Dell 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

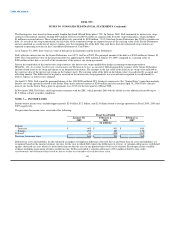

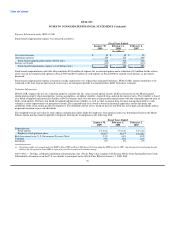

matches 100% of each participant's voluntary contributions, subject to a maximum contribution of 5% of the participant's compensation, and

participants vest immediately in all Dell contributions to the 401(k) Plan. From January 1, 2005, to December 31, 2007, Dell matched 100% of each

participant's voluntary contributions, subject to a maximum contribution of 4% of the participant's compensation. Prior to January 1, 2005, Dell

matched 100% of each participant's voluntary contributions, subject to a maximum contribution of 3% of the participant's compensation. Dell's

contributions during Fiscal 2009, 2008, and 2007 were $93 million, $76 million, and $70 million, respectively. Dell's contributions are invested

according to each participant's elections in the investment options provided under the Plan. Investment options include Dell stock, but neither

participant nor Dell contributions are required to be invested in Dell stock.

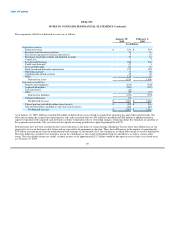

Deferred Compensation Plan — Dell has a nonqualified deferred compensation plan (the "Deferred Compensation Plan") for the benefit of certain

management employees and non-employee directors. The Deferred Compensation Plan permits the deferral of base salary and annual incentive

bonus. The deferrals are held in a separate trust, which has been established by Dell to administer the Plan. The assets of the trust are subject to the

claims of Dell's creditors in the event that Dell becomes insolvent. Consequently, the trust qualifies as a grantor trust for income tax purposes (i.e. a

"Rabbi Trust"). In accordance with the provisions of EITF No. 97-14, Accounting for Deferred Compensation Arrangements Where Amounts

Earned are Held in a Rabbi Trust and Invested, the assets and liabilities of the Deferred Compensation Plan are presented in long-term investments

and accrued and other liabilities in the Consolidated Statements of Financial Position, respectively. The assets held by the trust are classified as

trading securities with changes recorded to investment and other income, net. These assets are valued at $73 million and are disclosed in Note 2 of

Notes to Consolidated Financial Statements. Changes in the deferred compensation liability are recorded to compensation expense.

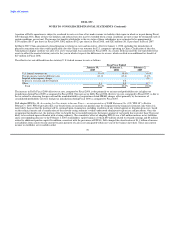

Employee Stock Purchase Plan — Dell discontinued its shareholder approved employee stock purchase plan during the first quarter of Fiscal 2009.

Prior to discontinuance, the ESPP allowed participating employees to purchase common stock through payroll deductions at the end of each three-

month participation period at a purchase price equal to 85% of the fair market value of the common stock at the end of the participation period.

Upon adoption of SFAS 123(R) in Fiscal 2007, Dell began recognizing compensation expense for the 15% discount received by the participating

employees. No common stock was issued under this plan in Fiscal 2009 or Fiscal 2008 due to Dell suspending the ESPP on April 4, 2007, and

subsequently discontinuing the ESPP as part of an overall assessment of its benefits strategy. Common stock issued under ESPP totaled 6 million

shares in Fiscal 2007, and the weighted-average fair value of the purchase rights under the ESPP during Fiscal 2007 was $3.89.

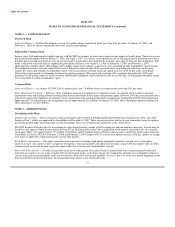

NOTE 6 —FINANCIAL SERVICES

Dell Financial Services L.L.C.

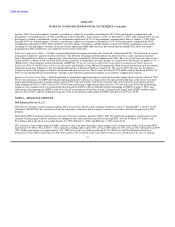

Dell offers or arranges various financing options and services for its business and consumer customers in the U.S. through DFS. a wholly-owned

subsidiary of Dell. DFS's key activities include the origination, collection, and servicing of customer receivables related to the purchase of Dell

products.

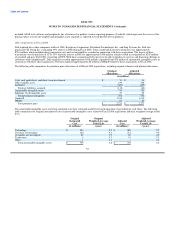

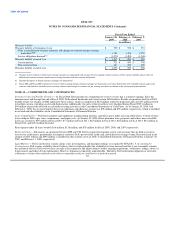

Dell utilizes DFS to facilitate financing for customers who elect to finance products sold by Dell. New financing originations, which represent the

amounts of financing provided to customers for equipment and related software and services through DFS, were $4.5 billion, $5.7 billion, and

$6.1 billion, during the fiscal years ended January 30, 2009, February 1, 2008, and February 2, 2007, respectively.

CIT, formerly a joint venture partner of DFS, continues to have the right to purchase a percentage of new customer receivables facilitated by DFS

until January 29, 2010 ("Fiscal 2010"). CIT's contractual funding right is up to 35% in Fiscal 2009 and up to 25% in Fiscal 2010. During Fiscal 2009

CIT's funding percentage was approximately 34%. DFS services the receivables purchased by CIT. However, Dell's obligation related to the

performance of the DFS originated receivables purchased by CIT is limited to the cash funded credit reserves established at the time of funding.

77