Dick's Sporting Goods 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

undiscounted cash flows expected to result from the use of the asset plus eventual net proceeds expected from disposition of the

asset (if any) are less than the carrying value of the asset. When an impairment loss is recognized, the carrying amount of the

asset is reduced to its estimated fair value as determined based on quoted market prices or through the use of other valuation

techniques.

The Company recognizes a liability for costs associated with closed or relocated premises when the Company ceases to use the

location. The calculation of accrued lease termination and other costs primarily includes future minimum lease payments,

maintenance costs and taxes from the date of closure or relocation to the end of the remaining lease term, net of contractual or

estimated sublease income. The liability is discounted using a credit-adjusted risk-free rate of interest. The assumptions used in

the calculation of the accrued lease termination and other costs are evaluated each quarter.

Goodwill and Intangible Assets — Goodwill represents the excess of acquisition cost over the fair value of the net assets of

acquired entities. The Company assesses the carrying value of goodwill and other intangible assets annually or whenever

circumstances indicate that a decline in value may have occurred, utilizing a fair value approach at the reporting unit level. A

reporting unit is the operating segment, or a business unit one level below that operating segment, for which discrete financial

information is prepared and regularly reviewed by segment management. Finite-lived intangible assets are amortized over their

estimated useful economic lives and are reviewed for impairment when factors indicate that an impairment may have occurred.

The goodwill impairment test is a two-step impairment test. In the first step, the Company compares the fair value of each

reporting unit to its carrying value. The Company determines the fair value of its reporting units using a combination of a

discounted cash flow and a market value approach. If the fair value of the reporting unit exceeds the carrying value of the net

assets assigned to that reporting unit, goodwill is not impaired and the Company is not required to perform further testing. If the

carrying value of the net assets assigned to the reporting unit exceeds the fair value of the reporting unit, then the Company must

perform the second step in order to determine the implied fair value of the reporting unit’s goodwill and compare it to the

carrying value of the reporting unit’s goodwill. The activities in the second step include valuing the tangible and intangible assets

and liabilities of the impaired reporting unit based on their fair value and determining the fair value of the impaired reporting

unit’s goodwill based upon the residual of the summed identified tangible and intangible assets and liabilities.

Intangible assets that have been determined to have indefinite lives are also not subject to amortization and are reviewed at least

annually for potential impairment, as mentioned above. The fair value of the Company’s intangible assets are estimated and

compared to their carrying value. The Company estimates the fair value of these intangible assets based on an income approach

using the relief-from-royalty method. This methodology assumes that, in lieu of ownership, a third party would be willing to pay a

royalty in order to exploit the related benefits of these types of assets. This approach is dependent on a number of factors,

including estimates of future growth and trends, royalty rates in the category of intellectual property, discount rates and other

variables. The Company recognizes an impairment charge when the estimated fair value of the intangible asset is less than the

carrying value.

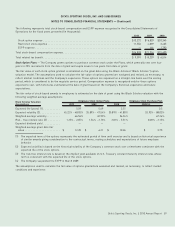

Investments — Investments consist of shares of unregistered common stock of GSI Commerce, Inc. (“GSI”) and are carried at fair

value within other assets, based upon the publicly quoted equity price of GSI’s stock. Unrealized holding gains and losses on the

stock are included in other comprehensive income and are shown as a component of stockholders’ equity as of the end of each

fiscal year (see Note 12). Gross unrealized holding gains at January 29, 2011 and January 30, 2010 were $10.5 million and

$10.6 million, respectively.

Deferred Revenue and Other Liabilities — Deferred revenue and other liabilities is primarily comprised of gift cards, deferred rent,

which represents the difference between rent paid and the amounts expensed for operating leases, deferred liabilities related to

construction allowances and liabilities for future rent payments for closed store locations. Deferred liabilities related to

construction allowances, net of related amortization, were $114.3 million at January 29, 2011 and $103.8 million at January 30,

2010. Deferred revenue related to gift cards at January 29, 2011 and January 30, 2010 was $104.0 million and $95.0 million,

respectively. Deferred rent, including deferred pre-opening rent, at January 29, 2011 and January 30, 2010 was $54.8 million and

$49.1 million, respectively.

Self-Insurance — The Company is self-insured for certain losses related to health, workers’ compensation and general liability

insurance, although we maintain stop-loss coverage with third-party insurers to limit our liability exposure. Liabilities associated

with these losses are estimated in part by considering historical claims experience, industry factors, severity factors and other

actuarial assumptions.

Dick’s Sporting Goods, Inc. ¬2010 Annual Report 51

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —(Continued)