Comfort Inn 2002 Annual Report Download - page 14

Download and view the complete annual report

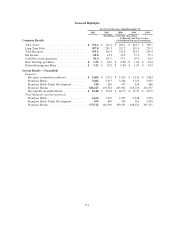

Please find page 14 of the 2002 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The number of domestic rooms on-line increased to 282,423 from 270,514, an increase of 4.4% for the year

ended December 31, 2002. For 2002, the total number of domestic hotels on-line grew 4.7% to 3,482 from 3,327

for 2001. International rooms on-line decreased slightly to 91,299 as of December 31, 2002 from 92,035 as of

December 31, 2001, a decrease of 0.8%. The total number of international hotels on-line decreased to 1,182 from

1,218, a decrease of 3.0% for the year ended December 31, 2002. The decrease in international hotels online is

primarily due to termination of certain Flag properties which failed to maintain the Company’s brand standards

or which declined to formalize a franchise relationship following the Company’s acquisition of a controlling

interest in Flag Choice Hotels during 2002. As of December 31, 2002, the Company had 310 franchised hotels

with 23,766 rooms either in design or under construction in its domestic system. The Company has an additional

164 franchised hotels with 17,799 rooms under development in its international system as of December 31, 2002.

Franchise Expenses: The cost to operate the franchising business is reflected in selling, general and

administrative expenses. Selling, general and administrative expenses were $54.9 million for the year ended

December 31, 2002, a decrease of $1.2 million from the year ended December 31, 2001 total of $56.1 million. As

a percentage of net franchise revenues, selling, general and administrative expenses declined to 31.9% in 2002

from 33.0% in 2001. This decline, which increased franchising margins from 67.0% to 68.1%, was largely due to

reductions in selling, general and administrative expenses resulting from the Company’s 2001 and 2000

restructurings.

Marketing and Reservations: The Company’s franchise agreements require the payment of franchise fees

which include marketing and reservation fees. These fees, which are based on a percentage of the franchisees’

gross room revenues, are used exclusively by the Company for expenses associated with providing franchise

services such as central reservation systems, national marketing and media advertising. The Company is

contractually obligated to expend the marketing and reservation fees it collects from franchisees in accordance

with the franchise agreements; as such, no income or loss to the Company is generated.

Total marketing and reservation revenues were $190.1 million and $168.2 million for the years ended

December 31, 2002 and 2001, respectively. Depreciation and amortization attributable to marketing and

reservation activities was $13.0 million and $11.8 million for the years ended December 31, 2002 and 2001,

respectively. Interest expense attributable to reservation activities was $1.4 million and $2.0 million for the years

ended December 31, 2002 and 2001, respectively. Marketing and reservation activities provided a positive cash

flow of $17.2 million and $20.3 million for the years ended December 31, 2002 and 2001, respectively. As of

December 31, 2002 and 2001, the Company’s balance sheet includes a receivable of $44.9 million and

$49.4 million, respectively, for marketing and reservation fees. The Company has the contractual authority to

require that the franchisees in the system at any given point repay the Company for any deficits related to

marketing and reservation activities. The Company’s current franchisees are legally obliged to pay any

assessment the Company imposes on its franchisees to obtain reimbursement of such deficit regardless of

whether those constituents continue to generate gross room revenue. The Company has no present intention to

accelerate repayment of the deficit from current franchisees.

Hotel Operations: In September 2000, the Company received title to three MainStay properties from

Sunburst Hospitality Corporation (“Sunburst”) as consideration for $16.3 million of the then $149 million

amount due under a note receivable from Sunburst. Revenues from hotel operations were $3.3 million and

$3.2 million for the years ended December 31, 2002 and 2001, respectively. Selling, general and administrative

expenses from hotel operations were $2.9 million and $2.5 million for those years, respectively.

Depreciation and Amortization: Depreciation and amortization decreased to $11.3 million in the year ended

December 31, 2002 from $12.5 million in the year ended December 31, 2001. This decrease is primarily

attributable to the Company’s adoption of Statement of Financial Accounting Standards No. 142, “Goodwill and

Other Intangible Assets”, pursuant to which the Company stopped amortizing goodwill effective January 1, 2002.

F-6