

4,000

5,000

200019991998199719961995 20022001

SEKm