E-Z-GO 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004

The Power to Grow

Table of contents

-

Page 1

The Power to Grow Annual Report 2004 -

Page 2

In the last few years, Textron has been transforming...strengthening the power of our brands, the power of our processes and the power of our people. This transformation positions us to lead our markets in exciting and sustainable ways. Indeed, it is giving us the power to grow. -

Page 3

Bell Helicopter is a world leader in vertical takeoff and landing aircraft for military and commercial segments. The pioneer of tiltrotor technology, Bell also has the largest and highest-rated customer support network in the industry. All of which may explain why every third helicopter flying is a ... -

Page 4

Cessna is the world's leading designer and manufacturer of light and mid-size business jets, utility turboprops and single-engine piston aircraft. Its Citation business jet fleet is the largest and most comprehensive in the world. And the Citation X is the world's fastest business jet. Now that's ... -

Page 5

At Textron Fastening Systems, some of our most exciting products are hidden. Miniature fasteners for electronic applications, "blind" fasteners for aircraft - even fasteners with microchips driven by remote devices. These new Intevia "intelligent" fasteners are even replacing traditional lock and ... -

Page 6

At Textron, we're pros at golf. E-Z-GO is the world leader in golf cars and utility vehicles. Groundskeepers around the world look to Jacobsen to keep their turf in tournament condition. And Textron Financial finances golf equipment as well as some of the world's top golf developments. When it comes... -

Page 7

Textron Financial helps thousands of businesses realize their dreams. Distribution finance, loans for timeshare resorts, golf courses and equipment, and Textron products such as Cessna jets, Bell helicopters, E-Z-GO golf cars and Jacobsen turf equipment. With more than $8 billion in managed assets, ... -

Page 8

... our networked enterprise. To Our Shareowners, Employees and Customers: 2004 was a very good year for Textron. The majority of ... customer value. Profitable growth - particularly organic growth - is a top priority. In 2004 alone, $2.1 billion - or 20 percent - of our sales were derived from new... -

Page 9

2004 was a very good year for Textron. We exceeded our earnings and cash flow targets... than ever before. We are currently executing an enterprise IT consolidation effort, which has already yielded annual savings of well over $40 million. We've integrated all Textron IT networks, enabling us to... -

Page 10

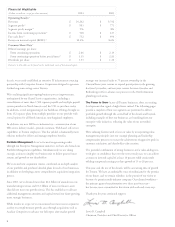

Financial Highlights (Dollars in millions, except per share amounts) 2004 $ $ $ $ 10,242 903 9% 528 752 10.4% $ $ $ $ 2003 ... to this table can be found on the inside back cover of this annual report. decade, we recently established an extensive IT infrastructure sourcing partnership with Computer ... -

Page 11

The power of Textron. The power to grow. 9 -

Page 12

We aspire to be the premier multi-industry company. That means bringing together powerful brands, world-class processes and talented people. It means combining our strengths to reach ever-higher goals. It comes from each Textron business, and it comes from all Textron businesses. And it's creating ... -

Page 13

The Power of the Enterprise Customer Leadership We are committed to helping each Textron brand prosper with innovative, market-leading solutions and a relentless focus on customer needs. By focusing on key elements of the customer experience, Textron is improving our expertise in segmenting, ... -

Page 14

... a member of the US101 Team selected in early 2005 to build a new fleet of Marine One helicopters for the President of the United States. 2004 was a big year for Textron Systems, part of the Bell segment and a maker of precision strike weapons, mobility products and surveillance systems. The company... -

Page 15

... and continued market leadership through the end of the decade. During 2004, Cessna received FAA certification and began delivery of three new jets:...Cessna received more than 64 orders for the two new Citations announced in November 2004: CJ1+ and CJ2+. Deliveries for the CJ1+ and CJ2+ are scheduled... -

Page 16

... subassemblies, electronics, construction and aerospace. By the end of 2004, TFS had become the only manufacturer in the world providing ...products, found in everything from aircraft to automobiles to tiny electronic devices. In 2004, TFS cut lead times in half on nearly 100 of those products using... -

Page 17

... in more than a decade. Kautex, which supplies automotive fuel tank systems to the world's major auto manufacturers, won a major French OEM contract in 2004, closing a gap in its global coverage. And as the booming market in Asia transitions from steel to plastic tanks, Kautex is well positioned to... -

