Comfort Inn 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Friendly: The Company’s entire investment in Friendly was written off in 2001, accordingly, the

Company’s 2002 results of operations do not include any equity method losses or other amounts related to

Friendly. In addition to the $22.7 million impairment described below, the Company recorded equity method

losses associated with its investment in Friendly totaling $10.3 million (net of tax) for the year ended

December 31, 2001.

On February 21, 2002, Friendly announced that it had been unable to find an acceptable buyer for its

business and would terminate such efforts at that time. Given the bid period termination and the adverse

economic conditions of Friendly, the Company disposed of its entire preferred and common equity interest in

Friendly on March 20, 2002, and immediately relinquished its three seats on Friendly’s board of directors.

Accordingly, the Company reduced its investment in Friendly to zero through a $22.7 million charge to reflect

the permanent impairment of this asset as of December 31, 2001.

Interest and Other: Interest expense of $13.1 million in the year ended December 31, 2002 is down

$2.3 million from $15.4 million in the year ended December 31, 2001 due primarily to lower effective interest

rates. The Company’s weighted average interest rate as of December 31, 2002 was 4.39% compared to 4.52% as

of December 31, 2001. Included in the results for 2002 and 2001 is approximately $4.6 million and $4.2 million,

respectively, of interest income earned on the note receivable from Sunburst. The note from Sunburst accrued

interest up until June 2002, at which point interest became payable semi-annually in arrears. As of December 31,

2002, the Company’s balance sheet includes an interest receivable from Sunburst of $2.3 million which is

included in other current assets in the accompanying consolidated balance sheets and was paid to the Company

by Sunburst in January 2003.

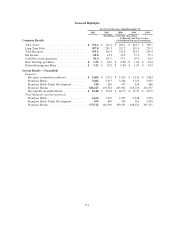

Comparison of 2001 Operating Results and 2000 Operating Results

The Company recorded net income of $14.3 million for the year ended December 31, 2001, a decrease of

$28.1 million, compared to net income of $42.4 million for the year ended December 31, 2000. Operating

income of $73.6 million in 2001 was $18.8 million less than 2000 operating income of $92.4 million due to an

impairment charge of $22.7 million associated with the Company’s investment in Friendly. Net income for 2001

was further adversely affected by a $10.3 million equity loss (net of taxes) in Friendly. The Friendly equity loss

was due to mid-year adverse fixed asset valuation adjustments due to a decline in economic conditions and other

incremental professional fees associated with Friendly’s continuing restructuring program.

F-7