Comfort Inn 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on the present value of expected future cash flows, discounted at the loan’s effective interest rate. The Company

did not record any impairment charges related to notes receivable during the years ended December 31, 2002 or

2001. During the year ended December 31, 2000, the Company recorded $7.6 million of impairment losses

related to its subordinated term note to Sunburst Hospitality Corporation (see Note 7).

Stock Compensation

The Company accounts for its stock-based employee compensation plans in accordance with the provisions

of Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees,” and

related interpretations. As such, compensation expense related to fixed employee stock options is recorded only

if on the date of grant the fair value of the underlying stock exceeds the exercise price. The Company adopted the

disclosure only requirements of SFAS No. 123, “Accounting for Stock-Based Compensation,” which allows

entities to continue to apply the provisions of APB Opinion No. 25 for transactions with employees and to

provide pro forma net income disclosures as if the fair value based method of accounting, described in SFAS No.

123 had been applied to employee stock option grants.

Effective January 1, 2003, the Company adopted, in accordance with SFAS No. 148, “Accounting for

Stock-Based Compensation—Transition and Disclosure,” the fair value based method of accounting for stock

option awards granted on or after January 1, 2003.

Comparison of 2002 Operating Results and 2001 Operating Results

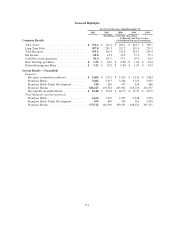

The Company recorded net income of $60.8 million for the year ended December 31, 2002, an increase of

$46.5 million from net income of $14.3 million for the year ended December 31, 2001. Net income in 2001

included an impairment charge of $22.7 million associated with the Company’s determination to write-off its

entire investment in Friendly Hotels PLC (currently known as C.H.E. Group PLC) (“Friendly”). Net income for

2001 also reflects $10.3 million of equity losses (net of taxes) in Friendly.

F-4