Page 18

... as structured capital and asset-based lending, Textron Financial is focused on building its core businesses and is positioned for growth. In 2004, Textron Financial completed financing of its third Trump golf resort, the Trump National Golf Club in Bedminster, N.J., and recently closed its fourth... -

Page 19

Management Committee: (left to right) Terrence O'Donnell, John D. Butler, Ted R. French, Mary L. Howell, Lewis B. Campbell. Transformation Leadership Team Lewis B. Campbell Buell J. Carter Jr. (Jay) Stuart I. Grief Richard J. Millman Peter N. Riley Chairman, President and Chief Executive Officer ... -

Page 20

Left to right, top to bottom: Campbell, Arnelle, Bader, Clark, Evans, Fish, Ford, Gagné, Powell, Rowe, Walker, Wheeler Board of Directors Lewis B. Campbell (1) R. Kerry Clark (2,4) Joe T. Ford (3) Brian H. Rowe (1,2,4) Chairman, President and Chief Executive Officer Textron Inc. H. Jesse ... -

Page 21

...(or for such shorter period that the registrant was required to ï¬le such reports) and (2) has been subject to such ï¬ling âœ" requirements for the past ...3, 2004, was approximately $8,024,486,784. Textron has no non-voting common equity. Portions of Textron's Proxy Statement for its Annual Meeting ... -

Page 22

... the consolidated ï¬nancial statements on pages 67 through 69 of this Annual Report on Form 10-K. Bell Segment The Bell segment is composed of ... 2003, and received U.S. Federal Aviation Administration certiï¬cation in December 2004. Ground run testing of the BA609 commenced in December 2002 and... -

Page 23

...for approximately 24%, 23% and 31% of our total revenues in 2004, 2003 and 2002, respectively. The family of business jets currently ...The Cessna Caravan is the world's best selling utility turboprop. Through the end of 2004, more than 1,478 Caravans have been sold by Cessna since the ï¬rst Caravan ... -

Page 24

...four-place 172 Skyhawk, 172 Skyhawk SP, 182 Skylane and Turbo 182 Skylane, and the six-place 206 Stationair and T206 Turbo Stationair. In 2004, certiï¬cation of the Garmin 1000 ("G1000") avionics package was completed for all models other than the 172 Skyhawk, and aircraft deliveries commenced with... -

Page 25

... and sheeting for household and industrial uses. Revenues of Kautex accounted for approximately 15%, 15% and 12% of our total revenues in 2004, 2003 and 2002, respectively. Kautex has a number of competitors worldwide, some of whom are owned by the automotive original equipment manufacturers that... -

Page 26

... States and Canada. However, Textron Financial Corporation ï¬nances Textron products worldwide, principally Bell helicopters and Cessna aircraft. In 2004, 2003 and 2002, Textron Financial Corporation paid Textron $0.9 billion, $0.9 billion and $1.0 billion, respectively, relating to the sale of... -

Page 27

...into a deï¬nitive purchase order and receipt of required deposits. The 2004 year-end backlog with the major fractional jet customer was approximately $1.3 billion...17 to the consolidated ï¬nancial statements on page 67 of this Annual Report on Form 10-K. Patents and Trademarks We own, or are ... -

Page 28

... Additional information regarding environmental matters is contained in Note 15 to the consolidated ï¬nancial statements on pages 64 and 65 of this Annual Report on Form 10-K. Employees At January 1, 2005, we had approximately 44,000 employees. Available Information We make available free of charge... -

Page 29

.... The complaint seeks unspeciï¬ed compensatory damages. On June 15, 2004, the District Court ruled that the plaintiffs could not maintain the...the consolidated amended complaint was granted on June 24, 2003. On May 7, 2004, the United States Court of Appeals for the First Circuit afï¬rmed dismissal ... -

Page 30

... holders during the last quarter of the period covered by this Annual Report on Form 10-K. Executive Ofï¬cers of the Registrant The following...Chairman and Chief Executive Ofï¬cer of Textron Financial Corporation in January 2004. Prior to joining Textron, Mr. French served as President, Financial... -

Page 31

...common stock. The high and low common stock prices per share as reported on the New York Stock Exchange, and the dividends paid per share, ...003,500 11,076,800 10,117,600 8,996,500 * On October 21, 2004, Textron's Board of Directors authorized a new share repurchase plan under which Textron is... -

