Cogeco 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (MD&A) COGECO CABLE INC. 2011 19

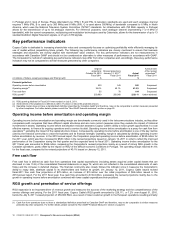

Consolidated statements of retained earnings

(In thousands of dollars) Note

August 31,

2011

September 1,

2010

Retained earnings under Canadian GAAP 40,876 123,025

Preliminary IFRS adjustments:

Property, plant and equipment i. (671 ) (4,235)

Employee benefits ii. (3,074 ) (3,277)

Share-based payments iii. (841) (956)

Impairment of assets iv. – –

Intangible assets v. 43,229 43,229

Business combinations vi. (13,719) (11,529)

Financial instruments: recognition and measurement vii. – –

Borrowing costs viii. 403 –

Income taxes ix. (41,020) (41,020)

Provisions, contingent liabilities and contingent assets x. – –

Effects of changes in foreign exchange rates xi. – –

Preliminary equity under IFRS 25,183 105,237

i. IAS 16 – Property, plant and equipment:

IFRS requires that each significant component of an asset be depreciated separately. The Corporation will apply IAS 16 retroactively

to all items of property, plant and equipment. The impact of the retroactive application on the Corporation’s opening IFRS balance

sheet at the date of transition will reduce fixed assets by an amount of approximately $5.7 million, reduce future income tax liabilities

by an amount of $1.5 million and reduce retained earnings by an amount of approximately $4.2 million. For fiscal 2011, amortization

expense under IFRS would have been $4.8 million lower than the amount recorded under Canadian GAAP.

ii. IAS 19 – Employee benefits:

IAS 19 requires an entity to recognize the expense related to past service cost on an accelerated basis compared to Canadian

GAAP. Furthermore, IAS 19 allows an entity a policy choice for the recognition of actuarial gains and losses on defined benefit

pension plans. One of these choices permits the immediate recognition of actuarial gains and losses as a component of other

comprehensive income, which was not permitted under Canadian GAAP.

The Corporation has elected to recognize actuarial gains and losses immediately as a component of other comprehensive income.

The impact of this policy choice will depend on the future fluctuations in market interest rates and actual returns on plan assets. In

addition, at the date of transition, the IFRS 1 optional election described above will result in an increase in pension plan liabilities and

accrued employee benefits of approximately $4.4 million, an increase in future income tax assets of $1.2 million and a decrease in

opening retained earnings of approximately $3.3 million. For fiscal 2011, operating costs related to pension plans under IFRS would

have been $0.3 million lower than the amount recorded under Canadian GAAP.

iii. IFRS 2 – Share-based payments:

IFRS 2 requires the graded-vesting method for the recognition of stock-based compensation awards, while Canadian GAAP

permitted the straight-line method. IFRS 2 also requires that an entity measure cash-settled stock-based payments at their fair value

based on an option pricing model.

The requirement to use the graded-vesting method for the recognition of stock-based compensation awards will result in an

accelerated recognition of the expense for the Corporation. At the date of transition to IFRS, and reflecting the IFRS 1 exemption

described above, this difference in accounting policies will result in an increase in contributed surplus by an amount of approximately

$1.4 million (equity settled employee compensation reserve in the Corporation’s IFRS financial statements), an increase in accounts

receivable of $0.4 million and a decrease in opening retained earnings of $1 million. As a result of this adjustment, operating costs

related to stock-based plans for fiscal 2011 would have been slightly lower under IFRS than under Canadian GAAP.