DELPHI 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 DELPHI annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Making it possible.

2015 Annual Report

Table of contents

-

Page 1

2015 Annual Report Making it possible. 1 -

Page 2

-

Page 3

...every Delphi action. Solutions for the megatrends we have built our business around-Safe, Green, Connected-continue to converge. Mastering their interplay and integration is vital to our future and to where our customers and their customers are headed. We continue to pioneer intelligent driving with... -

Page 4

... automotive industry continues its journey towards autonomous driving, enabled by rapidly evolving technology and computing power focused on delivering a safe and secure driving experience. Along the way, Delphi innovations in active safety- a necessity for the driverless vehicles of the future-are... -

Page 5

5 -

Page 6

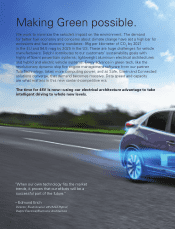

...manufacturers. Delphi contributes to our customers' sustainability goals with highly efï¬cient powertrain systems; lightweight aluminum electrical architectures and hybrid and electric vehicle systems. Every advance in green tech, like the revolutionary dynamic skip ï¬re engine management software... -

Page 7

7 -

Page 8

... informed, personalized and extraordinarily safer driving experience. "The advent of new technologies continues to blend industry borders and domains, making automotive electronics and software synonymous with innovation." - Dr. Krishna Prasad, Ph.D., Director at the Delphi Technical Center India... -

Page 9

9 -

Page 10

... our customer base. In support of accelerating revenue growth, the Delphi operating team also did a tremendous job executing on a record 150 major new program launches. These award-winning products included gesture recognition infotainment control technology with BMW; RACam safety systems with... -

Page 11

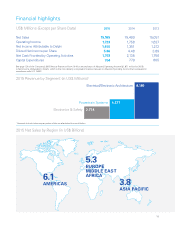

...in US$ Millions)1 Electrical/Electronic Architecture 8,180 Powertrain Systems Electronics & Safety 2,774 4,377 1 Amounts include intercompany sales which are eliminated in consolidation. 2015 Net Sales by Region (in US$ Billions) 5.3 6.1 AMERICAS EUROPE MIDDLE EAST AFRICA 3.8 ASIA PACIFIC 11 -

Page 12

... global scale Diversiï¬cation by region 2015 sales Stock performance 450 400 25% Asia Pacific 350 300 40% Americas 35% EMEA 250 200 2015 bookings 150 31% Asia Pacific 100 50 36% Americas 33% EMEA 11/17 2011 12/31 2011 12/31 2012 12/31 2013 12/31 2014 12/31 2015 Delphi Automotive... -

Page 13

Delphi business segments Electrical/Electronic Architecture Provides complete design of the vehicle's electrical architecture, including connectors, wiring assemblies and harnesses, electrical centers and hybrid high voltage and safety distribution systems. Our products provide the critical ... -

Page 14

... integrated solutions. Delphi's 48V hybrid design enables safer, greener and more connected cars. More electrical power means more ability to operate-simultaneously and ï¬,awlessly- increasingly advanced systems, from the next generation of active safety to dynamic skip ï¬re fuel management to... -

Page 15

From concept to CES show ï¬,oor, our innovative new cluster uses layered displays to create a 3D effect. 15 -

Page 16

... by working together to create practical solutions for a better world. This extends to our customers. Our global footprint- strategically emphasizing growth markets-enables us to collaborate with our customers wherever they are, whenever they need us. Together, we design world-class products in... -

Page 17

...to commercialize this innovative Delphi safety technology. Three Delphi technologies- High Voltage Splice Connection; Dual Role Hub; and Power Device for Electriï¬ed Vehicle Traction Drive Inverter - are among the 28 innovations from 21 different automotive suppliers that have been named ï¬nalists... -

Page 18

... that manage complexity, drive performance and deliver excellence every time. Our customers demand precision, and our production capacity is vast and fully engaged. For example, our fuel injector manufacturing equipment in Romania, Mexico and China never stops, running 24 hours a day, 7 days a week... -

Page 19

..., Green and Connected solutions-shifting investment to focus on these desired and distinctive aspects. Global platforms deliver economies of scale through sharing basic parts and spreading the costs of product development and manufacturing tools over millions of vehicles. Delphi offers automakers an... -

Page 20

... that helps the environment and our business. Through volunteerism and community support, the people of Delphi strive to be a positive force. Every day, everywhere we work and live, you can see us living our values. Overall, our global enterprise is grounded in corporate responsibility. We create... -

Page 21

... honor of being named one of the "World's Most Ethical Companies" by the Ethisphere Institute for the third year in a row, demonstrating our ongoing commitment to, leadership in and actions in support of ethical business practices. Delphi is one of only three automotive companies in 2015 to be... -

Page 22

...77845 Shareholder Services Number: (800) 622- 6757 Investor Centreâ„¢ portal: www.computershare.com/investor Investor Relations Contact Copies of the Annual Report, Forms 10-K and 10-Q and other Delphi publications are available via our website at www.delphi.com or contact: Delphi Investor Relations... -

Page 23

... as of June 30, 2015, the last business day of the registrant's most recently completed second fiscal quarter, was $24,121,485,016 (based on the closing sale price of the registrant's ordinary shares on that date as reported on the New York Stock Exchange). The number of the registrant's ordinary... -

