CompUSA 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYSTEMAX INC

FORM 10-K

(Annual Report)

Filed 03/08/12 for the Period Ending 12/31/11

Address 11 HARBOR PARK DR

PORT WASHINGTON, NY 11050

Telephone 5166087000

CIK 0000945114

Symbol SYX

SIC Code 5961 - Catalog and Mail-Order Houses

Industry Retail (Catalog & Mail Order)

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2012, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

SYSTEMAX INC FORM 10-K (Annual Report) Filed 03/08/12 for the Period Ending 12/31/11 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 11 HARBOR PARK DR PORT WASHINGTON, NY 11050 5166087000 0000945114 SYX 5961 - Catalog and Mail-Order Houses Retail (Catalog & Mail Order) Services ... -

Page 2

... Number: 1-13792 Systemax Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 11-3262067 (I.R.S. Employer Identification No.) 11 Harbor Park Drive Port Washington, New York 11050 (Address of principal executive offices... -

Page 3

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2011, which is the last business day of the registrant's most recently completed second fiscal quarter, was approximately $164,511,601. For purposes of this computation, all executive officers and ... -

Page 4

... OF C ONTENTS Part I Item 1. Business General Products Sales and Marketing Customer Service, Order Fulfillment and Support Suppliers Competition and Other Market Factors Employees Environmental Matters Financial Information About Foreign and Domestic Operations Available Information Risk Factors... -

Page 5

...to accept credit cards significant changes in the computer products retail industry, especially relating to the distribution and sale of such products timely availability of existing and new products risks associated with delivery of merchandise to customers by utilizing common delivery services the... -

Page 6

... in 1995. Certain predecessor businesses which now constitute part of the Company have been in business since 1949. Our headquarters office is located at 11 Harbor Park Drive, Port Washington, New York. Products We offer hundreds of thousands of brand name and private label products. We endeavor to... -

Page 7

... such customers with electronic data interchange ("EDI") ordering and customized billing services, customer savings reports and stocking of specialty items specifically requested by these customers. Our relationship marketers' efforts are supported by frequent catalog mailings and e-mail campaigns... -

Page 8

... the internet and by computer and office supply superstores. Timely introduction of new products or product features are critical elements to remaining competitive. Other competitive factors include product performance, quality and reliability, technical support and customer service, marketing and... -

Page 9

...,901 See Item 7, "Management's Discussions and Analysis of Financial Condition and Results of Operations", for further information with respect to our operations. Available Information We maintain an internet website at www.systemax.com. We file reports with the Securities and Exchange Commission... -

Page 10

... the listing standards of the New York Stock Exchange, each of the Corporate Governance Documents is available on our Company website (www.systemax.com). Item 1A. Risk Factors. There are a number of factors and variables described below that may affect our future results of operations and financial... -

Page 11

... we sell and could be adversely affected by a continuation of our customers' shift to lower-priced products. • Sales tax laws may be changed which could result in ecommerce and direct mail retailers having to collect sales taxes in states where the current laws do not require us to do so. This... -

Page 12

... available to our customers a wide selection of products without having to maintain large amounts of inventory. The termination or interruption of our relationships with any of these suppliers could materially adversely affect our business. We purchase a number of our products from vendors outside... -

Page 13

.... We have 42 retail stores operating in North America at December 31, 2011 and one under construction. The Company needs to effectively manage its cost structure in order to maintain profitability including the additional inventory needs, retail point of sales IT systems, retail personnel and leased... -

Page 14

... cost reductions or new product line expansion to address gross profit and operating margin pressures; failure to mitigate these pressures could adversely affect our operating results and financial condition . The computer and consumer electronics industry is highly price competitive and gross... -

Page 15

... Comments. None. Item 2. Properties. We operate our business from numerous facilities in North America, Europe and Asia. These facilities include our headquarters location, administrative offices, telephone call centers, distribution centers, computer assembly and retail stores. Certain facilities... -