Page 32

Item 6. Selected Financial Data (Dollars in millions, except per share amounts and where otherwise noted) 2004 $ 2,254 2,473 1,924 3,046 545 $ 2003 2,348 2,299 1,737 2,836 572 9,792 234 199 66 150 122 771 (152) 619 15 - (119) (98) (112) (13 ... -

Page 33

... steel products, primarily in our Fastening Systems segment, to mitigate the impact of the higher material costs. While many of these actions were taken in 2004, we believe it will take a few quarters to determine what impact our pricing actions will have on our customers and volumes. In addition to... -

Page 34

...due to certain costs incurred in 2002, as described in the Bell segment section. Special Charges Special charges are summarized below: (In millions) 2004 $ 143 - (12) - 131 $ 2003 137 15 - - 152 $ 2002 93 - - 38 131 Restructuring Unamortized issuance costs on preferred securities Gain on sale of... -

Page 35

... of these actions, ï¬nancial results of these businesses, net of income taxes, are now reported as discontinued operations. Discontinued operations also reï¬,ect the after-tax gain in the second quarter of 2004 from the sale of InteSys' two Brazilian-based joint ventures. In the third quarter of... -

Page 36

...all in the Bell segment. See "Backlog" in Item 1. Business of Textron on page 6 for more information. Segment Analysis Bell (Dollars in millions) 2004 $ 2,254 $ 250 11% $ 3,775 2003 $ 2,348 $ 234 10% $ 2,197 2002 $ 2,235 $ 169 8% $ 1,815 Revenues Segment proï¬t Proï¬t margin Backlog Bell is... -

Page 37

... of $35 million related to a contract that began shipments during the third quarter of 2002. Bell Segment Proï¬t Segment proï¬t increased $16 million in 2004, compared with 2003, due to higher proï¬t of $47 million in the commercial business, partially offset by the impact of lower revenue of $31... -

Page 38

...$13 million in 2003 and lower volume primarily in the European industrial markets. Fastening Systems Segment Proï¬t Segment proï¬t decreased $13 million in 2004, compared with 2003, primarily due to inï¬,ation of $88 million, partially offset by improved cost performance of $35 million, pricing of... -

Page 39

... sales volume of $61 million, partially offset by $17 million related to the divestiture of a non-core product line during the second quarter of 2004. The higher sales volume primarily reï¬,ects an increase of $44 million at Kautex, largely due to new product launches and growth in its international... -

Page 40

...nance portfolio. Finance Segment Proï¬t Segment proï¬t increased $17 million in 2004, compared with 2003, primarily due to a $23 million decrease in the...for each of the last three year-ends by business are as follows: (In millions) 2004 $ 53 12 26 5 7 37 $ 2003 55 26 22 11 6 42 $ 2002 ... -

Page 41

... Terminations Fixed Asset Impairments Other Associated Costs Other Charges Total Special Charges (In millions) Total 2004 Bell Cessna Fastening Systems Industrial Finance Corporate 2003 $- - 37 28 - - $ 65 $- - 7 37 - - $ 44 $- - - 2 - - $ 2 $- - 2 2 - - $ 4 $ (1) - 9 1 - - $ 9 $- 1 34 10... -

Page 42

...initiatives. The $282 million increase in Textron Manufacturing's operating cash ï¬,ows is largely due to a decrease in working capital of $205 million in 2004, compared with a $65 million increase in working capital in 2003. A signiï¬cant portion of this decrease was due to an increase in customer... -

Page 43

... dividend payment was paid on January 3, 2005 to holders of record at the close of business on December 10, 2004, resulting in an annual dividend per common share of $1.325 in 2004, compared with $1.30 each in 2003 and 2002. Dividend payments to shareholders totaled $135 million, $222 million and... -

Page 44

... lines of credit to support their outstanding commercial paper. None of these lines of credit were used at January 1, 2005 or at January 3, 2004. Textron Manufacturing has primary revolving credit facilities of $1.25 billion, of which $1.0 billion will expire in 2007 and $0.25 billion will expire in... -

Page 45

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations Textron maintains deï¬ned beneï¬t pension plans and postretirement beneï¬t plans other than pensions as discussed in Note 12 to the consolidated ï¬nancial statements. Included in the table above are ... -

Page 46

... from continuing operations of $394 million and $765 million in 2004 and 2003, respectively. Textron Finance has used the proceeds from ... million. Textron Finance has valued this contingent liability based on assumptions for annual credit losses and prepayment rates of 0.25% and 7.50%, respectively.... -

