Cogeco 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 COGECO CABLE INC. 2011 Management’s Discussion and Analysis (MD&A)

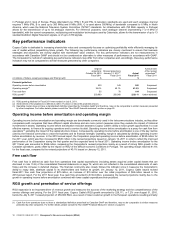

Reconciliation of Canadian GAAP to IFRS

The Corporation has completed the evaluation of the differences between IFRS and Canadian GAAP. The preliminary financial statement

impacts of the most significant differences in accounting policies adopted on and after transition to IFRS with respect to the recognition,

measurement, presentation and disclosure of financial information are as follows:

Consolidated statement of income (loss) for the year ended August 31, 2011

(In thousands of dollars, except per share data) Note

Canadian

GAAP

Preliminar

y

IFRS

adjustments

Preliminary

IFRS

Revenue

Service 1,350,352 (4,206) 1,346,146

Equipment 10,814 – 10,814

1,361,166 (4,206) 1,356,960

Operating costs ii., iii., vi. 786,011 (2,275) 783,736

Management fees – COGECO Inc. 9,172 – 9,172

Operating income before amortization 565,983 (1,931) 564,052

A

mortization i. 247,178 (4,805) 242,373

Operating income 318,805 2,874 321,679

Financial expense viii. 71,629 (541) 71,088

Impairment of goodwill and fixed assets 225,873 – 225,873

Income before income taxes 21,303 3,415 24,718

Income taxes i., ii., vi., viii. 68,969 1,320 70,289

Net income (loss) (47,666) 2,095 (45,571)

Earnings (loss) per share

Basic (0.98) 0.04 (0.94)

Diluted (0.98) 0.04 (0.94)

Consolidated statement of comprehensive income (loss) for the year ended August 31, 2011

(In thousands of dollars) Note

Canadian

GAAP

Preliminar

y

IFRS

adjustments

Preliminar

y

IFRS

Net income (loss) (47,666) 2,095 (45,571)

Other comprehensive income (loss)

Unrealized losses on derivative financial instruments designated as cash flow hedges, net of income

tax recovery (15,353) – (15,353)

Reclassification to financial expense of unrealized losses on derivative financial instruments

designated as cash flow hedges, net of income tax recovery 14,425 – 14,425

Unrealized gains on translation of a net investment in self-sustaining foreign subsidiaries 7,248 – 7,248

Unrealized losses on translation of long-term debts designated as hedges of a net investment in self-

sustaining foreign subsidiaries (3,903) – (3,903)

A

ctuarial losses on defined benefit plans ii. – (1,968 ) (1,968)

2,417 (1,968 ) 449

Comprehensive income (loss) (45,249) 127 (45,122)