EMC 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have never paid cash dividends on our common stock. While subject to periodic review, the current policy of our Board of Directors is to retain cash

and investments primarily to provide funds for our future growth. Additionally, from time to time, we use cash to repurchase our common stock.

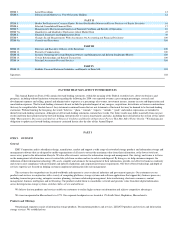

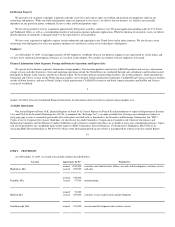

ISSUER PURCHASES OF EQUITY SECURITIES IN THE FOURTH QUARTER OF 2003

Period

Total

Number of

Shares

Purchased (1)

Average Price

Paid per Share

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

Maximum Number

(or Approximate

Dollar Value) of

Shares that May

Yet Be Purchased

Under the Plans or

Programs

October 1, 2003 –

October 31, 2003 2,100,000 $ 13.11 2,100,000 237,917,700

November 1, 2003 –

November 30, 2003 – – – 237,917,700

December 1, 2003 –

December 31, 2003 – – – 237,917,700

Total 2,100,000 $ 13.11 2,100,000 237,917,700

All shares were purchased in open-market transactions pursuant to a previously announced authorization by our Board of Directors in October 2002 to

repurchase 250.0 million shares of our common stock. In addition, in May 2001, our Board authorized the repurchase of up to 50.0 million shares of

our common stock, which shares were repurchased in 2001 and 2002.

16

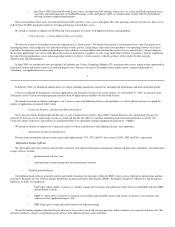

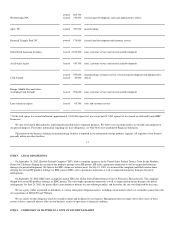

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

FIVE YEAR SELECTED CONSOLIDATED FINANCIAL DATA

EMC Corporation

(in thousands, except per share amounts)

Year Ended December 31,

2003 2002 2001 2000 1999 (1)

Summary of Operations:

Revenues $ 6,236,808 $5,438,352 $7,090,633 $ 8,872,816 $6,715,610

Operating income (loss) (2) 401,157 (493,831) (697,841) 2,256,903 1,241,094

Net income (loss) (2) 496,108 (118,706) (507,712) 1,782,075 1,010,570

Net income (loss) per weighted average share, basic (2)(3) $ 0.22 $ (.05) $ (0.23) $ 0.82 $ 0.49

Net income (loss) per weighted average share, diluted (2)(3) $ 0.22 $ (.05) $ (0.23) $ 0.79 $ 0.46

Weighted average shares,

basic (3) 2,211,544 2,206,294 2,211,273 2,164,180 2,061,101

Weighted average shares,

diluted (3) 2,237,656 2,206,294 2,211,273 2,245,203 2,219,065

Balance Sheet Data:

Working capital $ 2,140,775 $2,175,598 $2,743,828 $ 3,986,404 $2,922,481

Total assets 14,092,860 9,590,447 9,889,635 10,537,799 7,064,701

Long-term obligations (4) 132,634 6,963 17,202 14,457 686,609

Stockholders' equity $10,884,721 $7,226,002 $7,600,820 $ 8,177,209 $4,951,786

The selected consolidated financial data for 1999 include the full year effects of the acquisition of Data General on October 12, 1999, which was

accounted for as a pooling-of-interests.

In 2003, we incurred restructuring costs and other special charges totaling approximately $66,000 pre-tax ($56,000 after-tax). All pre-tax amounts were

included in operating income. In 2002, we incurred restructuring costs and other special charges totaling approximately $100,000 pre-tax ($82,000

after-tax). The pre-tax amounts consist of $91,000 included in operating loss and $9,000 included in other expense, net. In 2001, we incurred

restructuring costs and other special charges totaling approximately $825,000 pre-tax ($675,000 after-tax). The pre-tax amounts consist of $719,000

included in operating loss and $106,000 included in other expense, net. In 1999, we incurred restructuring, merger and other special charges totaling

approximately $224,000 pre-tax ($170,000 after-tax). All pre-tax amounts were included in operating income.

All share and per share amounts have been restated to reflect the stock splits effective May 28, 1999 and June 2, 2000 for all periods presented.

Includes long-term convertible debt and capital leases, excluding current portion.

17

(1)

(1)

(2)

(3)

(4)