E-Z-GO 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

receivables declined by $580 million—capping off a four-year

process to exit our Non-Captive finance business. We expect

to liquidate the majority of the remaining $370 million in

Non-Captive receivables over the next two years.

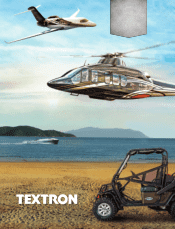

As Textron continues to lead the way with new aircraft,

golf cars and turf care equipment, the Finance segment has

a natural opportunity to facilitate loans and leases for many

of those customers. These services strengthen our customer

relationships, and open new avenues for profitable growth.

SUPPORTING TEXTRON

SALES WORLDWIDE.

PERFORMANCE HIGHLIGHTS

(In millions) 2012 2011 2010

Segment Revenues $215 $103 $218

Segment Profit (Loss) $ 64 $ (333) $(237)

FINANCE PERFORMANCE HIGHLIGHTS (In millions)

8

FINANCE

Aviation: $1,667

CAPTIVE RECEIVABLES: $1,704

Timeshare: $100

Golf Mortgage: $140

Structured Capital: $122

Other: $8

NON-CAPTIVE RECEIVABLES: $370

Our Captive Finance business performed well in 2012,

enabling many of our customers to purchase and

lease Textron-manufactured products—primarily new

Cessna aircraft and Bell helicopters. With more than a

half-century of aviation finance experience, our experts

have guided over 182,000 customers through their aircraft loan

or lease origination—in more than 68 countries.

For aircraft transactions outside the U.S., our Captive Finance

solutions are often superior to what customers can obtain

through their in-country banks. In fact, most of our Captive

Finance loans are related to cross-border aircraft sales. In

2012, Captive Finance supported sales of 93 new aircraft for

Cessna and Bell Helicopter. Of these loans, 87 percent were for

customers outside the United States and coordinated through

our key strategic relationships with the Export-Import Bank of

the United States and Export Development Canada. Our ability to

offer this financing provides added value for our customers, and

is increasingly important for our businesses’ international growth.

In addition to our focus on the financing of Textron product

purchases around the world, we also continued to exit other

types of financial services. As a result, the health of the Finance

segment has strengthened considerably in recent years. Textron’s

Finance segment was profitable in 2012 for the first time since

2007. Revenues totaled $215 million, with segment profit of

$64 million for the year. During 2012, total Non-Captive finance