E-Z-GO 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

decade, we recently established an extensive IT infrastructure sourcing

partnership with Computer Sciences Corporation designed to generate

further long-term savings across Textron.

We’re realizing significant ongoing business process improvements,

underpinned by our Shared Service organizations, including a

consolidation of more than 1,500 separate payrolls and multiple payroll

system providers in North America and the U.K. to just three today.

In addition, a total reengineering of our healthcare offerings brought us

from 152 separate plans from multiple providers to one provider with

several options for all North American, non-bargained employees.

In addition, our new HR Invent infrastructure – a reinvention of our

HR service delivery model – provides common, Web-based, self-service

capabilities to Textron employees. This has yielded a dramatically more

efficient method to deliver and manage employee benefits.

Portfolio Management As we’ve focused on generating results

through our Enterprise Management initiatives, we have also honed our

Portfolio Management capabilities. Simultaneously, we are taking

strategic actions to simplify our business mix to deliver greater future

returns and growth to our shareholders.

We’ve created new acquisition criteria, conducted an in-depth analysis

of our portfolio and produced detailed plans for each of our businesses,

in addition to developing a more comprehensive acquisition integration

process.

Since 2001, we’ve divested more than $2.4 billion of annual non-core

manufacturing revenues and $1.3 billion of non-core finance assets

that did not meet our growth criteria. This has enabled us to allocate

additional management attention and capital toward our faster-growing,

more strategic businesses.

While modest in scope, we’ve concentrated our more recent acquisitive

activity on complementary growth areas through acquisitions such as

Acadian Composites to advance our helicopter after-market growth

strategy; our increased stake to 75 percent ownership in the

CitationShares joint venture to expand participation in the growing

fractional jet market; and our joint venture between Greenlee and

Rothenberger AG to advance our presence in the North American

plumbing tools arena.

The Power to Grow Across all Textron businesses, there are exciting

developments that signal a bright future indeed. The following pages

provide a snapshot of how our segments are positioned to deliver

profitable growth through the second half of the decade and beyond,

including examples of how our businesses are benefiting from our

enterprise-wide initiatives, reflecting the value of our networked

enterprise.

We’re infusing Textron with a focus on value by incorporating value

management principles into our strategic planning and leadership

compensation processes to ensure the achievement of aggressive goals in

customer satisfaction and shareholder value creation.

The powerful combination of strong businesses and a value-adding net-

work gives us confidence that over the next several years, we can achieve

a return on invested capital of at least 14 percent while consistently

yielding compound earnings per share growth of 15 to 20 percent.

This year, and the rest of the decade, will be an exciting time of growth

for Textron. We have an undeniable sense of enthusiasm for the promise

of our future, and we remain relentless in the pursuit of our vision to

become the premier multi-industry company. Our talented workforce –

the primary agent of transformation over these past four years –

has become more committed to this vision with each and every step.

Thank you for your continued support.

Lewis B. Campbell

Chairman, President and Chief Executive Officer

8

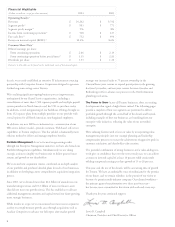

Financial Highlights

(Dollars in millions, except per share amounts) 2004 2003

Operating Results(1)

Revenues $ 10,242 $ 9,792

Segment profit(2) $ 903 $ 771

Segment profit margin(2) 9% 8%

Income from continuing operations(3) $ 528 $ 417

Free cash flow(4) $ 752 $ 494

Return on invested capital (ROIC)(5) 10.4% 8.6%

Common Share Data(1)

Diluted earnings per share:

From continuing operations $ 2.66 $ 2.13

From continuing operations before special items(6) $ 3.35 $ 2.83

Dividends per share $ 1.33 $ 1.30

Footnotes to this table can be found on the inside back cover of this annual report.