E-Z-GO 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Item 1. Business

In the fourth quarter of 2008, we announced a plan to exit the non-captive portion of the commercial finance business of our Finance segment,

while retaining the captive portion of the business that supports customer purchases of products that we manufacture. We made the decision to

exit this business in order to address our long-term liquidity position in light of the disruption and instability in the capital markets. The non-

captive business includes the following product lines: asset-based lending, distribution finance, golf mortgage, hotel, structured capital and

timeshare. The exit plan is being effected through a combination of orderly liquidation and selected sales. During 2009, we reduced our owned

and managed finance receivable portfolio by approximately $3.8 billion and expect, depending on market conditions, to substantially complete

liquidation of the remaining non-captive portfolio over the next two to three years. This reduction included approximately $450 million in finance

receivables from our captive finance business.

Our Finance segment continues to originate new customer relationships and finance receivables in the captive finance division, which provides

financing for new Cessna aircraft and Bell helicopters and new E-Z-GO and Jacobsen golf and turf-care equipment. Financing continues to be

provided to purchasers of used Cessna aircraft and Bell helicopters on a limited basis. Our Finance segment’s services are offered primarily in

North America; however, purchases of certain Textron products, principally Bell helicopters and Cessna aircraft, are financed worldwide. Most

financing for Cessna aircraft sold to international buyers now is provided by using funding from the Export-Import Bank of the United States

through a credit facility provided to a wholly-owned finance subsidiary of Textron and guaranteed by TFC.

In 2009, 2008 and 2007, our Finance group paid our Manufacturing group $0.6 billion, $1.0 billion and $1.2 billion, respectively, related to the

sale of Textron-manufactured products to third parties that were financed by the Finance group. Our Cessna and Industrial segments also received

proceeds in those years of $13 million, $18 million and $27 million, respectively, from the sale of equipment from their manufacturing operations

to our Finance group for use under operating lease agreements.

The commercial finance business has traditionally been extremely competitive. Our Finance segment is subject to competition from various types

of financing institutions, including banks, leasing companies, commercial finance companies and finance operations of equipment vendors.

Competition within the commercial finance industry primarily is focused on price, term, structure and service.

Our Finance segment’s largest business risks are continued access to financing through the capital markets and the collectability of its finance

receivable portfolio. See “Finance Portfolio Quality” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

on pages 26 and 27 for a discussion of the credit quality of this portfolio.

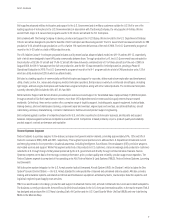

Backlog

Our backlog at the end of 2009 and 2008 is summarized below:

January 2, January 3,

(In millions) 2010 2009

U.S. Government:

Bell $ 6,416 $ 5,037

Textron Systems 1,408 2,004

Total U.S. Government backlog 7,824 7,041

Commercial:

Cessna 4,893 14,530

Bell 487 1,155

Textron Systems 256 186

Industrial 47 76

Total commercial backlog 5,683 15,947

Total backlog $ 13,507 $ 22,988

The decrease in backlog at Cessna reflects the cancellation of numerous business jet orders during the year and includes a $2.1 billion impact

from our decision to cancel the development of the Citation Columbus aircraft and a $1.3 billion impact due to cancellations by one customer. The

economic recession has significantly impacted many of our customers, resulting in a significant number of Cessna’s customers requesting

deferral of their scheduled delivery date, transition to a smaller or less expensive model, or, in many cases, cancellation of their order. We

continue to identify customers interested in accelerating their aircraft delivery date to replace deferrals or cancellations and expect ongoing

volatility in the timing of fulfillment of our Cessna backlog until economic conditions begin to recover.