Page 47

...of an asset might be impaired. We completed our annual impairment test in the fourth quarter of 2004 using the estimates from our long-term strategic plans... conditions, and the proï¬t margin assumptions are projected by each reporting unit based on the current cost structure and anticipated net cost... -

Page 48

...an important effect on postretirement liabilities. The 2004 healthcare cost trend rate, which is the weighted-average annual projected rate of increase in the per... are determined based on temporary differences between the ï¬nancial reporting and tax bases of assets and liabilities, applying enacted ... -

Page 49

... compensation over the service period beginning with the ï¬rst interim or annual period after June 15, 2005. The pro forma disclosures previously permitted... rate exchange agreements did not signiï¬cantly impact interest expense in 2004, 2003 or 2002. Within its Finance segment, Textron's strategy ... -

Page 50

...The notional amount of outstanding foreign exchange contracts, foreign currency options and currency swaps was approximately $493 million at the end of 2004 and $519 million at the end of 2003. Quantitative Risk Measures Textron utilizes a sensitivity analysis to quantify the market risk inherent in... -

Page 51

...Annual Report on Form 10-K on the page indicated below. Page Report of Management Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting Report... Segment Data Supplementary Information: Quarterly Data for 2004 and 2003 (Unaudited) Schedule II - Valuation... -

Page 52

... of Management Management is responsible for the integrity and objectivity of the ï¬nancial data presented in this Annual Report on Form 10-K. The consolidated ï¬nancial statements have been prepared in conformity with accounting principles generally accepted in the United States and include... -

Page 53

... Inc. maintained, in all material respects, effective internal control over ï¬nancial reporting as of January 1, 2005, based on the COSO criteria. We also ...sheets of Textron Inc. as of January 1, 2005 and January 3, 2004, and the related consolidated statements of operations, cash ï¬,ows and changes... -

Page 54

...Textron Inc. (the "Company") as of January 1, 2005 and January 3, 2004, and the related consolidated statements of operations, cash ï¬,ows and changes in ... Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 16, 2005 expressed an unqualiï¬ed opinion thereon... -

Page 55

Consolidated Statements of Operations For each of the years in the three-year period ended January 1, 2005 (In millions, except per share amounts) 2004 $ 9,697 545 10,242 7,894 1,383 248 58 131 - 9,714 528 (155) - 373 (8) 365 - $ 365 $ $ 2003 9,220 572 9,792 7,595 1,287 275 81 152 (15) 9,... -

Page 56

Consolidated Balance Sheets As of January 1, 2005 and January 3, 2004 (Dollars in millions, except share data) 2004 2003 Assets Textron Manufacturing Cash and cash equivalents Accounts receivable, net Inventories Other current assets Assets of discontinued operations Total current assets $ ... -

Page 57

...of Changes in Shareholders' Equity Shares Outstanding* For each of the years in the three-year period ended January 1, 2005 Dollars (In millions) (In thousands) 2004 $2.08 Preferred stock 2003 120 (8) 112 56 (4) 52 136,500 (1,951) 1,788 48 853 137,238 2002 133 (13) 120 62 (6) 56 141,251 (5,734... -

Page 58

Consolidated Statements of Cash Flows For each of the years in the three-year period ended January 1, 2005 Consolidated (In millions) 2004 $ 373 - 338 15 58 - 131 2 29 (41) (222) 6 5 340 (105) 20 949 $ 2003 292 - 336 18 81 (15) 152 (15) (41) 82 279 (208) (201) ... -

Page 59

... 7 - (15) 146 - (12) 82 257 (223) (202) 21 - 40 691 2002 $ 374 (23) 303 16 - (25) 131 - 268 (20) 55 (312) (137) (159) - 10 481 $ 2004 94 - 36 10 58 - - 2 69 - - 2 - (110) - - 161 $ 2003 79 - 34 11 81 - 6 (15) (29) - - (4) 1 74 - 4 242 $ 2002 76 - 27 10 111 - - (28) 58 - - (14) (23... -

Page 60

Notes to Consolidated Financial Statements Note 1 Summary of Signiï¬cant Accounting Policies Nature of Operations Textron Inc. ("Textron") is a global, multi-industry company with manufacturing and ï¬nance operations primarily in North America, Western Europe, South America and Asia/Paciï¬c. ... -

