Dollar General 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

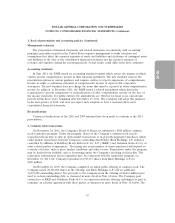

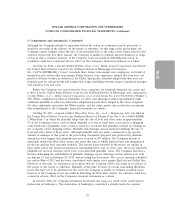

5. Income taxes (Continued)

the Company’s effective income tax rate if the Company were to recognize the tax benefit for these

positions.

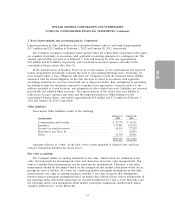

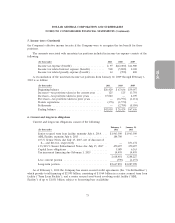

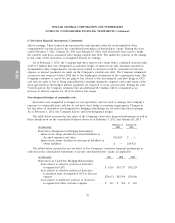

The amounts associated with uncertain tax positions included in income tax expense consists of the

following:

(In thousands) 2011 2010 2009

Income tax expense (benefit) .................... $ 97 $(12,000) $11,900

Income tax related interest expense (benefit) ......... 968 (5,800) 2,300

Income tax related penalty expense (benefit) ......... 63 (700) 400

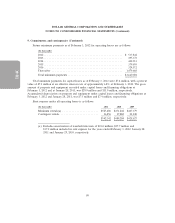

A reconciliation of the uncertain income tax positions from January 30, 2009 through February 3,

2012 is as follows:

(In thousands) 2011 2010 2009

Beginning balance .......................... $26,429 $ 67,636 $59,057

Increases—tax positions taken in the current year . . . 125 125 13,701

Increases—tax positions taken in prior years ....... 15,840 — 4,039

Decreases—tax positions taken in prior years ....... — (36,973) (1,111)

Statute expirations .......................... (376) (1,570) —

Settlements ............................... — (2,789) (8,050)

Ending balance ............................ $42,018 $ 26,429 $67,636

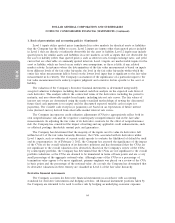

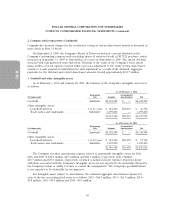

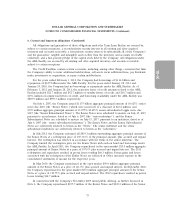

6. Current and long-term obligations

Current and long-term obligations consist of the following:

February 3, January 28,

(In thousands) 2012 2011

Senior secured term loan facility, maturity July 6, 2014 .... $1,963,500 $1,963,500

ABL Facility, maturity July 6, 2013 .................. 184,700 —

105⁄8% Senior Notes due July 15, 2015, net of discount of

$— and $11,161, respectively ..................... — 853,172

117⁄8/125⁄8% Senior Subordinated Notes due July 15, 2017 . . 450,697 450,697

Capital lease obligations .......................... 5,089 6,363

Tax increment financing due February 1, 2035 .......... 14,495 14,495

2,618,481 3,288,227

Less: current portion ............................ (590) (1,157)

Long-term portion .............................. $2,617,891 $3,287,070

As of February 3, 2012 the Company has senior secured credit agreements (the ‘‘Credit Facilities’’)

which provide total financing of $2.995 billion, consisting of $1.964 billion in a senior secured term loan

facility (‘‘Term Loan Facility’’), and a senior secured asset-based revolving credit facility (‘‘ABL

Facility’’) of up to $1.031 billion, subject to borrowing base availability.

73