Dish Network 1999 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

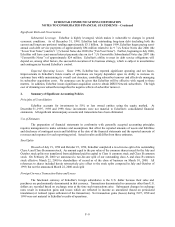

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–15

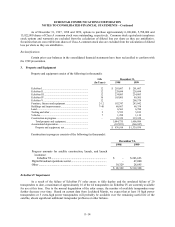

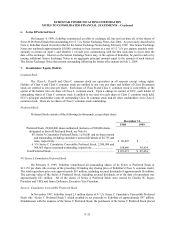

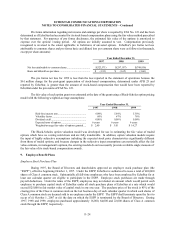

In addition to transponder failures, EchoStar IV experienced anomalies affecting its heating systems and

fuel system during 1999. As a result of the heating system and fuel system anomalies, the remaining useful life of

EchoStar IV has been reduced to less than 10 years. Accordingly, as of November 1, 1999, EchoStar prospectively

revised the remaining useful life of EchoStar IV. This change, after the additional loss provision discussed below,

increased EchoStar’s net loss for 1999 by approximately $357,000.

During September 1998, EchoStar recorded a $106 million provision for loss in connection with the partial

failure of EchoStar IV solar arrays to deploy. During December 1999, EchoStar recorded an additional $13.7

million provision for loss related to the reduction in the remaining useful life of EchoStar IV. The aggregate loss

provision of $119.7 million represented EchoStar’s estimate, at December 31, 1999, of the asset impairment

attributable to lost transmission capacity on EchoStar IV resulting from the solar array anomaly described above.

EchoStar also recorded a $106 million gain, during September 1998, attributable to an anticipated insurance claim

receivable that it believes is probable of receipt. While there can be no assurance as to the amount of the final

insurance settlement, EchoStar believes that it will receive insurance proceeds at least equal to the $106 million

receivable recorded. To the extent that it appears probable that EchoStar will receive insurance proceeds in excess

of the $106 million currently recorded and that no further provision for loss is necessary, a gain will be recognized

for the incremental amount in the period that the amount of the final settlement can be reasonably estimated.

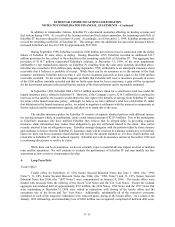

In September 1998, EchoStar filed a $219.3 million insurance claim for a constructive total loss under the

launch insurance policy related to EchoStar IV. However, if the Company receive $219.3 million for a constructive

total loss on the satellite, the insurers would obtain the sole right to the benefits of salvage from EchoStar IV under

the terms of the launch insurance policy. Although we believe we have suffered a total loss of EchoStar IV under

that definition in the launch insurance policy, we intend to negotiate a settlement with the insurers to compensate us

for the reduced satellite transmission capacity and allow us to retain title to the asset.

The satellite insurance policy for EchoStar IV consists of separate identical policies with different carriers

for varying amounts which, in combination, create a total insured amount of $219.3 million. Two of the participants

in EchoStar’s insurance line have notified EchoStar they believe that its alleged delay in providing required

insurance claim information may reduce their obligation to pay any settlement related to the claim. One carrier

recently asserted it has no obligation to pay. EchoStar strongly disagrees with the position taken by those insurers

and continues to believe that the EchoStar IV insurance claim will be resolved in a manner satisfactory to EchoStar.

However, there can be no assurance that EchoStar will receive the amount claimed or, if it does, that EchoStar will

retain title to EchoStar IV with its reduced capacity. EchoStar met with its insurance carriers in November 1999 and

is continuing discussions to resolve its claim.

While there can be no assurance, we do not currently expect a material adverse impact on short or medium

term satellite operations. We will continue to evaluate the performance of EchoStar IV and may modify our loss

assessment as new events or circumstances develop.

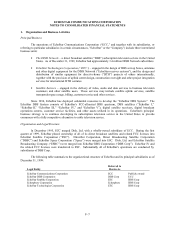

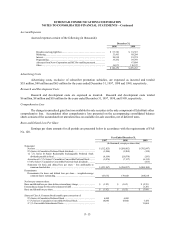

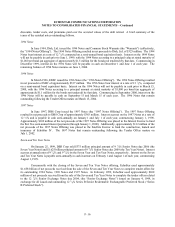

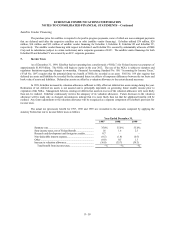

4. Long-Term Debt

Tender Offers

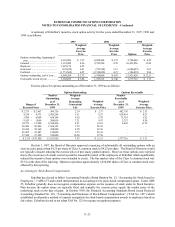

Tender offers for EchoStar’s 12 7/8% Senior Secured Discount Notes due June 1, 2004, (the “1994

Notes”), 13 1/8% Senior Secured Discount Notes due 2004, (the “1996 Notes”) and 13 1/8% Senior Secured

Discount Notes due 2004, (the “1997 Notes”) were consummated on January 25, 1999. The tender offers were

funded with proceeds from the offering of the Seven Year Notes and the Ten Year Notes. Except for residual

aggregate non-tendered debt of approximately $2.6 million, the 1994 Notes, 1996 Notes and the 1997 Notes that

were outstanding at December 31, 1998 were retired in connection with closing of the tender offers and the

concurrent sale of the Seven and Ten Year Notes. Additionally, substantially all of the restrictive covenants

contained in each of the respective indentures were removed upon closing of the tender offers. As a result of the

January 1999 refinancing, an extraordinary loss of $269 million was recognized, comprised of deferred debt costs,