Page 24

... 2. Item 3. Item 4. Business Executive Officers of the Registrant Risk Factors Unresolved Staff Comments Properties Legal Proceedings Mine Safety Disclosure Part II Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities Selected Financial Data... -

Page 25

... retain customers. Additional factors are discussed under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Company's filings with the Securities and Exchange Commission. New risks and uncertainties arise from time to time... -

Page 26

... and technicians focused on developing market relevant product solutions for our customers. We are focused on growing and improving the profitability of our businesses, and have implemented a strategy designed to position Delphi to deliver industry-leading long-term shareholder returns. This... -

Page 27

... provides complete design of the vehicle's electrical architecture, including connectors, wiring assemblies and harnesses, electrical centers and hybrid high voltage and safety distribution systems. Our products provide the critical electrical and electronics backbone that supports increased vehicle... -

Page 28

..., and the Asia Pacific market from China. Our global scale and regional service model enables us to engineer globally and execute regionally to serve the largest OEMs, which are seeking suppliers that can serve them on a worldwide basis. Our footprint also enables us to adapt to the regional design... -

Page 29

...of these systems will also require on-going software support services, as these vehicle systems will be continuously upgraded with new features and performance enhancements. To guide our product strategies and investments in technology with a focus on developing advanced technologies to drive growth... -

Page 30

... original equipment service in the Powertrain Systems segment. Electronics and Safety. This segment offers a wide range of electronic and safety equipment and software in the areas of controls, security, infotainment, communications, safety systems and power electronics Electronic controls products... -

Page 31

... net sales to our largest customers for the year ended December 31, 2015: Customer Percentage of Net Sales GM...Volkswagen Group ("VW")...Ford Motor Company ("Ford") ...Fiat Chrysler Automobiles N.V. ("FCA")...Daimler AG ("Daimler") ...PSA Peugeot Citroën ("PSA")...Shanghai General Motors Company... -

Page 32

...OEM production during such future periods, customer agreements including applicable terms and conditions do not necessarily constitute firm orders. Firm orders are generally limited to specific and authorized customer purchase order releases placed with our manufacturing and distribution centers for... -

Page 33

... We are continually seeking to manage these and other material-related cost pressures using a combination of strategies, including working with our suppliers to mitigate costs, seeking alternative product designs and material specifications, combining our purchase requirements with our customers and... -

Page 34

...environmental and safety and health laws and regulations. These include laws regulating air emissions, water discharge, hazardous materials and waste management. We have an environmental management structure designed to facilitate and support our compliance with these requirements globally. Although... -

Page 35

... in 2000 and held positions in sales, marketing, purchasing and general management. Prior to FCI, Mr. Butterworth worked for Lucas Industries and TRW Automotive. Jeffrey J. Owens, 61, was named chief technology officer and executive vice president of Delphi in February 2013. He previously was senior... -

Page 36

.... Earlier, Mr. Vijayvargiya was global business line executive (BLE) for Body Security & Mechatronics at Delphi Electrical/Electronic Architecture. Prior to his BLE assignment, Mr. Vijayvargiya was director of program management before being named product line manager of Audio Systems in 2002. 14 -

Page 37

...-Looking Information in this annual report. Risks Related to Business Environment and Economic Conditions The cyclical nature of automotive sales and production can adversely affect our business. Our business is directly related to automotive sales and automotive vehicle production by our customers... -

Page 38

... on our making the right investments at the right time to support product development and manufacturing capacity in areas where we can support our customer base. We have identified the Asia Pacific region, and more specifically China, as a key market likely to experience substantial growth, and... -

Page 39

... automotive industry, ship products to our customers' vehicle assembly plants throughout the world so they are delivered on a "just-in-time" basis in order to maintain low inventory levels. Our suppliers also use a similar method. However, this "just-in-time" method makes the logistics supply chain... -

Page 40

.... Although we receive purchase orders from our customers, these purchase orders generally provide for the supply of a customer's requirements for a particular vehicle model and assembly plant, rather than for the purchase of a specific quantity of products. The loss of business with respect to... -

Page 41

... plans, which generally provide benefits based on negotiated amounts for each year of service. Our primary funded non-U.S. plans are located in Mexico and the United Kingdom and were underfunded by $418 million as of December 31, 2015. The funding requirements of these benefit plans, and the related... -

Page 42

...and financial condition. We cannot assure that any current or future restructuring will be completed as planned or achieve the desired results. Additionally, from time to time in the past, we have recorded asset impairment losses relating to specific plants and operations. Generally, we record asset... -

Page 43

... of the U.S., including Mexico, China and other countries in Asia Pacific, Eastern and Western Europe, South America and Northern Africa. We also purchase raw materials and other supplies from many different countries around the world. For the year ended December 31, 2015, approximately 63% of... -

Page 44

... adverse effect on our business, financial condition and results of operations. Risks Related to Legal, Regulatory, Tax and Accounting Matters We may incur material losses and costs as a result of warranty claims, product recalls, product liability and intellectual property infringement actions that... -

Page 45

.... As we sell, close and/or demolish facilities around the world, environmental investigations and assessments will continue to be performed. We may identify previously unknown environmental conditions or further delineate known conditions that may require remediation or additional costs related to... -

Page 46

... increasing our long-term effective tax rate to approximately 20% to 22%. For the year ended December 31, 2015, our effective tax rate was 17%. Taxing authorities could challenge our historical and future tax positions. The amount of tax we pay is subject to our interpretation of applicable tax laws... -

