CompUSA 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Board of Directors has adopted the following corporate governance documents with respect to the Company (the “Corporate Governance

Documents”):

In accordance with the listing standards of the New York Stock Exchange, each of the Corporate Governance Documents is available on our Company

website (www.systemax.com).

Item 1A. Risk Factors.

There are a number of factors and variables described below that may affect our future results of operations and financial condition. Other factors of

which we are currently not aware or that we currently deem immaterial may also affect our results of operations and financial position.

Risks Related to the Economy and Our Industries

Current economic conditions may cause the loss of consumer confidence in the Company’s markets which may result in a decrease of

spending in the categories of products we sell. With conditions in the market for technology products remaining highly competitive,

reductions in our selling prices, as we have experienced in recent years, would adversely affect our revenues and profits. It is also possible

that as manufacturers react to the marketplace they may reduce manufacturing capacity or allocations to their customers creating shortages

of product. Both we and our customers are subject to global political, economic and market conditions, including inflation, interest rates,

energy costs, the impact of natural disasters, military action and the threat of terrorism. Our consolidated results of operations are directly

affected by economic conditions in North America and Europe. We may experience a decline in sales as a result of poor economic

conditions and the lack of visibility relating to future orders. Our results of operations depend upon, among other things, our ability to

maintain and increase sales volumes with existing customers, our ability to limit price reductions and maintain our margins, our ability to

attract new customers and the financial condition of our customers. A decline in the economy that adversely affects our customers, causing

them to limit or defer their spending, would likely adversely affect our sales, prices and profitability as well. We cannot predict with any

certainty whether we will be able to maintain or improve upon historical sales volumes with existing customers, or whether we will be able

to attract new customers.

In response to economic and market conditions, from time to time we have undertaken initiatives to reduce our cost structure where

appropriate. These initiatives, as well as any future workforce and facilities reductions, may not be sufficient to meet current and future

changes in economic and market conditions and allow us to continue to achieve the growth rates and levels of profitability we have recently

experienced. In addition, costs actually incurred in connection with our restructuring actions may be higher than our estimates of such costs

and/or may not lead to the anticipated cost savings.

We may not be able to compete effectively with current or future competitors. The markets for our products and services are intensely

competitive and subject to constant technological change. We expect this competition to further intensify in the future. Competitive factors

include price, availability, service and support. We compete with a wide variety of other resellers and retailers, including internet marketers,

as well as manufacturers. Many of our competitors are larger companies with greater financial, marketing and product development

resources than ours. The market for the sale of industrial products in North America is highly fragmented and is characterized by multiple

distribution channels such as small dealerships, direct mail distribution, internet-based resellers, large warehouse stores and retail outlets.

We also face competition from manufacturers’ own sales representatives, who sell industrial equipment directly to customers, and from

regional or local distributors. In addition, new competitors may enter our markets. This may place us at a disadvantage in responding to

competitors’ pricing strategies, technological advances and other initiatives, resulting in our inability to increase our revenues or maintain

our gross margins in the future.

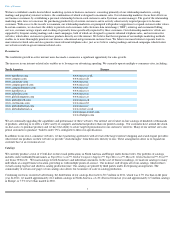

Table of Contents

•

Corporate Ethics Policy for officers, directors and employees

•

Charter for the Audit Committee of the Board of Directors

•

Charter for the Compensation Committee of the Board of Directors

•

Charter for the Nominating/Corporate Governance Committee of the Board of Directors

•

Corporate Governance Guidelines and Principles

• General economic conditions, such as decreased consumer confidence and spending, reductions in manufacturing capacity, and inflation

could result in our failure to achieve our historical sales growth rates and profit levels.

•

The markets for our products and services are extremely competitive and if we are unable to successfully respond to our competitors

’

strategies our sales and gross margins will be adversely affected.

8