Dell 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

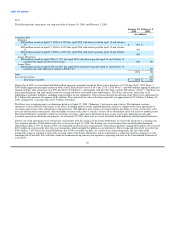

Our retained interest in the securitizations is determined by calculating the present value of excess cash flows over the expected duration of the

transactions. In estimating the value of the retained interest, we make a variety of financial assumptions, including pool credit losses, payment rates,

and discount rates. These assumptions are supported by both our historical experience and anticipated trends relative to the particular receivable

pool. The weighted average assumptions for valuing retained interest can be affected by the many factors, including the type of assets (revolving

versus fixed), repayment terms, and the credit quality of assets being securitized. We review our investments in retained interest periodically for

impairment, based on estimated fair values. All gains and losses are recognized in income immediately. Retained interest balances and assumptions

are disclosed in Note 6 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary

Data."

We service securitized contracts and earn a servicing fee. Our securitization transactions generally do not result in servicing assets and liabilities, as

the contractual fees are adequate compensation in relation to the associated servicing cost.

During Fiscal 2009, the disruption in the debt and capital markets resulted in reduced liquidity and increased costs for funding of financial assets.

Due to the proposed increase to the cost structure in our revolving credit conduit, we elected not to extend the terms of the agreement. This resulted

in a scheduled amortization of the transaction. During this scheduled amortization period, no new debt will be issued and all principal collections

will be used to pay down the outstanding debt amount related to the securitized assets. Our right to receive cash collections is delayed until the debt

is fully paid off.

During the scheduled amortization period, no transfers of new revolving loans will occur. Additional purchases made on existing securitized

revolving loans (repeat purchases) will continue to be transferred to the qualified special purpose entity, which will increase our retained interest on

the balance sheet.

We will be required to consolidate the assets and liabilities relating to the revolving securitization transaction on our balance sheet once the amount

of beneficial interest in the revolving credit conduit owned by third parties falls below 10%. We expect the securitization transaction related to

revolving receivables to terminate completely in Fiscal 2010. The impact to our balance sheet is anticipated to be immaterial. Our fixed-term lease

and loan securitization programs will be up for renewal in Fiscal 2010. We expect to renew these facilities. As we negotiate these annual renewals,

management will continue to assess the costs and benefits of using securitization to fund our receivables. We expect to be able to continue to offer or

arrange financing for our customers, despite our reduced reliance on securitization as a means of funding receivables.

All of our securitization programs contain standard structural features related to the performance of the securitized receivables. These structural

features include defined credit losses, delinquencies, average credit scores, and excess collections above or below specified levels. In the event one

or more of these features are met and we are unable to restructure the program, no further funding of receivables will be permitted, and the timing of

expected retained interest cash flows will be delayed, which would impact the valuation of our retained interest. Should these events occur, we do

not expect a material adverse affect on the valuation of the retained interest.

Liquidity, Capital Commitments, and Contractual Cash Obligations

Liquidity

Our cash balances are held in numerous locations throughout the world, including substantial amounts held outside of the U.S.; however, the

majority of our cash and investments that are located outside of the U.S. are denominated in the U.S. dollar. Most of the amounts held outside of the

U.S. could be repatriated to the U.S., but under current law, would be subject to U.S. federal income taxes, less applicable foreign tax credits. In

some countries, repatriation of certain foreign balances is restricted by local laws. We have provided for the U.S. federal tax liability on these

amounts for financial statement purposes, except for foreign earnings that are considered indefinitely reinvested outside of the U.S. Repatriation

could result in additional U.S. federal income tax payments. We utilize a variety of tax planning and financing strategies with the objective of having

our worldwide cash available in the locations in which it is needed.

We have an active working capital management team that monitors the efficiency of our balance sheet by evaluating liquidity under various

macroeconomic and competitive scenarios. These scenarios quantify risks to the financial statements and provide a basis for actions necessary to

ensure adequate liquidity. We took a number of actions during Fiscal 2009 to improve short- and long-term liquidity. We have reprioritized capital

expenditures and other discretionary spending. The movement of some of our manufacturing operations to third party manufacturers and the

associated closure of several of our manufacturing facilities has reduced the amount of capital required for our business. Also, during the second half

of Fiscal 2009, we slowed our share repurchases. We remained active in the commercial paper market by issuing short-term borrowings with

maturities extending into Fiscal 2010. We also increased the size of our commercial paper program and supporting senior unsecured revolving credit

facility by $500 million to $1.5 billion in April 2008. On April 3, 2009, $500 million of the credit facility will expire, and the remainder will expire

June 1, 2011. We intend to have a new $500 million credit

40