Dish Network 1999 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

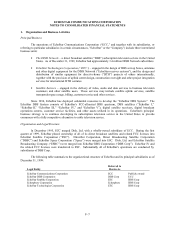

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–10

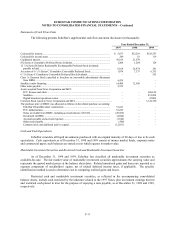

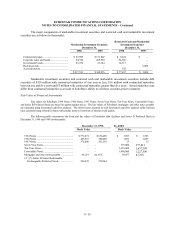

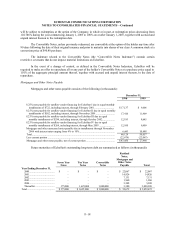

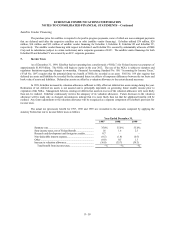

The major components of marketable investment securities and restricted cash and marketable investment

securities are as follow (in thousands):

Marketable Investment Securities

Restricted Cash and Marketable

Investment Securities

December 31, December 31,

1998 1999 1998 1999

Commercial paper...................................... $ 87,099 $ 121,802 $ 8,424 $ –

Corporate notes and bonds.......................... 84,520 205,930 54,360 –

Government bonds..................................... 45,934 21,144 14,517 –

Restricted cash........................................... – – – 3,000

Accrued interest......................................... – – 356 –

$ 217,553 $ 348,876 $ 77,657 $ 3,000

Marketable investment securities and restricted cash and marketable investment securities include debt

securities of $329 million with contractual maturities of one year or less, $16 million with contractual maturities

between one and five years and $3 million with contractual maturities greater than five years. Actual maturities may

differ from contractual maturities as a result of EchoStar’s ability to sell these securities prior to maturity.

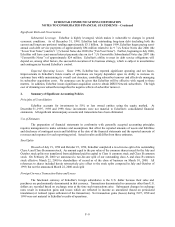

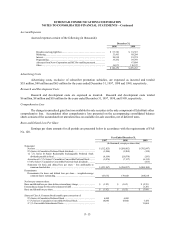

Fair Value of Financial Instruments

Fair values for EchoStar’s 1994 Notes, 1996 Notes, 1997 Notes, Seven Year Notes, Ten Year Notes, Convertible Notes,

and Series B Preferred Stock are based on quoted market prices. The fair values of EchoStar’s mortgages and other notes payable

are estimated using discounted cash flow analyses. The interest rates assumed in such discounted cash flow analyses reflect interest

rates currently being offered for loans with similar terms to borrowers of similar credit quality.

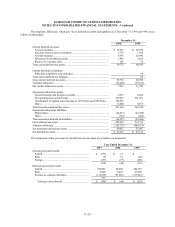

The following table summarizes the book and fair values of EchoStar’s debt facilities and Series B Preferred Stock at

December 31, 1998 and 1999 (in thousands):

December 31, 1998

31, 1999

Book Value Book Value

1994 Notes ..................................................... $ 571,674 $ 636,480 $ 1,503 $ 1,503

1996 Notes ..................................................... 497,955 580,000 1,097 1,097

1997 Notes ..................................................... 375,000 431,250 15 15

Seven Year Notes............................................ ––375,000 377,813

Ten Year Notes............................................... ––1,625,000 1,637,188

Convertible Notes ........................................... ––1,000,000 1,227,500

Mortgages and other notes payable .................. 66,129 61,975 50,057 47,238

12 1/8% Series B Senior Redeemable

Exchangeable Preferred Stock ..................... 226,038 259,944 – –