Page 16

... his direction such removed product inventory, without payment to the Company and for his own personal gain; ii) Mr. Fiorentino caused substantial amounts of Company inventory purchases to be effected through Company credit cards in order to accrue and/or use "reward points" for his personal benefit... -

Page 17

... improper activities. The Company also terminated the employment of Ms. Andrea Fongyee (assistant to Mr. Gilbert Fiorentino) in May 2011. In January 2012, the Company commenced a lawsuit in Miami-Dade County Circuit Court in Florida against, among others, Carl Fiorentino, Patrick Fiorentino, Andrea... -

Page 18

... Issuer Purchases of Equity Securities Systemax common stock is traded on the NYSE Euronext Exchange under the symbol "SYX." The following table sets forth the high and low closing sales price of our common stock as reported on the New York Stock Exchange for the periods indicated. High 2011 First... -

Page 19

... of brand name and private label products. Our operations are organized in two reportable business segments - Technology Products and Industrial Products. Our Technology Products segment sells computers, computer supplies and consumer electronics which are marketed in North America, Puerto Rico and... -

Page 20

...are sales from retail stores, consumer websites, inbound call centers and television shopping channels. Constant currency refers to the adjustment of the results of our foreign operations to exclude the effects of period to period fluctuations in currency exchange rates. Critical Accounting Policies... -

Page 21

... store sales growth, gross margin percentages, new business opportunities, working capital requirements, capital expenditures and growth in selling, general and administrative expense. We also use our company's market capitalization and comparable company market data to validate our reporting unit... -

Page 22

... are developed based on the terms of our vendor agreements and using existing expenditures for which funding is available, determining products whose market price would indicate coverage for markdown or price protection is available and estimating the level of our performance under agreements... -

Page 23

... Accounting policy Income Taxes. We are subject to taxation from federal, state and foreign jurisdictions and the determination of our tax provision is complex and requires significant management judgment. We conduct operations in numerous U.S. states and foreign locations. Our effective tax rate... -

Page 24

...read in conjunction with the consolidated financial statements included herein Sales grew 2.6%, 1% on a constant currency basis, to $3.7 billion in 2011 over 2010. One new retail store opened. Movements in exchange rates positively impacted European sales by approximately $45.6 million and Canadian... -

Page 25

.... The Industrial Products net sales increase in 2011 is attributable to more products offered on the Company's websites and the addition of sales personnel. GEOGRAPHIES: The North American sales increase resulted primarily from the Industrial Products segment's additional new product lines partially... -

Page 26

... 2010 compared to 2009 benefiting from increased retail and internet sales in the consumer channel, the result of opening seven retail stores in 2010 and the Circuit City acquisition in 2009. On a constant currency basis, North American sales would have grown 8.9%. The movement in the exchange rates... -

Page 27

... of its Software Solutions segment. OPERATING MARGIN Technology Products operating margin increased 10 basis points in 2011 versus 2010 due to the effect of a special gain recorded in 2011 related to the investigation of the former officer and director of the Company and the special charges incurred... -

Page 28

... 2010. Accounts receivable days outstanding were at 27 in 2011 up from 25 in 2010. We expect that future accounts receivable and inventory balances will fluctuate with growth in net sales and the mix of our net sales between consumer and business customers. Net cash provided by operating activities... -

Page 29

...cash needs to support our growth and expansion plans, continued investment in upgrading and expanding our technological capabilities and information technology infrastructure, opening of new retail stores, and in building out and expanding our distribution center facilities and inventory systems. 27 -

Page 30

... $3.0 million if average foreign exchange rates changed by 10% in 2011. We have limited involvement with derivative financial instruments and do not use them for trading purposes. We may enter into foreign currency options or forward exchange contracts aimed at limiting in part the impact of certain... -

Page 31

... regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company's assets that could have a material effect on the Company's financial statements. Management, including the Company's Chief Executive Officer and Chief Financial Officer, does not expect... -

