Dell 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

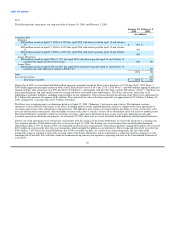

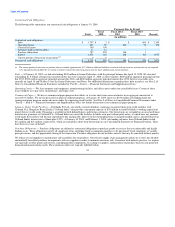

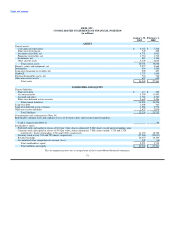

30 days and are entered into during the ordinary course of business in order to establish best pricing and continuity of supply for our production.

Purchase orders are not included in the table above as they typically represent our authorization to purchase rather than binding purchase obligations.

Purchase obligations decreased to approximately $787 million at January 30, 2009, from $893 million at February 1, 2008. The decrease is primarily

due to the fulfillment of commitments to purchase key components and services partially offset by the renewal of or entering into new purchase

contracts.

Interest — See Note 2 of Notes to the Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary

Data" for further discussion of our debt and related interest expense.

Risk Factors Affecting Our Business and Prospects

There are numerous risk factors that affect our business and the results of our operations. Some of these risks are beyond our control. These risk

factors include:

• weakening global economic conditions and instability in financial markets;

• strong competition;

• our ability to generate substantial non-U.S. net revenue;

• our ability to accurately predict product, customer, and geographic sales mix and seasonal sales trends;

• information technology and manufacturing infrastructure failures;

• our ability to effectively manage periodic product transitions;

• our ability to successfully transform our sales capabilities and add to our product and service offerings;

• disruptions in component or product availability;

• our reliance on vendors;

• our reliance on third-party suppliers for quality product components, including reliance on several single-sourced or limited-sourced suppliers;

• our ability to access the capital markets;

• risks relating to our internal controls;

• unfavorable results of legal proceedings;

• our acquisition of other companies;

• our ability to properly manage the distribution of our products and services;

• our cost cutting measures;

• effective hedging of our exposure to fluctuations in foreign currency exchange rates and interest rates;

• risks related to counterparty default;

• obtaining licenses to intellectual property developed by others on commercially reasonable and competitive terms;

• our ability to attract, retain, and motivate key personnel;

• loss of government contracts;

• expiration of tax holidays or favorable tax rate structures or unfavorable outcomes in tax compliance and regulatory matters;

• changing environmental laws; and

• the effect of armed hostilities, terrorism, natural disasters, and public health issues.

For a discussion of these risk factors affecting our business and prospects, see "Part I — Item 1A — Risk Factors."

Critical Accounting Policies

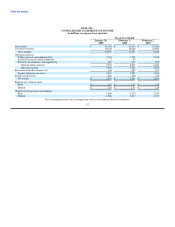

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The

preparation of financial statements in accordance with GAAP requires certain estimates, assumptions, and judgments to be made that may affect our

Consolidated Statement of Financial Position and Consolidated Statement of Income. We believe our most critical accounting policies relate to

revenue recognition, business combinations, warranty accruals, income taxes, stock-based compensation, and loss contingencies. We have discussed

the development, selection, and disclosure of our critical accounting policies with the Audit Committee of our Board of Directors. These critical

accounting policies and our other accounting policies are also described in Note 1 of Notes to Consolidated Financial Statements included in

"Part II — Item 8 — Financial Statements and Supplementary Data."

45