Cogeco 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

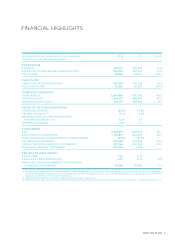

FINANCIAL HIGHLIGHTS

(in thousands of dollars, except rates of return and ratios, 2006 2005 CHANGE

customers, per share data and percentages) $ $ %

OPERATIONS

REVENUE 620,001 554,404 11.8

OPERATING INCOME BEFORE AMORTIZATION(1) 252,978 227,521 11.2

NET INCOME 65,556 28,721 128.3

CASH FLOW

CASH FLOW FROM OPERATIONS(1) 194,739 170,938 13.9

FREE CASH FLOW(1) 30,293 45,267 (33.1)

FINANCIAL CONDITION

TOTAL ASSETS 2,602,603 1,755,796 48.2

INDEBTEDNESS(2) 1,316,977 692,481 90.2

SHAREHOLDER’S EQUITY 745,191 689,484 8.1

RATES OF RETURN AND RATIOS

OPERATING MARGIN(1) 40.8% 41.0%

RETURN ON EQUITY(1) 9.1% 4.2%

INDEBTEDNESS ON OPERATING INCOME

BEFORE AMORTIZATION 5.2(3) 3.0

INTEREST COVERAGE 4.4(3) 4.1

CUSTOMERS

RGU 2,184,977 1,347,733 62.1

BASIC SERVICE CUSTOMERS 1,102,871 821,433 34.3

PENETRATION AS A PERCENTAGE OF HOMES PASSED 47.9% 56.7%

HSI SERVICE CUSTOMERS 479,358 277,648 72.6

DIGITAL TELEVISION SERVICE CUSTOMERS 327,364 247,204 32.4

TELEPHONY SERVICE CUSTOMERS 275,384 1,448 —)

PER SHARE DATA (BASIC)

NET INCOME 1.64 0.72 —)

CASH FLOW FROM OPERATIONS 4.87 4.28 13.8

WEIGHTED AVERAGE NUMBER OF OUTSTANDING

SHARES (IN THOUSANDS) 39,990 39,965 0.1

(1) THE INDICATED TERMS ARE NOT DEFINED UNDER CANADIAN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP) AND MAY NOT BE COMPARABLE

TO OTHER MEASURES PRESENTED BY OTHER COMPANIES. REFER TO PAGES 10, 11 AND 32 OF THE MANAGEMENT’S DISCUSSION AND ANALYSIS FOR A

DETAILED DESCRIPTION OF NON-GAAP MEASURES.

(2) INDEBTEDNESS IS DEFINED AS BANK INDEBTEDNESS PLUS LONG-TERM DEBT.

(3) FOR FISCAL YEAR 2006, THE RATIO INCLUDES THE FINANCIAL RESULTS FOR A ONE-MONTH OPERATION PERIOD OF CABOVISÃO – TELEVISÃO POR CABO, S.A.

FINANCIAL HIGHLIGHTS

COGECO CABLE INC. 2006 3