Page 32

... Reporting There have been no changes in the Company's internal controls over financial reporting for the quarter ended December 31, 2011 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting. Item 9B. Other Information... -

Page 33

.... PART IV Item 15. Exhibits and Financial Statement Schedules. (a) 1. Consolidated Financial Statements of Systemax Inc. Reports of Ernst & Young LLP Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2011 and 2010 Consolidated Statements of Operations for... -

Page 34

...) Form of 2005 Employee Stock Purchase Plan* (incorporated by reference to the Company's annual report on Form 10-K for the year ended December 31, 2006) Lease Agreement dated September 20, 1988 between the Company and Addwin Realty Associates (Port Washington facility) (incorporated by reference... -

Page 35

... by reference to the Company's Definitive Proxy Statement filed April 29, 2010) Corporate Ethics Policy for Officers, Directors and Employees (revised as of March, 2010) Subsidiaries of the Registrant (filed herewith) Consent of Independent Registered Public Accounting Firm (filed herewith... -

Page 36

... behalf by the undersigned, thereunto duly authorized. SYSTEMAX INC. By: /s/ RICHARD LEEDS Richard Leeds Chairman and Chief Executive Officer Date: March 8, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf... -

Page 37

...of the Company's management. Our responsibility is to express an opinion on these financial statements and schedule based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 38

... also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Systemax Inc. as of December 31, 2011 and 2010 and the related consolidated statements of operations, shareholders' equity, and cash flows for each of... -

Page 39

... of Contents SYSTEMAX INC. CONSOLIDATED BALANCE SHEETS (in thousands, except for share data) December 31, 2011 2010 ASSETS: Current assets: Cash Accounts receivable, net of allowances of $14,646 and $17,881 Inventories Prepaid expenses and other current assets Deferred income taxes Total current... -

Page 40

...,706 37,343 0.75 Net sales Cost of sales Gross profit Selling, general and administrative expenses Special (gains) charges Operating income Foreign currency exchange loss Interest and other income, net Interest expense Income before income taxes Provision for income taxes Net income Net income per... -

Page 41

...Compensation expense related to equity compensation plans Return of common stock-special gain Excess tax benefit from exercises of stock options Loss on dispositions and abandonment Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets... -

Page 42

... stock Exercise of stock options Return of common stock Surrender of fully vested options Income tax benefit on stock-based compensation Change in cumulative translation adjustment Net income Total comprehensive income Balances, December 31, 2011 See notes to consolidated financial statements... -

Page 43

... of the Company's foreign entities are translated into U.S. dollars, the reporting currency, using year-end exchange rates for assets and liabilities, average exchange rates for the statement of operations items and historical rates for equity accounts. Translation gains or losses are recorded as... -

Page 44

... the Company's effective tax rate in a given financial statement period may be affected. Revenue Recognition and Accounts Receivable - The Company recognizes sales of products, including shipping revenue, when persuasive evidence of an order arrangement exists, delivery has occurred, the sales price... -

Page 45

...primarily of investments in cash, trade accounts receivable debt and accounts payable. The Company estimates the fair value of financial instruments based on interest rates available to the Company and by comparison to quoted market prices. At December 31, 2011 and 2010, the carrying amounts of cash... -

Page 46

...2011 $ 3,280 $ 3,280 December 31, 2010 $ 930 1,350 1,000 $ 3,280 Balance January 1 Deferred tax adjustment Adjustments to finalize purchase price...976 Retail store leases Client lists Technology Total The aggregate amortization expense for these intangibles was approximately $1.6 million in 2011. ... -

Page 47

... by GE Government Finance Inc., and mature on October 1, 2018. Interest on the Bonds is calculated at the rate of 4.15% per annum and principal and interest payments are due monthly. The proceeds of the Bonds are used to finance or repay the costs of capital equipment purchased for the Company... -

