Creative 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

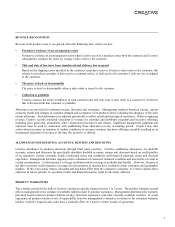

VALUATION OF INVENTORIES

Creative states inventories at the lower of cost or market. The company records a write-down for inventories of components

and products which have become obsolete or are in excess of anticipated demand or net realizable value. Management performs

a detailed assessment of inventory at each balance sheet date to establish provisions for excess and obsolete inventories.

Management’s evaluation includes a review of, among other factors, historical sales, current economic trends, forecasted

sales, demand requirements, product lifecycle and product development plans, quality issues, and current inventory levels.

The markets for PC peripherals and personal digital entertainment products are subject to a rapid and unpredictable pace

of product and component obsolescence and demand changes. If future demand or market conditions for the company’s

products are less favorable than forecasted or if unforeseen technological changes negatively impact the utility of component

inventory, Creative may be required to record write-downs which would negatively affect gross margins in the period when

the write-downs are recorded and its operating results and financial position could be adversely affected.

VALUATION OF INVESTMENTS

Creative holds equity investments in various companies from less than 1% to 100% of the issuer’s outstanding capital stock.

Investments in companies in which Creative acquires more than 50% of the outstanding capital stock and which are under

Creative’s effective control, are treated as investments in subsidiaries, and the balance sheets and results of operations are

fully consolidated after making an allowance for any minority interests. Companies in which Creative’s investments total

between 20% and 50% of such company’s capital stock are treated as associated companies and recorded on an equity basis,

whereby the cost of investment is adjusted to recognise Creative’s share of all post acquisition results of operations.

As for investments of less than 20%, non-quoted investments are carried at cost, less provisions for permanent impairment

where necessary, and quoted investments are reported at fair value with the unrealised gains and losses included as a separate

component of shareholders’ equity. The investment portfolio is monitored on a periodic basis for impairment. Creative’s

investments in these companies are inherently risky because the markets for the technologies or products they have under

development are typically in the early stages and may never develop. In the event that the carrying value of an investment

exceeds its fair value and the decline in value is determined to be other-than-temporary, an impairment charge is recorded

and a new cost basis for the investment is established. Fair values for investments in public companies are determined

using quoted market prices. Fair values for investments in privately-held companies are estimated based upon one or more

of the following: pricing models using historical and forecasted financial information and current market rates, liquidation

values, the values of recent rounds of financing, or quoted market prices of comparable public companies.

In order to determine whether a decline in value is other-than-temporary, Creative evaluates, among other factors: the duration

and extent to which the fair value has been less than the carrying value; the financial condition of and business outlook for

the company, including key operational and cash flow metrics, current market conditions and future trends in the company’s

industry, and the company’s relative competitive position within the industry; and Creative’s intent and ability to retain the

investment for a period of time sufficient to allow for any anticipated recovery in fair value.

VALUATION OF GOODWILL AND OTHER INTANGIBLE ASSETS

Creative uses the purchase method of accounting for business combinations, in line with Financial Accounting Standards

Board’s (“FASB”) Statement of Financial Accounting Standard (“SFAS”) No. 141 “Business Combinations.” The purchase

method of accounting for acquisitions requires extensive use of accounting estimates and judgment to allocate the purchase

price paid to the fair value of the net tangible and intangible assets acquired, including in-process technology. The allocation

of the purchase price is based on independent appraisals. The amounts and useful lives assigned to intangible assets could

impact future amortization. The amount assigned to in-process technology is expensed immediately. If the assumptions

and estimates used to allocate the purchase price are not correct, purchase price adjustments or future asset impairment

charges could be required.

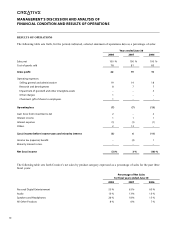

MANAGEMENT’SDISCUSSIONANDANALYSISOF

FINANCIALCONDITIONANDRESULTSOFOPERATIONS