Page 47

... North America Asia Pacific South America Total Electrical/Electronic Architecture...Powertrain Systems...Electronics and Safety...Total... 30 4 3 37 32 10 7 49 25 5 3 33 5 2 - 7 92 21 13 126 In addition to these manufacturing sites, we had 14 major technical centers: four in North America... -

Page 48

... claims and prior experience with similar matters. While the Company believes its accruals are adequate, the final amounts required to resolve these matters could differ materially from the Company's recorded estimates and Delphi's results of operations could be materially affected. ITEM 4. MINE... -

Page 49

... RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our ordinary shares have been publicly traded since November 17, 2011 when our ordinary shares were listed and began trading on the New York Stock Exchange ("NYSE") under the symbol "DLPH." The following table sets forth the high... -

Page 50

...Fiscal year ending December 31, 2015. Delphi Automotive PLC S&P 500 - Standard & Poor's 500 Total Return Index Automotive Supplier Peer Group - Russell 3000 Auto Parts Index, including American Axle & Manufacturing, BorgWarner Inc., Cooper Tire & Rubber Company, Dana Holding Corp., Delphi Automotive... -

Page 51

...our executives. All grants were made under the Delphi Automotive PLC Long Term Incentive Plan, as amended and restated effective April 23, 2015 (the "PLC LTIP"). (2) The restricted stock units have no exercise price. (3) Remaining shares available under the PLC LTIP. Repurchase of Equity Securities... -

Page 52

... in this Annual Report. The financial information presented may not be indicative of our future performance. The assets and liabilities and operating results for the previously reported Thermal Systems segment have been reclassified as discontinued operations separate from the Company's continuing... -

Page 53

... 2014 2013 2012 2011 (in millions, except employee data) (1) On October 26, 2012, we completed the acquisition of the Motorized Vehicles Division of FCI ("MVL"). MVL is a leading global manufacturer of automotive connection systems with a focus on high-value, leading technology applications. Given... -

Page 54

...Green and Connected products which are being added to vehicle content, and new business wins with existing and new customers. We have successfully created a competitive cost structure, continued to align our product offerings with the high-growth industry mega-trends and re-aligned our manufacturing... -

Page 55

... and world class engineering capabilities we intend to employ our rigorous, forward-looking product development process to deliver new technologies that provide solutions to OEMs. We are committed to creating value for our shareholders. We expanded our repurchases of ordinary shares in 2015 to... -

Page 56

...geographic penetration and scale to complement our current businesses. Trends, Uncertainties and Opportunities Rate of economic recovery. Our business is directly related to automotive sales and automotive vehicle production by our customers. Automotive sales depend on a number of factors, including... -

Page 57

... of our customers. We have a team of more than 19,000 scientists, engineers and technicians focused on developing leading product solutions for our key markets, located at 14 major technical centers in Brazil, China, France, Germany, India, Luxembourg, Mexico, Poland, South Korea, the United Kingdom... -

Page 58

... on-going restructuring programs focused on aligning our manufacturing capacity and footprint with the current automotive production levels in Europe and South America and the continued rotation of our manufacturing footprint to low cost locations within these regions. As we continue to operate in... -

Page 59

...-related cost exposures using a number of approaches, including combining purchase requirements with customers and/or other suppliers, using alternate suppliers or product designs, negotiating cost reductions and/or commodity cost contract escalation clauses into our vehicle manufacturer supply... -

Page 60

... divestiture of our Reception Systems business in the third quarter of 2015. Cost of Sales Cost of sales is primarily comprised of material, labor, manufacturing overhead, freight, fluctuations in foreign currency exchange rates, product engineering, design and development expenses, depreciation and... -

Page 61

... primarily recognized as part of the Acquisition and resulting from our business acquisitions. The consistency in amortization during the year ended December 31, 2015 compared to 2014 reflects the continued amortization of our definite-lived intangible assets over their estimated useful lives. Refer... -

Page 62

... automotive production levels in Europe and South America. These charges included the recognition of employeerelated and other costs of $35 million during the year ended December 31, 2014 for the initiation of a new restructuring program at a European manufacturing site within the Powertrain Systems... -

Page 63

... recorded $8 million for certain fees earned pursuant to the transition services agreement in connection with the sale of the Company's wholly owned Thermal Systems business, and $5 million of interest income. During the year ended December 31, 2014, Delphi repaid a portion of the Tranche A Term... -

Page 64

... information for all periods presented. Discontinued operations also includes the Company's thermal original equipment service business, the results of which were previously reported within the Powertrain Systems segment. Certain operations, primarily related to contract manufacturing services... -

Page 65

Table of Contents Electrical/ Electronic Architecture Powertrain Systems Electronics and Safety (in millions) Eliminations and Other Total For the Year Ended December 31, 2015: Adjusted operating income ...$ Restructuring ...Other acquisition and portfolio project costs ...Asset impairments ... -

Page 66

... 29 $ (334) Gross Margin Percentage by Segment Year Ended December 31, 2015 2014 Electrical/Electronic Architecture ...Powertrain Systems ...Electronics and Safety ...Eliminations and Other...Total...Adjusted Operating Income by Segment Year Ended December 31, Favorable/ (unfavorable) Volume, net... -

Page 67

... sales in North America and Asia Pacific, partially offset by contractual price reductions. Cost of Sales Cost of sales is primarily comprised of material, labor, manufacturing overhead, freight, fluctuations in foreign currency exchange rates, product engineering, design and development expenses... -

