E-Z-GO 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

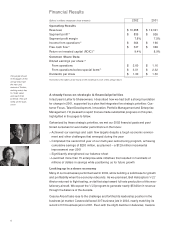

(Dollars in millions except per share amounts) 2002 2001

Operating Results

Revenues $ 10,658 $ 12,321

Segment profit(1) $835 $ 926

Segment profit margin 7.8% 7.5%

Income from operations(2) $364 $ 166

Free cash flow(3) $347 $ 369

Return on invested capital (ROIC)(4) 9.4% 8.9%

Common Share Data

Diluted earnings per share:(2)

From operations $ 2.60 $ 1.16

From operations before special items(5) $3.01 $ 2.32

Dividends per share $ 1.30 $ 1.30

Footnotes to this table can be found on the inside back cover of this annual report.

The people shown

in the pages of this

annual report are

the men and

women of Textron,

working every day

to create value

and reach their

potential. They are

listed on the back

cover.

Financial Results

4

A steady focus on strategic & financial priorities

In last year’s Letter to Shareowners, I described how we had built a strong foundation

for change in 2001, supported by a plan that integrates five strategic priorities: Cus-

tomer Focus, Talent Development, Innovation, Portfolio Management and Enterprise

Management. I’m pleased to report that we made substantial progress on this plan,

highlighted in the pages to follow.

Galvanized by these strategic priorities, we met our 2002 financial goals and posi-

tioned ourselves for even better performance in the future:

>Achieved our earnings and cash flow targets despite a tough economic environ-

ment and other challenges that emerged during the year

>Completed the second full year of our multi-year restructuring program, achieving

cumulative savings of $253 million, as planned – a $129 million incremental

improvement over 2001

>Significantly strengthened our balance sheet

>Launched more than 15 enterprise-wide initiatives that resulted in hundreds of

millions of dollars in savings while positioning us for future growth

Looking up in a down economy

Many of our businesses performed well in 2002, while building a solid base for growth

and profitability when the economy rebounds. As we promised, Bell Helicopter’s V-22

tiltrotor returned to flight testing, a vital first step toward full-rate production of this revo-

lutionary aircraft. We expect the V-22 program to generate nearly $5 billion in revenue

through the balance of the decade.

Cessna Aircraft also rose to the challenge and fortified its leadership position in the

business jet market. Cessna delivered 307 business jets in 2002, nearly matching its

record of 313 business jets in 2001. Even with the slight decline in deliveries, Cessna