Page 48

45 -

Page 49

... Matters. In January and February 2011 the Company received anonymous whistleblower allegations concerning the Company's Miami Florida operations involving the actions of Mr. Gilbert Fiorentino, then the Chief Executive of the Company's Technology Products Group. In response to the allegations... -

Page 50

... his direction such removed product inventory, without payment to the Company and for his own personal gain; ii) Mr. Fiorentino caused substantial amounts of Company inventory purchases to be effected through Company credit cards in order to accrue and/or use "reward points" for his personal benefit... -

Page 51

... income tax benefits recognized for 2011, 2010 and 2009 were $0.6 million, $0.6 million and $0.9 million, respectively. Stock options The following table presents the weighted-average assumptions used to estimate the fair value of options granted in 2011, 2010 and 2009: 2011 Expected annual dividend... -

Page 52

... market price of the Company's stock at the date of the award. Compensation expense related to the restricted stock award was approximately $0.1 million in 2011, and $0.6 million in each of 2010 and 2009. As part of the settlement agreement (see Note 8 of Notes to Consolidated Financial Statements... -

Page 53

49 -

Page 54

... valuation allowances, net of federal tax benefit Foreign taxes at rates different from the U.S. rate Changes in valuation allowances Decrease in tax reserves Non-deductible items Adjustment for prior year taxes Other items, net Income tax at Federal statutory rate $ 2011 27,539 1,680 (893) (3,666... -

Page 55

... to pay amounts in excess of accruals, our effective tax rate in a given financial statement period could be affected. There were no accrued interest or penalty charges related to unrecognized tax benefits recorded in income tax expense in 2011 or 2010. As of December 31, 2011 the Company had... -

Page 56

... and Industrial Products. The Company's chief operating decision-maker is the Company's Chief Executive Officer. The Company evaluates segment performance based on income from operations before net interest, foreign exchange gains and losses, special (gains) charges and income taxes. Corporate costs... -

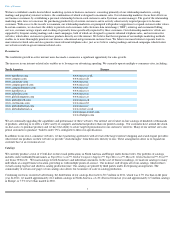

Page 57

...information relating to the Company's entity-wide product category sales was as follows (in thousands): Year Ended December 31, 2010 % 879.2 982.8 856.3 551.0 250.0 70.7 3,590.0 53 2011 Product Category: Computers $ Computer accessories & software Consumer electronics Computer components Industrial... -

Page 58

... 13. QUARTERLY FINANCIAL DATA (UNAUDITED) Quarterly financial data is as follows (in thousands, except for per share amounts): First Quarter Second Quarter Third Quarter Fourth Quarter 2011: Net sales Gross profit Net income Net income per common share: Basic Diluted 2010: Net sales Gross profit... -

Page 59

...Allowance for sales returns and doubtful accounts 2011 2010 2009 Allowance for deferred tax assets 2011 Current Noncurrent 2010 Current ...(1)(2) WStore opening balance sheet adjustment. (3) Included in other is allowances recorded for deferred tax assets and net operating losses acquired in the... -

Page 60

... Reporting Person. You agree to devote your full working time, attention and skill to the business and affairs of the Company and to use your best efforts to advance the best interests of the Company. The Employee shall perform his duties primarily at the Company's offices located in Miami, Florida... -

Page 61

...For the performance of all duties, responsibilities and services by the Employee hereunder during the Employment Period, the Company shall pay to the Employee, and the Employee agrees to accept, a base salary (the "Base Salary") at an annual rate of Seven Hundred Thousand Dollars ($700,000), payable... -

Page 62

... 100,000 shares of the Company's common stock (in accordance with the Company's 2010 Long Term Incentive Plan) (a) exercisable at an exercise price per share equal to the fair market value of a share of the Company's common stock as quoted on the NYSE at close of business on the date of grant... -

Page 63

... Section 2(j)) and meals while in the Miami vicinity on Company business and (iii) pay for your bi-weekly commuting between Miami, Florida and Minneapolis, Minnesota pursuant to the Company's travel and entertainment policy. In addition to the payments and benefits in clauses (i), (ii) and (iii) in... -

