Dish Network 1999 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–21

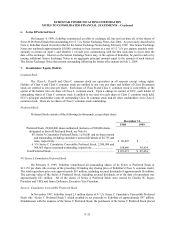

6. Series B Preferred Stock

On January 4, 1999, EchoStar commenced an offer to exchange all, but not less than all, of the shares of

Series B Preferred Stock then outstanding for 12 1/8% Senior Exchange Notes due 2004. As previously described in

Note 4, EchoStar closed its tender offer for the Senior Exchange Notes during February 1999. The Senior Exchange

Notes not tendered (approximately $5,000) continue to bear interest at a rate of 12 1/8% per annum, payable semi-

annually in arrears on April 1 and October 1 of each year, commencing with the first such date to occur after the

date of the exchange. Interest on the Senior Exchange Notes may, at the option of EchoStar, be paid in cash or by

issuing additional Senior Exchange Notes in an aggregate principal amount equal to the amount of such interest.

The Senior Exchange Notes that remain outstanding following the tender offer mature on July 1, 2004.

7. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C common stock are equivalent in all respects except voting rights.

Holders of Class A and Class C common stock are entitled to one vote per share and holders of Class B common

stock are entitled to ten votes per share. Each share of Class B and Class C common stock is convertible, at the

option of the holder, into one share of Class A common stock. Upon a change in control of ECC, each holder of

outstanding shares of Class C common stock is entitled to ten votes for each share of Class C common stock held.

ECC’s principal stockholder owns all outstanding Class B common stock and all other stockholders own Class A

common stock. There are no shares of Class C common stock outstanding.

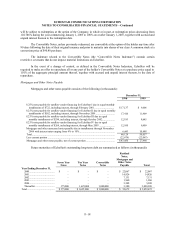

Preferred Stock

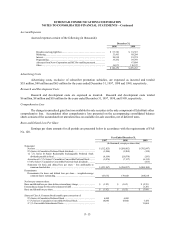

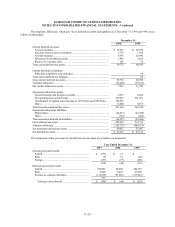

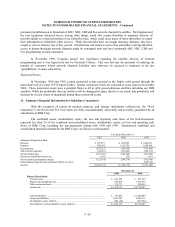

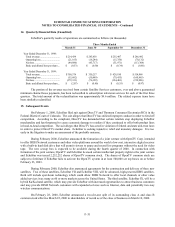

Preferred Stock consists of the following (in thousands, except share data):

December 31,

1998 1999

Preferred Stock, 20,000,000 shares authorized (inclusive of 900,000 shares

designated as Series B Preferred Stock, see Note 6):

8% Series A Cumulative Preferred Stock, 1,616,681 and no shares issued

and outstanding, including cumulative accrued dividends of $5,755 and

none, respectively...................................................................................... $ 20,807 $ –

6 ¾% Series C Cumulative Convertible Preferred Stock, 2,300,000 and

908,665 shares issued and outstanding, respectively ............................... 108,666 45,434

Total Preferred Stock ........................................................................................... $ 129,473 $ 45,434

8% Series A Cumulative Preferred Stock

On February 8, 1999, EchoStar repurchased all outstanding shares of its Series A Preferred Stock at

$13.153 per share (the average of the preceding 20 trading day closing price of EchoStar’s Class A common stock).

The total repurchase price was approximately $91 million, including accrued dividends of approximately $6 million.

The carrying value of the Series A Preferred Stock, including accrued dividends, as of the date of repurchase was

approximately $21 million. All of the shares of Series A Preferred Stock were owned by Charles W. Ergen,

President and CEO, and James DeFranco, Executive Vice President.

Series C Cumulative Convertible Preferred Stock

In November 1997, EchoStar issued 2.3 million shares of 6 3/4% Series C Cumulative Convertible Preferred

Stock (the “Series C Preferred Stock”) which resulted in net proceeds to EchoStar of approximately $97 million.

Simultaneous with the issuance of the Series C Preferred Stock, the purchasers of the Series C Preferred Stock placed