Page 68

... of property of approximately $11 million from the sale of a manufacturing site that was closed as a result of Delphi's overall restructuring program. Selling, General and Administrative Expense Year Ended December 31, 2014 2013 (dollars in millions) Favorable/ (unfavorable) Selling, general and... -

Page 69

... during the year ended December 31, 2014 for the initiation of a new restructuring program at a European manufacturing site within the Powertrain Systems segment in the second quarter of 2014. Restructuring expenses recorded during the year ended December 31, 2013 were primarily attributable... -

Page 70

... information for all periods presented. Discontinued operations also includes the Company's thermal original equipment service business, the results of which were previously reported within the Powertrain Systems segment. Certain operations, primarily related to contract manufacturing services... -

Page 71

... and gains (losses) on business divestitures. The reconciliations of Adjusted Operating Income to net income attributable to Delphi for the years ended December 31, 2014 and 2013 are as follows: Electrical/ Electronic Architecture Powertrain Systems Electronics and Safety (in millions) Eliminations... -

Page 72

..., primarily related to accruals for incentive compensation, information technology costs and costs for other service providers; and The absence of a prior period gain on the disposal of property of approximately $11 million from the sale of a manufacturing site that was closed as a result of Delphi... -

Page 73

...to our authorized common share repurchase programs, as further described below. We also continue to expect to be able to move funds between different countries to manage our global liquidity needs without material adverse tax implications, subject to current monetary policies and to the terms of the... -

Page 74

... on July 30, 2015, Delphi completed the acquisition of 100% of the issued ordinary share capital of HellermannTyton Group PLC ("HellermannTyton") a public limited company based in the United Kingdom, and a leading global manufacturer of high-performance and innovative cable management solutions. The... -

Page 75

... the purchase price funded with cash on hand that was received from the sale of the Company's Thermal Systems business, as further described below. Prior to the transaction closing, in connection with the offer to acquire HellermannTyton in July 2015, £540 million ($844 million using July 30, 2015... -

Page 76

... involvement with the divested Thermal Systems business following the closing of the transactions. Reception Systems-On July 31, 2015, Delphi completed the sale of its Reception Systems business, which was previously reported within the Electronics and Safety segment, and received net cash proceeds... -

Page 77

... of Delphi Corporation's direct and indirect parent companies. All guarantees of Delphi Corporation's subsidiaries and all then-existing security interests were released during the first quarter of 2014 when the Company satisfied certain credit rating-related and other conditions under the terms of... -

Page 78

...of issuance costs in connection with the 2013 Senior Notes. Interest is payable semi-annually on February 15 and August 15 of each year to holders of record at the close of business on February 1 or August 1 immediately preceding the interest payment date. On March 3, 2014, Delphi Corporation issued... -

Page 79

... Federal agencies in the year ended December 31, 2015 for work performed. These programs supplement our internal research and development funds and directly support our product focus of Safe, Green and Connected. We continue to pursue many technology development programs by bidding on competitively... -

Page 80

... presented were: Year Ended December 31, 2015 2014 (in millions) 2013 Electrical/Electronic Architecture...Powertrain Systems...Electronics and Safety...Eliminations and Other (1)...Total capital expenditures...North America...Europe, Middle East & Africa...Asia Pacific ...South America...Total... -

Page 81

..., the effective date of the program. This program is unfunded. Executives receive benefits over 5 years after an involuntary or voluntary separation from Delphi. The SERP is closed to new members and was frozen effective September 30, 2008. There are no required contributions for the SERP in 2015... -

Page 82

... based on our historical experience, terms of existing contracts, our evaluation of trends in the industry, information provided by our customers and information available from other outside sources, as appropriate. We consider an accounting estimate to be critical if: • • It requires us to make... -

Page 83

... economic factors and business strategies. Other estimates used in determining fair value include, but are not limited to, future cash flows or income related to intangibles, market rate assumptions, actuarial assumptions for benefit plans and appropriate discount rates. Our estimates of fair value... -

Page 84

... years ended December 31: 2.70% N/A 2.50% N/A 3.81% 3.67% 3.67% 3.65% Pension Benefits U.S. Plans 2015 2014 2013 2015 Non-U.S. Plans 2014 2013 Weighted-average discount rate ...Weighted-average rate of increase in compensation levels...Weighted-average expected long-term rate of return on plan... -

Page 85

...sales data, independent automotive production volume estimates and customer commitments and review of appraisals. The key factors which impact our estimates are (1) future production estimates; (2) customer preferences and decisions; (3) product pricing; (4) manufacturing and material cost estimates... -

Page 86

... as normal purchases or sales. Changes in fair value are reported currently through earnings unless they meet hedge accounting criteria. Our derivative exposures are with counterparties with long-term investment grade credit ratings. We estimate the fair value of our derivative contracts using an... -

Page 87

... information. Share-Based Compensation The Delphi Automotive PLC Long Term Incentive Plan, as amended and restated effective April 23, 2015 ("PLC LTIP") allows for the grant of share-based awards for long-term compensation to the employees, directors, consultants and advisors of the Company (further... -

Page 88

.../average rate forward contracts are executed to offset a portion of our exposure to the potential change in prices mainly for various non-ferrous metals used in the manufacturing of automotive components, primarily copper. As a result of the divestiture of our Thermal Systems business in 2015, as... -

Page 89

Table of Contents The table below indicates interest rate sensitivity on interest expense to floating rate debt based on amounts outstanding as of December 31, 2015. Tranche A Term Loan Change in Rate (impact to annual interest expense, in millions) 25 bps decrease ...25 bps increase... - $1 +$1 ... -