Page 64

... or for an aggregate of ninety (90) days within any consecutive six month period. The Employee's receipt of disability benefits under the Company's long-term disability plan, if any, or receipt of Social Security disability benefits shall be deemed conclusive evidence of Total Disability for purpose... -

Page 65

... current location (after giving effect to your relocation to reside near the Company's Miami, Florida offices). A termination by the Employee shall not be deemed for Good Reason unless the Employee has notified the Company in writing of his intention to terminate for Good Reason within 30 days of... -

Page 66

... of the applicable stock option agreement or applicable restricted stock agreement, respectively. In addition, the Company shall pay to the Employee that portion of the annual Bonus, on the date set forth herein, that is equal to the number of days the Employee was employed by the Company (based on... -

Page 67

...of the applicable stock option agreement or applicable restricted stock agreement, respectively. In addition, the Company shall pay to such designated person or the estate that portion of the annual Bonus, on the date set forth herein, that is equal to the number of days the Employee was employed by... -

Page 68

... or medical plan or other employee benefit plan or arrangement of the Company then in effect and provided further that any stock option or restricted stock held by the Employee shall be treated in accordance with the applicable stock option agreement or restricted stock agreement. The payment of any... -

Page 69

... Companies' internal operations. Such Confidential Information includes, but is not limited to: (i) financial and business information, such as information with respect to costs, commission, fees, profits, sales, markets, mailing lists, strategies and plans for future business, new business, product... -

Page 70

... the Reporting Person, directly or indirectly, own, manage, operate, control, consult with or be employed in a capacity similar to the position(s) held by Employee with the Company by any company or other for-profit entity engaged in the sale of computer, consumer electronic and industrial products... -

Page 71

... the Company immediately. The Employee agrees that he shall not disclose to the Company, use for the Company's benefit, or induce the Company to use any trade secret or confidential information he may possess belonging to any former employer or other third party. (h) Non-Disparagement and Protection... -

Page 72

..." Policy . The Employee may not use his position, influence, knowledge of Confidential Information and Trade Secrets or Company assets for personal gain, and you shall be subject in all respects to the Company's Code of Ethics and corporate governance policies, as amended from time to time. In... -

Page 73

...it is directed upon actual receipt by such party. Any notice which is addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, forty-eight hours after the day it is... -

Page 74

... such payments or other benefits shall be restructured, to the extent possible, in a manner determined by the Company that does not cause such acceleration or additional tax. All references in this Agreement to the termination of your employment shall mean your separation from service within... -

Page 75

... Agreement shall inure to the benefit of and be enforceable by, and may be assigned by the Company without your consent to, any affiliate or purchaser of all or substantially all of the Company's business or assets, any successor to the Company or any assignee thereof (whether direct or indirect, by... -

Page 76

EXHIBIT 10.19 Dated December___, 2011 MISCO UK LIMITED and PERMINDER DALE EXECUTIVE DIRECTOR'S SERVICE AGREEMENT -

Page 77

... or management, inclu (but not limited to) information relating to financial and business information (inclu information relating to costs, commissions, fees, profits and sales) rnarkets, mailing strategies, plans for future business, product or other development, potential acquisit new marketing... -

Page 78

...is made wholly or partially by the Employee at any time durin course of his employment with the Company (whether or not during working hou using premises or resources or the Company, and whether or not recorded in ma form). any period during which the Company has exercised its rights under clause 22... -

Page 79

...24 months before Termination, w customer or prospective customer of or was in the habit of dealing with the Compa any Group Company with whom the Employee had contact or about whom he be aware or informed in the course of his employment. anyone employed or engaged by the Company or any Group Company... -

Page 80

... as the Company or Group Company considers appropriate. The Employee shall report to the Chairman & CEO of Systemax Inc., which is the ultimate parent company of the Company. The Employee's direct reports shall initially be the General Managers of each of the companies comprising the Systemax Europe... -

