Dollar General 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

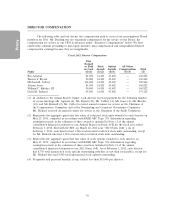

DIRECTOR COMPENSATION

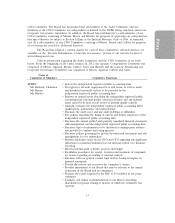

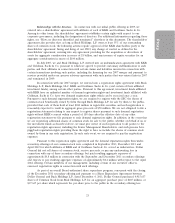

The following table and text discuss the compensation paid to each of our non-employee Board

members for 2011. Mr. Dreiling was not separately compensated for his service on the Board; his

compensation for service as our CEO is discussed under ‘‘Executive Compensation’’ below. We have

omitted the columns pertaining to non-equity incentive plan compensation and nonqualified deferred

compensation earnings because they are inapplicable.

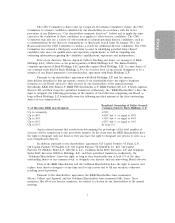

Fiscal 2011 Director Compensation

Fees

Earned

or Paid Stock Option All Other

in Cash Awards Awards Compensation Total

Name ($)(1) ($)(2) ($)(3) ($)(4) ($)

Raj Agrawal 81,000 34,420 45,402 — 160,822

Warren F. Bryant 90,000 34,420 45,402 — 169,822

Michael M. Calbert 106,000 34,420 45,402 — 185,822

Adrian Jones 81,000 34,420 45,402 — 160,822

William C. Rhodes, III 90,000 34,420 45,402 — 169,822

David B. Rickard 95,500 34,420 45,402 — 175,322

(1) In addition to the annual Board retainer, each director received payment for the following number

of excess meetings: Mr. Agrawal (4); Mr. Bryant (10); Mr. Calbert (4); Mr. Jones (4); Mr. Rhodes

(10); and Mr. Rickard (2). Mr. Calbert received annual retainers for service as the Chairman of

the Compensation Committee and of the Nominating and Corporate Governance Committee.

Mr. Rickard received an annual retainer for service as the Chairman of the Audit Committee.

(2) Represents the aggregate grant date fair value of restricted stock units awarded to each director on

May 25, 2011, computed in accordance with FASB ASC Topic 718. Information regarding

assumptions made in the valuation of these awards is included in Note 11 of the annual

consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended

February 3, 2012, filed with the SEC on March 22, 2012 (our ‘‘2011 Form 10-K’’). As of

February 3, 2012, each director had 1,546 total unvested restricted stock units outstanding, except

for Mr. Rickard who had 1,524 total unvested restricted stock units outstanding.

(3) Represents the aggregate grant date fair value of stock options awarded to each director on

May 25, 2011, computed in accordance with FASB ASC Topic 718. Information regarding

assumptions made in the valuation of these awards is included in Note 11 of the annual

consolidated financial statements in our 2011 Form 10-K. As of February 3, 2012, each director

had 8,743 total unexercised stock options outstanding (whether or not then exercisable), except for

Mr. Rickard who had 8,500 total unexercised stock options outstanding.

(4) Perquisites and personal benefits, if any, totaled less than $10,000 per director.

16