Page 61

... activities, on a consolidated basis, for the prior periods presented is as follows: Year Ended January 3, 2004 As Reported As Reclassiï¬ed (In millions) Year Ended December 28, 2002 As Reported As Reclassiï¬ed Net cash provided by operating activities Net cash provided (used) by investing... -

Page 62

Textron Inc. Aircraft sales with guaranteed minimum resale values are viewed as leases and are accounted for in accordance with Emerging Issues Task Force No. 95-1, "Revenue Recognition on Sales with a Guaranteed Minimum Resale Value." To determine whether the transaction should be classiï¬ed as ... -

Page 63

...ï¬nancial strength and speciï¬c prospects of the investee, and investment analyst reports, if available. If a decline in the fair value of an ... the consolidated statement of operations. The net loss totaled $11 million in 2004, $12 million in 2003 and $13 million in 2002. Since these losses... -

Page 64

...discounted cash ï¬,ows. Goodwill Management evaluates the recoverability of goodwill annually or more frequently if events or changes in circumstances, such...is considered to be impaired when the net book value of a reporting unit exceeds its estimated fair value. Fair values are established primarily... -

Page 65

... "Accounting for Stock-Based Compensation," to stock-based employee compensation: (Dollars in millions, except per share data) 2004 $ 365 20 (26) $ $ $ $ $ 359 2.66 2.61 2.61 2.56 $ $ $ ...(loss) per share: Basic - as reported Basic - pro forma Diluted - as reported Diluted - pro forma * Net of ... -

Page 66

... period beginning with the ï¬rst interim or annual period after June 15, 2005. The pro...share interests in business jets. On June 30, 2004, Textron acquired an additional 25% interest in ...this business, net of income taxes, are now reported as discontinued operations. The carrying value of this ... -

Page 67

... remaining OmniQuip business to JLG Industries, Inc. for $90 million in cash and a $10 million promissory note that was paid in full in February 2004. In the second quarter of 2003, Textron recorded $30 million in special charges for the impairment of $15 million in intangible assets and $15 million... -

Page 68

... down and sold as discussed in Note 14. Note 3 Accounts Receivable Accounts receivable is composed of the following: January 1, January 3, 2005 2004 $ 1,055 220 1,275 64 $ 1,211 $ 966 224 1,190 66 $ 1,124 (In millions) Commercial and customers U.S. Government contracts Less allowance for doubtful... -

Page 69

... 169 55 152 (9) 526 $ $ 2008 182 - 64 59 138 73 516 $ $ 2009 142 - 70 17 130 38 397 Thereafter $ 570 - 144 86 172 440 $ 1,412 2004 $ 1,455 1,026 1,402 410 1,005 539 5,837 99 $ 5,738 2003 $ 1,396 778 1,194 309 945 513 5,135 119 $ 5,016 Installment contracts Distribution ï¬nance Revolving loans... -

Page 70

... $58 million at January 1, 2005 and $137 million at January 3, 2004. The allowance for losses on ï¬nance receivables related to impaired loans is ...are past due loans of $31 million and $41 million at the end of 2004 and 2003, respectively, that meet the nonaccrual criteria but are not classiï¬ed as... -

Page 71

...trust. Servicing fees range from 75 to 150 basis points. During 2004, key economic assumptions used in measuring the retained interests at the date..., net Weighted-average life (years) Prepayment speed (annual rate) Expected credit losses (annual rate) Residual cash ï¬,ows discount rate $ 98 ... -

Page 72

...following: January 1, 2005 $ 1,210 3,364 4,574 2,652 $ 1,922 January 3, 2004 $ 1,084 3,256 4,340 2,439 $ 1,901 (In millions) Land and buildings... requires an annual review for impairment. All existing goodwill as of December 30, 2001 was required to be tested for impairment on a reporting unit basis... -

Page 73

...extend its expiration into 2006. Textron Manufacturing's credit facilities permit Textron Finance to borrow under these facilities. At January 1, 2005 and January 3, 2004, none of the lines of credit were used or reserved as support for commercial paper. The weighted-average interest rates for these... -

Page 74

... coverage ratio (no less than 125%). The following table shows required payments during the next ï¬ve years on debt outstanding at the end of 2004. The payment schedule excludes amounts that are payable under or supported by long-term credit facilities: (In millions) 2005 $ 433 656 $ $ 2006 8 985... -

