EMC 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

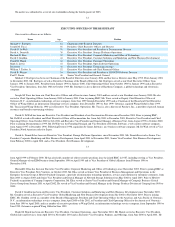

Costs and expenses

The following table presents our costs and expenses and net loss. Certain columns may not add due to rounding.

2002 2001 $ Change % Change

Cost of revenue:

Information storage products $2,614.1 $3,489.4 $ (875.3) 25%

Information storage services 629.1 599.0 30.1 5

Other businesses 76.3 158.7 (82.4) 52

Total cost of revenue 3,319.5 4,247.0 (927.5) 22

Gross margins:

Information storage products $1,604.3 $2,377.8 $ (773.5) 33

Information storage services 449.3 373.3 76.0 20

Other businesses 65.3 92.4 (27.1) 29

Total gross margin 2,118.8 2,843.6 (724.8) 26

Operating expenses:

Research and development 781.5 928.7 (147.2) 16

Selling, general and administrative 1,680.8 2,214.2 (533.4) 24

Restructuring and other special charges 150.4 398.5 (248.1) 62

Total operating expenses 2,612.7 3,541.4 (928.7) 26

Operating loss (493.8) (697.8) 204.0 29

Investment income, interest expense and other expenses, net 197.3 120.8 76.5 63

Loss before income taxes (296.5) (577.0) 280.5 49

Benefit from income taxes (177.8) (69.3) (108.5) 157

Net loss $ (118.7) $ (507.7) $ 389.0 77%

In 2001, included in our costs and expenses was goodwill amortization of $52.4. As a result of implementing Statement of Financial Accounting

Standards ("FAS") No. 142, "Goodwill and Other Intangible Assets," in 2002, goodwill is no longer amortized.

• Gross Margins

The gross margin percentages for information storage products were 38.0% and 40.5% in 2002 and 2001, respectively. The gross margin percentage for

2001 was negatively impacted by $320.1, or 5.5%, for a provision for excess and obsolete inventory and impaired capitalized software. The gross margin

percentage for 2002 was favorably impacted by $61.6, or 1.5%, resulting primarily from the sale of previously identified obsolete inventory for which a full

reserve had been established. The decline in the gross margin percentage in 2002 compared to 2001 was primarily attributable to the reduction in revenues

resulting from lower sales volume, which caused fixed overhead costs to be absorbed over a lower sales base. In addition, lower average selling prices due to

competitive pricing contributed to the decline. Partially offsetting this decline were reductions in our fixed overhead costs resulting from measures we took to

reduce costs which were initiated in the second half of 2001. Additionally, the 2002 gross margin percentage was favorably impacted as a result of

implementing FAS No. 142.

The gross margin percentage for information storage services increased to 41.7% in 2002 compared to 38.4% in 2001. The increase in the gross margin

percentage was primarily attributable to greater productivity of our customer service and professional services personnel.

28

The gross margin percentages for other businesses were 46.1% and 36.8% in 2002 and 2001, respectively. The increase in the gross margin percentage

resulted primarily from this segment consisting only of services revenue in 2002 compared to both systems and services revenue in 2001.

• Research and Development

As a percentage of revenues, R&D expenses were 14.4% and 13.1% in 2002 and 2001, respectively. In addition, we spent $126.7 and $120.7 in 2002 and

2001, respectively, on software development, which costs were capitalized. R&D spending levels reflect our efforts to continue to improve our long-term

competitive position, offset in part by our continued cost cutting. R&D spending includes enhancements to information storage software and information

storage systems, including networked information storage systems.

• Selling, General and Administrative

As a percentage of revenues, SG&A expenses were 30.9% and 31.2% in 2002 and 2001, respectively. The decrease in SG&A in 2002 compared to 2001

was due to measures we took to reduce costs, which were initiated in the second half of 2001 and continued in 2002, enabling us to begin to achieve a cost

structure commensurate with reduced revenue levels. Additionally, lower commission expense due to lower revenues reduced SG&A expenses.