Dell 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

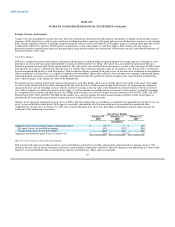

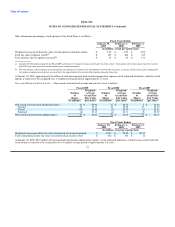

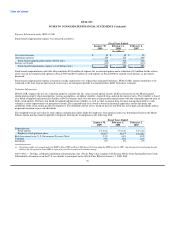

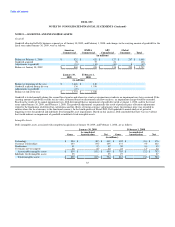

Other information pertaining to stock options for the Stock Plans is as follows:

Fiscal Years Ended

January 30, February 1, February 2,

2009 2008 2007

(in millions, except per option data)

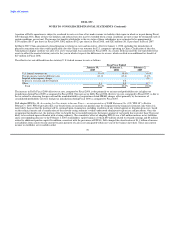

Weighted-average grant date fair value of stock options granted per option $ 5.87 $ 6.29 $ 6.90

Total fair value of options vested(a) $ 187 $ 208 $ 415

Total intrinsic value of options exercised(b) $ 15 $ 64 $ 171

(a) Includes the $104 million charge for the Fiscal 2009 acceleration of vesting of certain unvested and "out-of-the-money" stock options with exercise prices equal to or greater

than $10.14 per share previously awarded under equity compensation plans.

(b) The total intrinsic value of options exercised represents the total pre-tax intrinsic value (the difference between the stock price at exercise and the exercise price multiplied by

the number of options exercised) that was received by the option holders who exercised their options during the fiscal year.

At January 30, 2009, approximately $1 million of total unrecognized stock-based compensation expense, net of estimated forfeitures, related to stock

options is expected to be recognized over a weighted-average period of approximately 2.3 years.

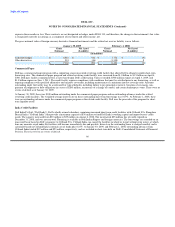

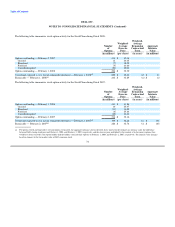

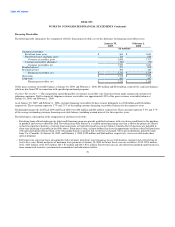

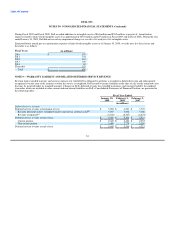

Non-vested Restricted Stock Activity — Non-vested restricted stock awards and activities were as follows:

Fiscal 2009 Fiscal 2008 Fiscal 2007

Weighted- Weighted- Weighted-

Number Average Number Average Number Average

of Grant Date of Grant Date of Grant Date

Shares Fair Value Shares Fair Value Shares Fair Value

(in millions) (per share) (in millions) (per share) (in millions) (per share)

Non-vested restricted stock beginning balance 36 $ 24.90 17 $ 28.76 2 $ 34.66

Granted 18 19.11 26 22.85 21 28.36

Vested (10) 24.64 (3) 28.79 (1) 28.84

Forfeited (8) 23.15 (4) 24.71 (5) 29.29

Non-vested restricted stock ending balance 36 $ 22.45 36 $ 24.90 17 $ 28.76

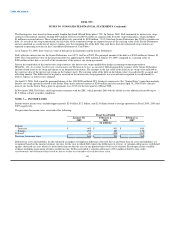

Fiscal Years Ended

January 30, February 1, February 2,

2009 2008 2007

(in millions, except per option data)

Weighted-average grant date fair value of restricted stock awards granted $ 19.11 $ 22.85 $ 28.36

Total estimated grant date fair value of restricted stock awards vested $ 252 $ 103 $ 16

At January 30, 2009, $507 million of unrecognized stock-based compensation expense, net of estimated forfeitures, related to non-vested restricted

stock awards is expected to be recognized over a weighted-average period of approximately 2.0 years.

75