Page 81

... provided for the use of the Employee by the Company, and any data or documents (including copies) produced, maintained or stored on the computer systems of the Company or other electronic equipment (including mobile phones), remain the property of the Company. 4.4 5 Place of work 5.1 The normal... -

Page 82

... or any Group Company as an officer of the Company or any Group Company). The salary paid to the Employee shall accrue from day to day and be payable monthly in arrears on or about the 1st of each month directly into his bank or building society. The salary paid to the Employee shall be reviewed by... -

Page 83

...as part of the basic salary for any purpose. Any car allowance payment shall not be pensionable. By way of an alternative to clause 11.1 the Employee may elect to drive a Company vehicle, which shall be a vehicle of such make, model and value as is determined by the Company for his sole business use... -

Page 84

... of any accidents involving the car (whether or not these take place while the Employee is on business); immediately inform the Company if he is convicted of a driving offence or disqualified from driving; and return the car, its keys and all documents relating to it to the HR Department or such... -

Page 85

...statutory sick pay due in accordance with applicable legislation in force at the time of absence. The Employee agrees to consent to medical examinations (at the expense of the Company) by a doctor nominated by the Company should the Company so require. The Employee agrees that any report produced in... -

Page 86

... time as the Company has agreed in writing that the Employee may offer them for sale to a third party. The Employee agrees: 18.4.1 18.4.2 to give the Company full written details of all Employment Inventions which relate to or are capable of being used in the business of any Group Company promptly... -

Page 87

... attorney to execute and do any such instrument or thing and generally to use his name for the purpose of giving the Company or its nominee the benefit of this clause 18. The Employee acknowledges in favour of a third party that a certificate in writing signed by any Director or the Secretary of the... -

Page 88

... payment in respect of benefits which the Employee would have been entitled to receive during the period for which the Payment in lieu is made; and any payment in respect of any holiday entitlement that would have accrued during the period for which the Payment in lieu is made. The Company may pay... -

Page 89

... false, disparaging or malicious statement (whether oral or written) about the Company or any Group Company or any of its or their directors, officers or employees; is guilty of a serious breach of any rules issued by the Company from time to time regarding its electronic communications systems; or... -

Page 90

...Company or any Group Company and The Company may require the Employee not to contact or deal with (or attempt to contact or deal with) any officer, employee, consultant, client, customer, supplier, agent, distributor, shareholder, adviser or other business contact of the Company or any Group Company... -

Page 91

... or services to that Restricted Customer in competition with any Restricted Business; or for twelve months after Termination in the course of any business concern which is in competition with any Restricted Business, offer to employ or engage or otherwise endeavour to entice away from the Company or... -

Page 92

... is subject to the disciplinary and grievance procedures of the Company, copies of which are available from the HR Manager from time to time. These procedures do not form part of the contract of employment of the Employee. If the Employee wants to raise a grievance, he may apply in writing to... -

Page 93

... provide products or services to the Company or any Group Company (such as advisers and payroll administrators), regulatory authorities, potential or future employers, governmental or quasi-governmental organisations and potential purchasers of the Company or the business in which the Employee works... -

Page 94

... banks are not open for business, deemed receipt is at 9.00 am on the next business day. 31.4 31.5 32 A notice required to be given by the Employee under this agreement shall not be validly given if sent by e-mail unless authorised by the Company. This clause does not apply to the service of any... -

Page 95

... date stated at the beginning of this agreement. Executed as a deed by MISCO UK LIMITED acting by RICHARD LEEDS a director, in the presence of: Signature of witness Name Address Occupation Signed as a deed by PERMINDER DALE in the presence of: Director Employee Signature of witness Name Address... -

Page 96

... WAIVER TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT This AMENDMENT NO. 1 AND WAIVER dated as of December 15, 2011 (this "Amendment") is made by and among SYSTEMAX INC., a corporation organized under the laws of the State of Delaware ("SYX"), each US Borrower listed on the signature pages below... -