Page 90

... relation to the basic financial statements taken as a whole, presents fairly in all material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Delphi Automotive PLC's internal control... -

Page 91

... the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Delphi Automotive PLC as of December 31, 2015 and 2014, and the related consolidated statements of operations, comprehensive income, shareholders' equity, and cash flows for each of the three years in... -

Page 92

Table of Contents DELPHI AUTOMOTIVE PLC CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2015 2014 2013 (in millions, except per share amounts) Net sales...$ Operating expenses: Cost of sales...Selling, general and administrative...Amortization ...Restructuring (Note 10) ...Total ... -

Page 93

... OF COMPREHENSIVE INCOME Year Ended December 31, 2015 2014 (in millions) 2013 Net income...$ Other comprehensive (loss) income: Currency translation adjustments ...Net change in unrecognized (loss) gain on derivative instruments, net of tax (Note 17) ...Employee benefit plans adjustment, net of... -

Page 94

... December 31, 2015 2014 (in millions) ASSETS Current assets: Cash and cash equivalents ...$ Restricted cash...Accounts receivable, net...Inventories (Note 3)...Other current assets (Note 4) ...Current assets held for sale (Note 25) ...Total current assets...Long-term assets: Property, net (Note... -

Page 95

... Taxes withheld and paid on employees' restricted share awards Net cash used in financing activities Effect of exchange rate fluctuations on cash and cash equivalents (Decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end... -

Page 96

... ...Dividend payments of consolidated affiliates to minority shareholders ...Taxes withheld on employees' restricted share award vestings...Repurchase of ordinary shares...Share-based compensation ...Assets purchased from non-controlling interests in excess of book value ...Balance at December 31... -

Page 97

... developing market relevant product solutions for its customers. In line with the long term growth in emerging markets, Delphi has been increasing its focus on these markets, particularly in China, where the Company has a major manufacturing base and strong customer relationships. Corporate history... -

Page 98

... as short-term, highly liquid investments with original maturities of three months or less. Marketable securities-Marketable securities with maturities of three months or less are classified as cash and cash equivalents for financial statement purposes. Available-for-sale securities are recorded in... -

Page 99

... Note 4. Assets. Special tools represent Delphi-owned tools, dies, jigs and other items used in the manufacture of customer components that will be sold under long-term supply arrangements, the costs of which are capitalized within property, plant and equipment if the Company has title to the assets... -

Page 100

... their estimated useful lives. The Company has definite-lived intangible assets related to patents and developed technology, customer relationships and trade names. Indefinite-lived in-process research and development intangible assets are not amortized, but are tested for impairment annually, or... -

Page 101

... of a component or a group of components of the Company represents a strategic shift that will have a major effect on the Company's operations and financial results. During the year ended December 31, 2015, Delphi completed the divestitures of the Company's wholly owned Thermal Systems business and... -

Page 102

... the time when such employees return to work, are eligible for retirement or otherwise terminate their employment. Share-based compensation-Our share-based compensation arrangements consist of the Delphi Automotive PLC Long Term Incentive Plan, as amended and restated effective April 23, 2015 (the... -

Page 103

...Delphi adopted this guidance effective January 1, 2015, and has applied it to the Company's discontinued operation classification of the Thermal Systems business, as further discussed in Note 25. Discontinued Operations. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers... -

Page 104

... impact on Delphi's financial statements, other than the application to adjustments to provisional amounts resulting from business combinations for which the accounting is provisional as of the end of a reporting period. In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740... -

Page 105

... As part of Delphi's continuing operations, it has investments in six non-consolidated affiliates accounted for under the equity method of accounting. These affiliates are not publicly traded companies and are located primarily in China and Mexico. Delphi's ownership percentages vary generally from... -

Page 106

... recorded for the years ended December 31, 2015, 2014 and 2013. The following is a summary of the combined financial information of significant affiliates accounted for under the equity method for continuing operations as of December 31, 2015 and 2014 and for the years ended December 31, 2015, 2014... -

Page 107

..., 2014, Delphi recorded asset impairment charges of $5 million in cost of sales and $2 million in selling, general and administrative expense related to declines in the fair values of certain fixed assets and capitalized software no longer being utilized. For the year ended December 31, 2013, Delphi... -

Page 108

... amount of goodwill, by operating segment, for the years ended December 31, 2015 and 2014 is presented below: Electrical/ Electronic Architecture Powertrain Systems Electronics and Safety Total (in millions) Balance at January 1, 2014 ...Acquisitions (1) ...Foreign currency translation and other... -

Page 109

... time of sale of the product based on an estimate of the amount that will eventually be required to settle such obligations. These accruals are based on factors such as past experience, production changes, industry developments and various other considerations. The estimated costs related to product... -

Page 110

... year ended December 31, 2015. These charges were primarily related to Delphi's on-going restructuring programs focused on aligning manufacturing capacity with the current automotive production levels in Europe and South America and the continued rotation of our manufacturing footprint to low cost... -

Page 111

... liability for the years ended December 31, 2015 and 2014: Employee Termination Benefits Liability Other Exit Costs Liability (in millions) Total Accrual balance at January 1, 2014...Provision for estimated expenses incurred during the year...Payments made during the year ...Foreign currency and... -

