Dish Network 1999 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1999 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

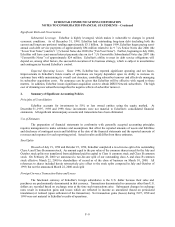

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–16

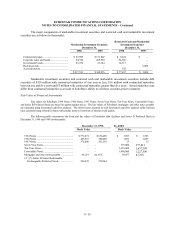

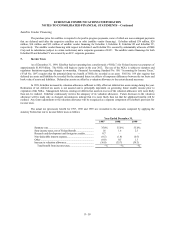

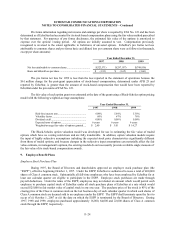

discounts, tender costs, and premiums paid over the accreted values of the debt retired. A brief summary of the

terms of the residual notes outstanding follows.

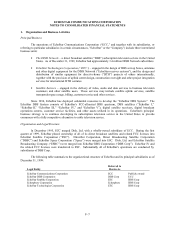

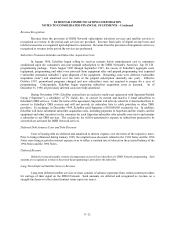

1994 Notes

In June 1994, Dish, Ltd. issued the 1994 Notes and Common Stock Warrants (the “Warrants”) (collectively,

the “1994 Notes Offering”). The 1994 Notes Offering resulted in net proceeds to Dish, Ltd. of $323 million. The 1994

Notes bear interest at a rate of 12 7/8% computed on a semi-annual bond equivalent basis. Interest on the 1994 Notes

will not be payable in cash prior to June 1, 1999, with the 1994 Notes accreting to a principal value at stated maturity of

$1,000 per bond (an aggregate of approximately $1.5 million for the bonds not tendered) by that date. Commencing in

December 1999, interest on the 1994 Notes will be payable in cash on December 1 and June 1 of each year. The

remaining balance of 1994 Notes matures on June 1, 2004.

1996 Notes

In March 1996, ESBC issued the 1996 Notes (the “1996 Notes Offering”). The 1996 Notes Offering resulted

in net proceeds to ESBC of approximately $337 million. The 1996 Notes bear interest at a rate of 13 1/8%, computed

on a semi-annual bond equivalent basis. Interest on the 1996 Notes will not be payable in cash prior to March 15,

2000, with the 1996 Notes accreting to a principal amount at stated maturity of $1,000 per bond (an aggregate of

approximately $1.1 million for the bonds not tendered) by that date. Commencing in September 2000, interest on the

1996 Notes will be payable in cash on September 15 and March 15 of each year. The 1996 Notes that remain

outstanding following the Tender Offers mature on March 15, 2004.

1997 Notes

In June 1997, DBS Corp issued the 1997 Notes (the “1997 Notes Offering”). The 1997 Notes Offering

resulted in net proceeds to DBS Corp of approximately $363 million. Interest accrues on the 1997 Notes at a rate of

12 ½% and is payable in cash semi-annually on January 1 and July 1 of each year, commencing January 1, 1998.

Approximately $109 million of the net proceeds of the 1997 Notes Offering was placed in the Interest Escrow to fund

the first five semi-annual interest payments (through January 1, 2000). Additionally, approximately $112 million of the

net proceeds of the 1997 Notes Offering was placed in the Satellite Escrow to fund the construction, launch and

insurance of EchoStar IV. The 1997 Notes that remain outstanding following the Tender Offers mature on

July 1, 2002.

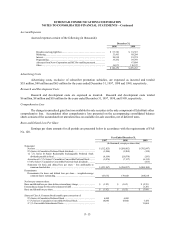

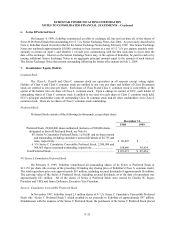

Seven and Ten Year Notes

On January 25, 1999, DBS Corp sold $375 million principal amount of 9 1/4% Senior Notes due 2006 (the

Seven Year Notes) and $1.625 billion principal amount of 9 3/8% Senior Notes due 2009 (the Ten Year Notes). Interest

accrues at annual rates of 9 1/4% and 9 3/8% on the Seven Year and Ten Year Notes, respectively. Interest on the Seven

and Ten Year Notes is payable semi-annually in cash in arrears on February 1 and August 1 of each year, commencing

August 1, 1999.

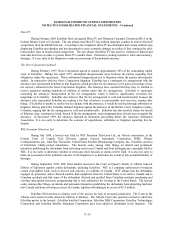

Concurrently with the closing of the Seven and Ten Year Notes offering, EchoStar used approximately

$1.658 billion of net proceeds received from the sale of the Seven and Ten Year Notes to complete tender offers for

its outstanding 1994 Notes, 1996 Notes and 1997 Notes. In February 1999, EchoStar used approximately $268

million of net proceeds received from the sale of the Seven and Ten Year Notes to complete the tender offers related

to the 12 1/8% Senior Exchange Notes due 2004, (the “Senior Exchange Notes”) issued on January 4, 1999, in

exchange for all issued and outstanding 12 1/8% Series B Senior Redeemable Exchangeable Preferred Stock (“Series

B Preferred Stock”).