EMC 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPARISON OF FISCAL 2002 AND 2001

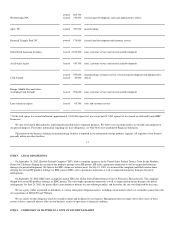

The following table presents certain consolidated statement of operations information stated as a percentage of total revenues. Certain columns may not

add due to rounding.

Year Ended

December 31,

2002 2001

Total revenue 100.0% 100.0%

Cost and expenses

Cost of sales 61.0 59.9

Research and development 14.4 13.1

Selling, general and administrative 30.9 31.2

Restructuring and other special charges 2.8 5.6

Operating loss (9.1) (9.8)

Investment income, interest expense and other expense, net 3.6 1.7

Loss before income taxes (5.5) (8.1)

Benefit from income taxes (3.3) (0.9)

Net loss (2.2)% (7.2)%

Revenue

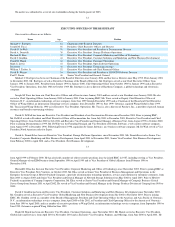

The following table presents revenue by our segments:

2002 2001 $ Change % Change

Information storage products $4,218.4 $5,867.2 $(1,648.8) 28%

Information storage services 1,078.4 972.3 106.1 11

Other businesses 141.6 251.1 (109.5) 44

Total revenues $5,438.4 $7,090.6 $(1,652.2) 23%

26

Information storage systems revenues were $2,985.3 and $4,307.2 in 2002 and 2001, respectively, representing a decrease of $1,321.9, or 31%. This

decrease was primarily due to declining sales volume and increased levels of competition. The global economic slowdown, which commenced in 2001 and

continued throughout 2002, led to a reduction in information technology spending. Competitive pricing pressures also had an adverse effect on revenues.

Information storage software revenues were $1,233.1 and $1,560.0 in 2002 and 2001, respectively, representing a decrease of $326.9, or 21%. The decrease

was also primarily due to declining sales volume caused by the global economic slowdown and increased levels of competition.

Information storage services revenues increased due to a greater volume of professional services, largely to support and implement automated networked

storage solutions. Additionally, the increase was due to a growth in maintenance revenues associated with a greater volume of both software and hardware

maintenance contracts.

Other businesses revenues consist of revenues from AViiON server products and related services. Included in the 2001 amount was revenue from

AViiON server products of $48.4. In the third quarter of 2001, we stopped selling AViiON server products. Accordingly, other businesses revenues for the

last quarter of 2001 and all of 2002 were comprised only of AViiON services revenues.

Revenues on sales into the North American markets were $3,225.4 and $4,185.4 in 2002 and 2001, respectively, representing a decrease of $960.0, or

23%. Revenues on sales into the European, Middle East and African markets were $1,327.8 and $1,774.9 in 2002 and 2001, respectively, representing a

decrease of $447.1, or 25%. Revenues on sales into the Asia Pacific markets were $769.8 and $893.4 in 2002 and 2001, respectively, representing a decrease

of $123.6, or 14%. Revenues on sales into the Latin American markets were $115.4 and $237.0 in 2002 and 2001, respectively, representing a decrease of

$121.6, or 51%.

The decline in revenues in all markets in 2002 was attributable to the global economic slowdown that began in 2001 and continued throughout 2002,

which led to a reduction in information technology spending. Increased levels of competition, including competitive pricing pressures, also had an adverse

effect on revenues. The decline in the Latin American markets in 2002 was further impacted by the region's political and currency instability.

Changes in exchange rates in 2002 compared to 2001 did not have a material effect on revenues.

At the time of sale, we provide for the potential returns of systems as a reduction of revenue. Our provision for sales returns was $158.6 in 2002 and

$635.9 in 2001. We estimate the amount of returns based upon our historical experience, specific identification of probable returns and current market and

economic conditions. The decrease in the provision for sales returns in 2002 compared to 2001 was attributable to a decline in revenue, a reduction in the

level of actual returns and lower than expected sales returns for 2002 compared to 2001.

27