Page 112

...month LIBOR interest rate option on the Tranche A Term Loan and the ABR interest rate option on the Revolving Credit Facility, as detailed in the table below, and the amounts outstanding, and rates effective as of December 31, 2015 were based on Delphi's current credit rating and the Applicable Rate... -

Page 113

...of issuance costs in connection with the 2013 Senior Notes. Interest is payable semi-annually on February 15 and August 15 of each year to holders of record at the close of business on February 1 or August 1 immediately preceding the interest payment date. On March 3, 2014, Delphi Corporation issued... -

Page 114

... institutions to sell eligible trade receivables from certain aftermarket customers in North America. These arrangements have original terms of one year and may be renewed annually. The receivables under these arrangements are sold without recourse to the Company and are therefore accounted for as... -

Page 115

... generally provide benefits based on negotiated amounts for each year of service. Delphi's primary non-U.S. plans are located in France, Germany, Mexico, Portugal and the United Kingdom ("U.K."). The U.K. and certain Mexican plans are funded. In addition, Delphi has defined benefit plans in South... -

Page 116

... acquisition...Divestitures ...Service cost ...Interest cost ...Actuarial (gain) loss...Benefits paid ...Impact of curtailments ...Exchange rate movements and other ...Benefit obligation at end of year ...Change in plan assets: Fair value of plan assets at beginning of year...Assets acquired in... -

Page 117

... methods and included the following: U.S. Plans Year Ended December 31, 2015 2014 (in millions) 2013 Interest cost ...$ Amortization of actuarial losses...Net periodic benefit cost ...$ 1 1 2 $ $ 2 - 2 $ $ 2 - 2 Non-U.S. Plans Year Ended December 31, 2015 2014 (in millions) 2013 Service cost... -

Page 118

... years ended December 31: 2.70% N/A 2.50% N/A 3.81% 3.67% 3.67% 3.65% Pension Benefits U.S. Plans 2015 2014 2013 2015 Non-U.S. Plans 2014 2013 Weighted-average discount rate ...Weighted-average rate of increase in compensation levels...Weighted-average expected long-term rate of return on plan... -

Page 119

...defined contribution plans for certain hourly and salaried employees. Expense related to the contributions for these plans was $51 million, $55 million, and $49 million for the years ended December 31, 2015, 2014 and 2013, respectively. Plan Assets Certain pension plans sponsored by Delphi invest in... -

Page 120

... of real estate properties is estimated using an annual appraisal provided by the administrator of the property investment. Management believes this is an appropriate methodology to obtain the fair value of these assets. Hedge funds-The fair value of the hedge funds is accounted for by a custodian... -

Page 121

... Real Estate Trust Fund Hedge Funds (in millions) Insurance Contracts Beginning balance at December 31, 2013...Actual return on plan assets: Relating to assets still held at the reporting date ...Purchases, sales and settlements ...Foreign currency translation and other...Ending balance at December... -

Page 122

... 2015, the difference between the recorded liabilities and the reasonably possible range of loss was not material. Operating Leases Rental expense totaled $95 million, $105 million and $99 million for the years ended December 31, 2015, 2014 and 2013, respectively. As of December 31, 2015, Delphi had... -

Page 123

... the years ended December 31, 2015, 2014 and 2013. For purposes of comparability and consistency, the Company uses the notional U.S. federal income tax rate when presenting the Company's reconciliation of the income tax provision. The Company is a U.K. resident taxpayer and as such is not generally... -

Page 124

... to the 2013 research and development credit. On July 17, 2013, the United Kingdom Finance Bill of 2013 became law as the Finance Act 2013 (the "U.K. Finance Act"). The U.K. Finance Act provides for a reduction to the corporate income tax rate from 23% to 21% effective April 1, 2014, with a further... -

Page 125

...dates ranging from one year to an indefinite period. The NOL carryforwards available for use on tax returns are $910 million as of December 31, 2015, which include approximately $8 million related to windfall tax benefits attributable to stock-based compensation for which a benefit would be recorded... -

Page 126

... benefit for the years ended December 31, 2015, 2014 and 2013, respectively. The Company files tax returns in multiple jurisdictions and is subject to examination by taxing authorities throughout the world. Taxing jurisdictions significant to Delphi include China, Brazil, France, Germany, Mexico... -

Page 127

...increasing our long-term effective tax rate to approximately 20% to 22%. For the year ended December 31, 2015, our effective tax rate was 17%. Although the outcome currently remains uncertain, the Company continues to maintain its position that neither Delphi Automotive LLP nor Delphi Automotive PLC... -

Page 128

... the annual dividend rate to $1.16 per ordinary share, and declared a regular quarterly cash dividend of $0.29 per ordinary share, payable on February 29, 2016 to shareholders of record at the close of business on February 17, 2016. Other Prior to the completion of the initial public offering on... -

Page 129

...in accumulated other comprehensive income (loss) attributable to Delphi (net of tax) are shown below. Other comprehensive income includes activity relating to discontinued operations. Year Ended December 31, 2015 2014 (in millions) 2013 Foreign currency translation adjustments: Balance at beginning... -

Page 130

...17. DERIVATIVES AND HEDGING ACTIVITIES Delphi is exposed to market risk, such as fluctuations in foreign currency exchange rates, commodity prices and changes in interest rates, which may result in cash flow risks. To manage the volatility relating to these exposures, Delphi aggregates the exposures... -

