E-Z-GO 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.jurisdictions. Accordingly, fluctuations in foreign currency rates could adversely affect our profitability in future periods. We

monitor and manage these exposures as an integral part of our overall risk management program. In some cases, we purchase

derivatives or enter into contracts to insulate our results of operations from these fluctuations. Nevertheless, changes in currency

exchange rates, raw material prices and interest rates can have substantial adverse effects on our results of operations.

We may be unable to effectively mitigate pricing pressures.

In some markets, particularly where we deliver component products and services to OEMs, we face ongoing customer demands for

price reductions, which sometimes are contractually obligated. However, if we are unable to effectively mitigate future pricing

pressures through technological advances or by lowering our cost base through improved operating and supply chain efficiencies,

our results of operations could be adversely affected.

Unanticipated changes in our tax rates or exposure to additional income tax liabilities could affect our profitability.

We are subject to income taxes in both the U.S. and various non-U.S. jurisdictions, and our domestic and international tax

liabilities are subject to the allocation of income among these different jurisdictions. Our effective tax rate could be adversely

affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax

assets and liabilities, changes to unrecognized tax benefits or changes in tax laws, which could affect our profitability. In

particular, the carrying value of deferred tax assets is dependent on our ability to generate future taxable income, as well as

changes to applicable statutory tax rates. In addition, the amount of income taxes we pay is subject to audits in various

jurisdictions, and a material assessment by a tax authority could affect our profitability.

Item 1B. Unresolved Staff Comments

None.

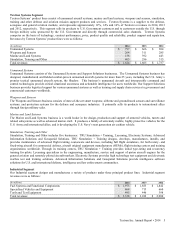

Item 2. Properties

On January 3, 2015, we operated a total of 56 plants located throughout the U.S. and 54 plants outside the U.S. We own 59 plants

and lease the remainder for a total manufacturing space of approximately 23.4 million square feet. We consider the productive

capacity of the plants operated by each of our business segments to be adequate. We also own or lease offices, warehouses,

service centers and other space at various locations. In general, our facilities are in good condition, are considered to be adequate

for the uses to which they are being put and are substantially in regular use.

Item 3. Legal Proceedings

On October 7, 2014, the Federal Aviation Administration of the U.S. Department of Transportation (DOT) issued a Notice of

Proposed Civil Penalty to McCauley Propeller Systems, a Division of Cessna Aircraft Company, for alleged violations of DOT’s

hazardous materials shipment regulations in connection with the shipment of resin product by air from McCauley’s Columbus, GA

facility. The DOT has proposed a civil penalty of $238,000, and Cessna Aircraft Company is currently negotiating the disposition

of the matter.

We also are subject to actual and threatened legal proceedings and other claims arising out of the conduct of our business,

including proceedings and claims relating to commercial and financial transactions; government contracts; alleged lack of

compliance with applicable laws and regulations; production partners; product liability; patent and trademark infringement;

employment disputes; and environmental, health and safety matters. Some of these legal proceedings and claims seek damages,

fines or penalties in substantial amounts or remediation of environmental contamination. As a government contractor, we are

subject to audits, reviews and investigations to determine whether our operations are being conducted in accordance with

applicable regulatory requirements. Under federal government procurement regulations, certain claims brought by the U.S.

Government could result in our suspension or debarment from U.S. Government contracting for a period of time. On the basis of

information presently available, we do not believe that existing proceedings and claims will have a material effect on our financial

position or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

15

Textron Inc. Annual Report • 2014