E-Z-GO 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 was a year of signicant growth for our company. Fueled by our strategic investments

in new products and acquisitions, and strong performances by our businesses, we generated

$13.9 billion in total revenues and a segment prot of $1.2 billion. This represents a 15%

increase in revenues and a 26% increase in segment prot over the previous year.

PROGRESS ACROSS OUR

BUSINESSES

Our businesses made progress on a

number of fronts. At Textron Aviation, the

acquisition of Beechcraft and encouraging

trends in business aviation helped increase

revenues from $2.8 billion in 2013 to

$4.6 billion in 2014. Bell Helicopter moved

forward on several new products, including

the 505 Jet Ranger X, which made its rst

ight just 20 months after the program’s

launch, and the new Bell 525, which

continues to make progress toward its

rst ight. On the military side, Bell’s

next-generation tiltrotor, the V-280 Valor,

achieved a major milestone in being

selected as one of two aircraft to compete

for the U.S. Department of Defense’s

Future Vertical Lift Program. This program

is worth an estimated $100 billion and is

expected to replace 2,000 to 4,000

medium-class utility and attack helicopters.

In our Industrial segment, segment prot

increased 16% over last year as the

businesses focused on the introduction of

new products, strategic acquisitions and

distribution channel expansion. Our

Textron Systems segment secured notable

domestic and international contract wins,

reecting a strong focus on aligning its

businesses’ products with customer

needs. Our TRU Simulation + Training

business substantially grew its aviation

customer base, including a contract to

supply full-ight simulators for Boeing’s

latest single-aisle airplane, the 737 MAX.

Winning such a competitive commercial

airplane program demonstrates the

condence that customers have in TRU

to deliver sophisticated ight training

requirements for their operations.

At Textron Financial, we completed

another successful year of providing our

customers with attractive nancing

options in support of Textron aircraft

product sales.

STRATEGIC ACQUISITIONS TO

EXPAND OUR MARKETS

A key element of our strategy is acquiring

businesses that will help us realize new

market opportunities, grow our customer

base and provide a greater range of

products and services to customers. In

2014, we acquired several businesses that

complement our product lines and add new

capabilities to our existing operations. Our

largest acquisition was Beech Holdings LLC,

which brought the iconic Beechcraft and

Hawker brands into the Textron family. With

Beechcraft, we have signicantly expanded

our portfolio to include the King Air and T-6

product families and Hawker parts and

services, and now have a greatly extended

service footprint for our global customer

base of more than 250,000 aircraft.

Within our Industrial segment, our Textron

Specialized Vehicles group of businesses

continued to widen its reach into new

customer markets through the acquisition

FELLOW SHAREHOLDERS,

Tex tron

Systems

Bell

Helicopter

Textron Aviation

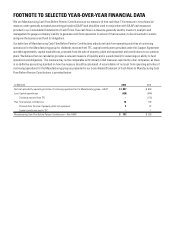

TOTAL REVENUES BY SEGMENT

Industrial

Finance

$4.6B

$4.3B

$3.3B

$0.1B

$1.6B