Page 131

..., during the year ended December 31, 2014, Delphi entered into and settled treasury rate lock agreements which were designated as cash flow hedges in anticipation of issuing the 2014 Senior Notes, as further discussed in Note 11. Debt. The impacts of these agreements and the related amount of... -

Page 132

... Other long-term liabilities $ (1) - $ $ Asset Derivatives Balance Sheet Location December 31, 2014 Liability Derivatives Balance Sheet Location (in millions) December 31, 2014 Net Amounts of Assets and (Liabilities) Presented in the Balance Sheet December 31, 2014 Designated derivatives... -

Page 133

... year ended December 31, 2013 is as follows: (Loss) Gain Recognized in OCI (Effective Portion) (Loss) Gain Reclassified from OCI into Income (Effective Portion) (in millions) Gain Recognized in Income (Ineffective Portion Excluded from Effectiveness Testing) Year Ended December 31, 2013 Designated... -

Page 134

...the originally forecasted transactions will occur. The amount included in cost of sales related to hedge ineffectiveness was insignificant for the years ended December 31, 2015 and 2014, respectively. Changes in the value of the Euro-denominated debt designated as a net investment hedge are recorded... -

Page 135

... unless they meet hedge accounting criteria. Delphi's derivative exposures are with counterparties with long-term investment grade credit ratings. Delphi estimates the fair value of its derivative contracts using an income approach based on valuation techniques to convert future amounts to a single... -

Page 136

... fair value upon initial recognition. During the year ended December 31, 2015, Delphi recorded non-cash asset impairment charges of $16 million in cost of sales related to declines in the fair values of certain fixed assets. During the year ended December 31, 2014, Delphi recorded non-cash asset 114 -

Page 137

... Operations, during the year ended December 31, 2015, Delphi recorded $8 million for certain fees earned pursuant to the transition services agreement in connection with the sale of the Company's wholly owned Thermal Systems business. During the year ended December 31, 2014, Delphi redeemed for cash... -

Page 138

...July 30, 2015, Delphi completed the acquisition of 100% of the issued ordinary share capital of HellermannTyton Group PLC ("HellermannTyton"), a public limited company based in the United Kingdom, and a leading global manufacturer of high-performance and innovative cable management solutions. Delphi... -

Page 139

... December 10, 2015, Delphi completed the exit of its Electronics business located in Argentina, which was previously reported within the Electronics and Safety segment. The net sales of this business in 2015 prior to the divestiture were approximately $34 million. Delphi recognized a pre-tax loss on... -

Page 140

...forma effects of this acquisition would not materially impact the Company's reported results for any period presented, and as a result no pro forma financial statements are presented. Sale of Reception Systems Business On July 31, 2015, Delphi completed the sale of its Reception Systems business for... -

Page 141

... from the date of acquisition within the Electrical/Electronic Architecture segment. The acquisition was accounted for as a business combination, with the total purchase price allocated on a preliminary basis using information available, in the fourth quarter of 2014. The purchase price and related... -

Page 142

...and Safety segment made a $3 million investment in Quanergy, a leader in 3D Light Detection and Ranging ("LIDAR") sensing technology for automated driving. The Company's investments in Tula and Quanergy are accounted for under the cost method. During the year ended December 31, 2013, Delphi executed... -

Page 143

... shares for all available trading days in the fourth quarter of the year preceding the grant, including dividends, and assessed against a comparable measure of competitor and peer group companies. The details of the executive grants were as follows: Grant Date RSUs Granted (in millions) Time... -

Page 144

... million ($58 million, net of tax) and $46 million ($35 million net of tax) based on the Company's best estimate of ultimate performance against the respective targets during the years ended December 31, 2015, 2014 and 2013, respectively. Delphi will continue to recognize compensation expense, based... -

Page 145

... with the presentation as of December 31, 2015. Statement of Operations Year Ended December 31, 2015 Parent Subsidiary Guarantors Subsidiary Issuer/ Guarantor NonGuarantor Subsidiaries Eliminations Consolidated (in millions) Net sales ...$ Operating expenses: Cost of sales...Selling, general and... -

Page 146

...: Cost of sales...Selling, general and administrative ...Amortization...Restructuring ...Total operating expenses...Operating (loss) income...Interest (expense) income...Other income (expense), net...(Loss) income from continuing operations before income taxes and equity income ...Income tax benefit... -

Page 147

...benefit plans adjustment, net of tax. Other comprehensive loss ...Equity in other comprehensive (loss) income of subsidiaries...Comprehensive income (loss)...Comprehensive income attributable to noncontrolling interests...Comprehensive income (loss) attributable to Delphi...Year Ended December 31, 2014... -

Page 148

... ...Employee benefit plans adjustment, net of tax. Other comprehensive income ...Equity in other comprehensive (loss) income of subsidiaries...Comprehensive income (loss)...Comprehensive income attributable to noncontrolling interests...Comprehensive income (loss) attributable to Delphi...$ 1,212... -

Page 149

...: Short-term debt ...$ Accounts payable...Intercompany payables, current...Accrued liabilities...Current liabilities held for sale Total current liabilities ...Long-term liabilities: Long-term debt ...Intercompany payables, long-term ...Pension benefit obligations...Other long-term liabilities... -

Page 150

...-term ...Property, net...Investments in affiliates...Investments in subsidiaries...Intangible assets, net...Other long-term assets ...Long-term assets held for sale ...Total long-term assets...Total assets...$ LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Short-term debt ...$ Accounts... -