Page 75

...For cash ï¬,ow hedges, Textron Finance recorded an after-tax loss of $7 million in 2004, a gain of $12 million in 2003, and a loss of $4 million in ...was a $32 million asset. At year-end 2004, $21 million of after-tax gain was reported in accumulated other comprehensive loss from qualifying cash ï¬,ow... -

Page 76

... are recorded as an adjustment to compensation expense when the award is charged to expense. These contracts impacted net income by $28 million in 2004, $23 million in 2003 and $(3) million in 2002. Cash received or paid on the contract settlement is included in cash ï¬,ows from operating activities... -

Page 77

... price of $57.30 and $40.61, respectively. There were no restricted shares granted in 2002. Reserved Shares of Common Stock At the end of 2004, common stock reserved for the subsequent conversion of preferred stock and shares reserved for the exercise of stock options were 2,698,000 and 9,261,000... -

Page 78

...ï¬ned contribution pension plans that together cover substantially all employees. The costs of the deï¬ned contribution plans amounted to approximately $29 million in 2004, $22 million in 2003 and $44 million in 2002. Deï¬ned beneï¬ts under salaried plans are based on salary and years of service... -

Page 79

...50 4,918 (534) 1,209 148 1 824 $ 2003 4,342 105 283 33 4 277 (297) 68 (2) 4,813 4,008 790 29 4 (297) 49 4,583 (230) 839 163 2 774 $ 2004 681 9 39 (1) 7 40 (78) 1 (3) 695 695) 168 (37) - (564) $ 2003 675 7 41 (41) 6 68 (76) 1 - 681 681) 137 (46) - (590) Change in beneï¬t obligation: Beginning... -

Page 80

...Pension Beneï¬ts The accumulated beneï¬t obligation for all deï¬ned beneï¬t pension plans was $5.0 billion at January 1, 2005 and $4.4 billion at January 3, 2004. Pension plans with accumulated beneï¬t obligations exceeding the fair value of plan assets were as follows at year-end: (In millions... -

Page 81

... purposes, Textron has assumed an annual healthcare cost trend rate of 11... a signiï¬cant effect on the amounts reported for the healthcare plans. A one-percentage...beneï¬t cost for postretirement beneï¬ts other than pensions in 2004 is approximately $7 million. Estimated Future Cash Flow Impact In... -

Page 82

...income tax rate reï¬,ected in the consolidated statements of operations: 2004 Federal statutory income tax rate Increase (decrease) in taxes resulting ...Textron's net deferred tax assets and liabilities were as follows: January 1, January 3, 2005 2004 $ 31 25 99 98 166 30 - 75 35 91 132 782 (155) $... -

Page 83

... Textron intends to repatriate approximately $200 million in non-U.S. cash and has recognized a related tax expense of $11 million in the fourth quarter of 2004. Textron is continuing to evaluate the effects of the AJCA and expects to complete this evaluation in 2005. It is possible that Textron may... -

Page 84

... Non-cash utilization Cash paid Balance at December 28, 2002 Additions Reserves deemed unnecessary Non-cash utilization Cash paid Balance at January 3, 2004 Additions Reserves deemed unnecessary Gains on sale of ï¬xed assets Non-cash utilization Cash paid Balance at January 1, 2005 $ 28 60... -

Page 85

...investment in C&A common stock for cash proceeds of $34 million and recorded a pre-tax gain of $12 million in the ï¬rst quarter of 2004. Note 15 Contingencies Textron is subject to legal proceedings and other claims arising out of the conduct of Textron's business, including proceedings and claims... -

Page 86

... the value of subcontracts received by AWB LLC from Lockheed Martin. As of January 1, 2005, AWB LLC had completed work under subcontracts received in 2004. On January 28, 2005, Lockheed Martin, with AWB LLC as its principal subcontractor, was selected to design, develop, manufacture and support the... -

Page 87

... Textron Finance has valued this contingent liability based on assumptions for annual credit losses and prepayment rates of 0.25% and 7.5%, respectively... revolving lines of credit, compared with $1.1 billion at January 3, 2004. Generally, interest rates on these commitments are not set until the... -

Page 88

... in Textron's warranty and product maintenance liability are as follows: (In millions) 2004 $ 304 147 (152) (17) 282 $ 2003 295 150 (151) 10...on pages 1 through 5 for products, of the segments. Textron's reportable segments are strategically aligned based on the manner in which Textron manages... -