Page 97

... no further duties or obligations under the Credit Agreement or other Loan Documents. Upon the occurrence of the Amendment No. 1 Effective Date, (x) all liens and security interests granted by UK Borrower to UK Administrative Agent for the benefit of the UK Lenders shall be automatically released... -

Page 98

...No. 1. " New Subsidiary " shall mean each of Global Industrial Holdings LLC, a Delaware limited liability company, SYX North American Tech Holdings LLC, a Delaware limited liability company, Rebate Holdings LLC, a Delaware limited liability company, SYX S.A. Holdings Inc., a Delaware corporation and... -

Page 99

(c) The definition of Applicable Rate in Section 1.01 of the Credit Agreement is hereby amended by amending the grid contained therein in its entirety to provide as follows: Trailing Quarterly Borrowing Base Availability Category 1 Less than $40,000,000 Category 2 $40,000,000 or more but less than $... -

Page 100

... as its principal depository bank, including for the maintenance of operating, administrative, cash management, collection activity, and other deposit accounts for the conduct of its business." (o) Section 5.16(a) of the Credit Agreement is hereby amended by deleting the reference therein to "if... -

Page 101

... is not a Loan Party incurred in the ordinary course of business to finance the acquisition of inventory (whether or not constituting a purchase money Indebtedness); provided that such Indebtedness is incurred prior to or within 30 days after such acquisition; and (q) Indebtedness of any Subsidiary... -

Page 102

... such article: "6.17 Holding Companies . Notwithstanding anything to the contrary contained in this Agreement, none of Global Industrial Holdings LLC, SYX North American Tech Holdings LLC, Rebate Holdings LLC, SYX S.A. Holdings Inc. or SYX S.A. Holdings II Inc. will engage in any business or own any... -

Page 103

...financial institution holding a deposit account of such Grantor as set forth in this Security Agreement, provided that (i) no DACA shall be required with respect to deposit accounts for retail store locations...any event not later than ten (10) Business Days following the date on which Misco UK Limited... -

Page 104

... under the laws of Puerto Rico or a province of Canada which are pledged to US Administrative Agent pursuant to the Security Agreement, together with the corresponding original stock or membership power executed in blank by not later than the earlier of (x) five (5) days following the issuance of... -

Page 105

...Letters of Credit; (c) payment in full... Schedule 8(c) hereto; (d) resolutions of the governing ...New Subsidiary and any other documents or information reasonably requested by US Administrative Agent with respect thereto; (h) stock or membership certificates (if any), as applicable, together with stock... -

Page 106

...be deemed to be an original signature hereto. 11. Governing Law . THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE INTERNAL LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND PERFORMED IN SUCH STATE WITHOUT REGARD TO THE PRINCIPLES THEREOF REGARDING CONFLICTS OF... -

Page 107

...INC. By: Name: Title: SYSTEMAX MANUFACTURING INC. GLOBAL COMPUTER SUPPLIES INC. GLOBAL EQUIPMENT COMPANY INC. TIGERDIRECT, INC. NEXEL INDUSTRIES, INC. MISCO AMERICA INC. ONREBATE.COM INC. PAPIER CATALOGUES, INC. TEK SERV INC. PROFIT CENTER SOFTWARE INC. GLOBAL GOV/ED SOLUTIONS INC. GLOBAL GOVERNMENT... -

Page 108

UK Borrower MISCO UK LIMITED By: Name: Title: -

Page 109

New Subsidiaries GLOBAL INDUSTRIAL HOLDINGS LLC SYX NORTH AMERICAN TECH HOLDINGS LLC REBATE HOLDINGS LLC SYX S.A. HOLDINGS INC. SYX S.A. HOLDINGS II INC. By: Name: Title: -