Page 151

... paid on employees' restricted share awards...Net cash provided by (used in) financing activities ...Effect of exchange rate fluctuations on cash and cash equivalents ...Decrease in cash and cash equivalents...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year... -

Page 152

...to affiliates...Repurchase of ordinary shares...Distribution of cash dividends...Taxes withheld and paid on employees' restricted share awards...Net cash (used in) provided by financing activities ...Effect of exchange rate fluctuations on cash and cash equivalents ...Increase (decrease) in cash and... -

Page 153

... paid on employees' restricted share awards...Net cash provided by (used in) financing activities ...Effect of exchange rate fluctuations on cash and cash equivalents ...Increase in cash and cash equivalents...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year... -

Page 154

... information for all periods presented. Discontinued operations also includes the Company's thermal original equipment service business, the results of which were previously reported within the Powertrain Systems segment. Certain operations, primarily related to contract manufacturing services... -

Page 155

...and support functions, including corporate headquarters and certain technical centers. Includes charges recorded in 2015 related to costs associated with employee termination benefits and other exit costs of $37 million for Electrical/ Electronic Architecture, $115 million for Powertrain Systems and... -

Page 156

... gains (losses) on business divestitures. The reconciliation of Adjusted Operating Income to net income attributable to Delphi for the years ended December 31, 2015, 2014 and 2013 are as follows: Electrical/ Electronic Architecture Powertrain Systems Electronics and Safety (in millions) Eliminations... -

Page 157

... 60 1,440 89 1,351 $ Electrical/ Electronic Architecture Powertrain Systems Electronics and Safety (in millions) Eliminations and Other Total For the Year Ended December 31, 2013: Adjusted operating income ...$ Restructuring ...Other acquisition and portfolio project costs ...Operating income... -

Page 158

...tooling that relate to the Company's maquiladora operations located in Mexico. These assets are utilized to produce products sold to customers located in the United States. Includes Delphi's country of domicile, Jersey, and the country of Delphi's principal executive offices, the United Kingdom. The... -

Page 159

... application of the classification of the Thermal Systems segment as a discontinued operation. Refer to Note 25. Discontinued Operations for additional information. Three Months Ended March 31, June 30, September 30, December 31, Total (in millions, except per share amounts) 2015 Net sales...$ Cost... -

Page 160

...Automotive Systems Corporation ("KDAC") joint venture, which was accounted for under the equity method and was principally reported as part of the Thermal Systems segment, to the joint venture partner for net cash proceeds of $70 million. During the year ended December 31, 2015, the Company recorded... -

Page 161

... within one year, and to current or long-term assets and liabilities held for sale, as appropriate, for prior periods. The Company ceased recording depreciation of the held for sale Thermal Systems assets in the first quarter of 2015. As described above, Delphi completed the sale of the wholly... -

Page 162

... reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported on a timely basis, and that such information is accumulated and communicated to management, including the Company's Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely... -

Page 163

... Company's operations, compliance programs and internal control processes. Specifically, as permitted by SEC rules and regulations, the Company has excluded HellermannTyton from management's evaluation of internal controls over financial reporting as of December 31, 2015. ITEM 9B. OTHER INFORMATION... -

Page 164

... shareholder who submits a request to: Corporate Secretary, Delphi Automotive PLC, c/o Delphi Automotive Systems, LLC, 5725 Delphi Drive, Troy, Michigan, 48098. Information on the Company's website is not deemed to be incorporated by reference into this Annual Report on Form 10-K. ITEM 11. EXECUTIVE... -

Page 165

... are filed as part of this Form 10-K. (1) Financial Statements: Page No Reports of Independent Registered Public Accounting Firm Consolidated Statements of Operations for the Years Ended December 31, 2015, 2014 and 2013 Consolidated Statements of Comprehensive Income for the Years Ended December... -

Page 166

...to the Current Report on Form 8-K of the Company filed with the SEC on February 14, 2013) Second Supplemental Indenture, dated as of March 3, 2014, among Delphi Corporation, the Guarantors named therein, Wilmington Trust, National Association, as Trustee, and Deutsche Bank Trust Company Americas, as... -

Page 167

...)+ Form of Continuity Time-Based RSU Award pursuant to the Delphi Automotive PLC Long-Term Incentive Plan, as amended and restated(13)+ Delphi Automotive PLC Leadership Incentive Plan, as amended and restated effective April 23, 2015 (incorporated by reference to the Company's Proxy Statement dated... -

Page 168

.... (10) Filed with Form 10-K for the year ended December 31, 2013 on February 10, 2014 and incorporated herein by reference. (11) Filed with Form 8-K on September 9, 2014 and incorporated herein by reference. (12) Filed with Form 10-K for the year ended December 31, 2014 on February 9, 2015 and... -

Page 169

...the undersigned, thereunto duly authorized. DELPHI AUTOMOTIVE PLC /s/ Mark J. Murphy By: Mark J. Murphy Chief Financial Officer and Executive Vice President Dated: February 8, 2016 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below as of February... -

Page 170

Table of Contents /s/ Sean O. Mahoney Sean O. Mahoney /s/ Timothy M. Manganello Timothy M. Manganello /s/ Bethany J. Mayer Bethany J. Mayer /s/ Thomas W. Sidlik Thomas W. Sidlik /s/ Bernd Wiedemann Bernd Wiedemann /s/ Lawrence A. Zimmerman Lawrence A. Zimmerman Director Director Director ... -

Page 171

-

Page 172

delphi.com 2 001CSN1F0D