Dick's Sporting Goods 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain of the agreements pertaining to other long-term debt contain financial and other restrictive covenants, none of which are

more restrictive than those of the Credit Agreement as discussed herein.

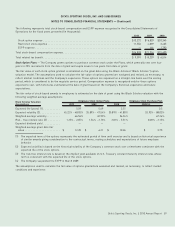

Scheduled principal payments on other long-term debt as of January 29, 2011 are as follows (in thousands):

Fiscal Year

2011................... $ 82

2012................... 88

2013................... 94

2014................... 101

2015................... 108

Thereafter . . . . . . . . . . . . . . . . . 348

$821

Capital Lease Obligations — The Company leases two buildings from the estate of a former stockholder, who is related to current

stockholders of the Company, under a capital lease entered into May 1, 1986 that expires in April 2021. In addition, the Company

has a capital lease for a store location with a fixed interest rate of 10.6% that matures in 2024. The gross and net carrying values

of assets under capital leases are approximately $10.3 million and $4.8 million, respectively, as of January 29, 2011 and

$10.5 million and $5.9 million, respectively, as of January 30, 2010.

Scheduled lease payments under capital lease obligations as of January 29, 2011 are as follows (in thousands):

Fiscal Year

2011................. $ 1,804

2012................. 1,804

2013................. 1,602

2014................. 1,437

2015................. 1,024

Thereafter. . . . . . . . . . . . . . . 8,184

15,855

Less: amounts representing interest . . . . . . . . . . . . . (6,331)

Present value of net scheduled lease payments . . . . . 9,524

Less: amounts due in one year . . . . . . . . . . . . . . . . . (913)

$ 8,611

Financing Lease Obligation — During fiscal 2008, the Company entered into a lease agreement for a new corporate headquarters

building that it began occupying in January 2010. The Company advanced a portion of the funds needed to prepare the site and

construct the building, which resulted in the Company being considered the owner of the building during the construction period.

The remaining project costs have been financed by the developer except for any project scope changes requested by the Company.

The Company has a purchase option for the building, exercisable by the Company at various times beginning in March 2012. Due

to this purchase option, the Company is deemed to have continuing involvement and the transaction qualifies as a financing lease

under sale-leaseback accounting and therefore represents a debt obligation to the Company. The debt obligation recognized by

the Company at the completion of the construction period represents the Company’s obligation to the lessor upon exercise of the

purchase option. Monthly rent payments for the premises are recognized as interest expense in the Consolidated Statements of

Operations, reflecting an implicit interest rate of approximately 8.5%.

The building is included in property and equipment, net and is depreciated using a 40 year life.

Dick’s Sporting Goods, Inc. ¬2010 Annual Report 57

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)