Page 110

JPMORGAN CHASE BANK, N.A., as US Administrative Agent and as a Lender By: Name: Donna M. DiForio Title: Authorized Officer J.P. MORGAN EUROPE LIMITED, as UK Administrative Agent and as a Lender By: Name: Title: -

Page 111

HSBC BANK USA, N.A., as a Lender By: Name: Title: WELLS FARGO CAPITAL FINANCE, LLC, as a Lender By: Name: Title: -

Page 112

Exhibit B See attached. Exhibit B - 1 -

Page 113

Exhibit G-1 See attached Exhibit G-1 -

Page 114

EXHIBIT G-2 See attached EXHIBIT G-2 -

Page 115

Schedule 1(a) Commitment Schedule Lender JPMorgan Chase Bank, N.A. HSBC Bank USA, N.A. Wells Fargo Capital Finance, LLC TOTAL Schedule 1(a) - 1 US Revolving Commitment $ $ $ $ 50,000,000 40,000,000 35,000,000 125,000,000 -

Page 116

... Fees: Amount Due in GBP(2) Per diem for each day after December 15th: Commitment Fee: Letter of Credit Fees: (1) Wire Instructions for US Dollars: To For A/C# Attn JPMorgan Chase Bank, New York (CHASUS33) J.P. Morgan Europe Limited (CHASGB22) 544714108 Loans & Agency Ridwana $ 242.59 GBP 63.75... -

Page 117

... Inc., SYX Distribution Inc., Streak Products Inc., CompUSA Retail Inc., TigerDirect, Inc., Software Licensing Center Inc., Global Computer Supplies Inc., CompUSA.com Inc., Target Advertising Inc., SYX Services Inc., Tek Serv Inc., Misco America Inc. and Systemax Puerto Rico Inc. from SYX to SYX... -

Page 118

..., Industries Inc., Profitcenter Software Inc., Global Government & Education Inc. and Papier Catalogues, Inc. from SYX to Global Industrial Holdings LLC. The transfer of the ownership of the Equity Interests of Worldwide Rebates Inc. and Onrebate.com Inc. from SYX to Rebate Holdings LLC. Schedule... -

Page 119

... Computer Supplies Inc. (a New York corporation) Global Equipment Company Inc. (a New York corporation) TigerDirect Inc. (a Florida corporation) Nexel Industries Inc. (a New York corporation) Systemax Manufacturing Inc. (a Delaware corporation) Profit Center Software Inc. (a New York corporation... -

Page 120

... company) SYX S.A. Holdings Inc. (a Delaware corporation) SYX S.A. Holdings II Inc. (a Delaware corporation) Foreign Subsidiaries Misco UK Limited (a U.K. corporation) TigerDirect.ca Inc. (a Canadian corporation) Global Industrial Canada Inc. (a Canadian corporation) Misco Italy Computer Supplies... -

Page 121

...to the consolidated financial statements and schedule of Systemax Inc., and the effectiveness of internal control over financial reporting of Systemax Inc. included in this Annual Report (Form 10-K) of Systemax Inc. for the year ended December 31, 2011. /s/ Ernst & Young LLP New York, New York March... -

Page 122

... CERTIFICATION OF CHIEF EXECUTIVE OFFICER I, Richard Leeds, certify that: 1. I have reviewed this annual report on Form 10-K of Systemax Inc. (the "registrant"); 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary... -

Page 123

...2002 CERTIFICATION OF CHIEF FINANCIAL OFFICER I, Lawrence P. Reinhold, certify that: 1. I have reviewed this annual report on Form 10-K of Systemax Inc. (the "registrant"); 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact... -

Page 124

...Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained in such Form 10-K fairly presents, in all material respects, the financial condition and results of operations of Systemax Inc. Dated: March 8, 2012 /s/ RICHARD LEEDS... -

Page 125

...Chief Financial Officer of Systemax Inc., hereby certifies that Systemax Inc.'s Form 10-K for the Year Ended December 31, 2011 fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78 (o)(d)) and that the information contained...