Electrolux 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We continued to achieve good growth in sales and income in all product

areas in North America, where we enlarged our market shares. I am also glad

to report that Consumer Durables outside Europe and North America achieved

positive operating income, after a considerable loss in the previous year.

The performance of white goods in Europe was a disappointment, however,

with lower income and margin despite good volume growth. This resulted partly

from increased pressure on prices and higher costs for materials, mainly during

the second half, and also from a less favorable mix in terms of products, coun-

tries and customers. The costs of establishing a new pan-European organization

also had an unfavorable effect.

The downturn in operating income for Professional Indoor Products

was primarily a result of divestments, and lower volumes for laundry equipment

resulting mainly from production delays related to the launch of a new product

range. A substantial downturn in income for compressors in China and Egypt

during the second half of the year also had an adverse effect.

Professional Outdoor Products achieved continued high growth

in sales as well as income, and also reported a somewhat better margin.

Contributing factors included the strong dollar and a large volume of exports

of chainsaws from Sweden to North America.

Both Consumer Durables in Europe and Professional Indoor Products

reported lower value creation in the second half of the year than in 1999.

… higher income for Consumer Durables

and Professional Outdoor.

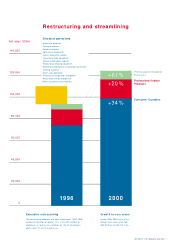

Value creation by business

area, 1998 –2000

–500

0

500

1,000

1,500

2,000

SEKm

Consumer Durables

Professional

Indoor Products

Professional

Outdoor Products

1998 1999 2000

8REPORT BY THE PRESIDENT AND CEO

Consumer Durables generated the largest

increase in value creation for the period

1998–2000, which mainly refers to North

America and Rest of the world.