Page 89

...$ 528 $ 417 $ 576 Assets (In millions) Property, Plant and Equipment Expenditures* 2004 $ 1,674 1,751 1,585 2,601 6,738 1,497 29 2003 $ 1,496 1,622... 72 $ 15,171 2002 $ 1,556 1,823 1,451 2,304 6,383 1,580 575 $ 15,672 $ 2004 62 98 52 100 12 22 - 346 $ 2003 50 99 34 105 17 18 4 327 $ 2002 ... -

Page 90

...area of Textron's operations: Revenues* (In millions) Property, Plant and Equipment, net** 2004 $ 6,069 348 509 866 670 356 374 1,050 2003 $ 6,093 364 466 ...350 909 $ 9,792 2002 $ 6,790 383 511 611 396 324 260 996 $ 10,271 $ 2004 1,283 71 32 252 66 82 93 84 1,963 2003 $ 1,281 74 34 231 54 95 91... -

Page 91

Quarterly Data (Unaudited) 2004 Q4 Q3 Q2 Q1 Q4 Q3 2003 Q2 Q1 (Dollars in millions, except per share amounts) Revenues Bell Cessna Fastening Systems Industrial Finance Total revenues ... -

Page 92

...Manufacturing's Reserves for Recourse Liability to Textron Finance (In millions) $ $ $ $ $ $ $ $ $ 2004 $ 64 10 (14) - (12) 48 $ 2003 59 37 (4) 21 (49) 64 $ 2002...") as of the end of the ï¬scal year covered by this report. Based upon that evaluation, our CEO and CFO concluded that our ... -

Page 93

... of Shareholders to be held on April 27, 2005, is incorporated by reference into this Annual Report on Form 10-K. Information regarding our executive ofï¬cers is contained in Part I of this Annual Report on Form 10-K. Item 11. Executive Compensation The information appearing under "Compensation of... -

Page 94

... 30 Exhibits 3.1 3.2 4.1 Restated Certiï¬cate of Incorporation of Textron as ï¬led January 29, 1998. Incorporated by reference to Exhibit 3.1 to Textron's Annual Report on Form 10-K for the ï¬scal year ended January 3, 1998. By-Laws of Textron. Incorporated by reference to Exhibit 3.2 to Textron... -

Page 95

...10.7C 10.7D Deferred Income Plan for Textron Key Executives. Incorporated by reference to Exhibit 10.2 to Textron's Annual Report on Form 10-K for the ï¬scal year ended January 3, 2004. Supplemental Beneï¬ts Plan for Textron Key Executives, as amended. Incorporated by reference to Exhibit 10.3 to... -

Page 96

... 5-Year Credit Agreement and the 364-day Credit Agreement. Incorporated by reference to Exhibit 10.19 to Textron's Annual Report on Form 10-K for the ï¬scal year ended January 3, 2004. Amendment No. 2 to the 364-day Credit Agreement. Incorporated by reference to Exhibit 10.1 to Textron's Quarterly... -

Page 97

...Agreement between Textron Inc. and Computer Sciences Corporation dated October 27, 2004. Conï¬dential treatment has been requested for portions of this agreement...the Securities Exchange Act of 1934, the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the ... -

Page 98

Textron Inc. Pursuant to the requirements of the Securities Exchange Act of 1934, this Annual Report on Form 10-K has been signed below on this 24th day of February 2005, by the following persons on behalf of the registrant and in ... -

Page 99

....wachovia.com/ï¬rstlink. Stock Exchange Information (Symbol:TXT) Company Publications and General Information To receive a copy of Textron's Forms 10K and 10-Q, Proxy Statement, Annual Report or the most recent company news and earnings press releases, visit our web site at www.textron.com, call... -

Page 100

-

Page 101

...fixed assets of $55 million, less capital expenditures and capital leases of $306 million. (5) Textron's calculation of ROIC is as follows: (Dollars in millions) 2004 $ 365 131 - (35) 8 2 - 3 60 25 $ 559 $ $ 2003 259 152 (15) (41) 33 (5) 13 6 61 25 488 ROIC Income Net Income Special charges Gain... -

Page 102

Textron Inc. 40 Westminster Street Providence, Rhode Island 02903 (401) 421-2800 www.textron.com