Cogeco 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10 COGECO CABLE INC. 2006 Management’s Discussion and Analysis

PORTUGAL

The Corporation provides its cable services in Portugal through state-of-the-art 750 MHz broadband distribution networks.

Cabovisão, Cogeco Cable’s subsidiary in Portugal, fully owns its distribution networks, headends and drops. Digital and

VOD services are not currently offered but are planned for launch progressively over the coming years. As in Canada HSI

service using fully certifi ed DOCSIS technology is offered to 100% of homes passed and served by a two-way cable plant.

Telephony service is also offered to 100% of homes passed, initially through the use of proprietary network interface units

(NIU), and more recently with standard based embedded multimedia terminal adapters (e-MTA). Cabovisão currently uses

class-5 circuit switches and will be deploying class-5 advanced softswitches in the near term. Cabovisão’s intercity fi bre

optic network extends to over 1,811 kilometres and includes 173,856 kilometres of optical fi bre. Cabovisão has deployed

optical fi bre to nodes serving clusters of typically 1,215 homes passed, with many fi bres per node in most cases, which

allows the Corporation to further extend the fi bre plant to smaller clusters of 500 homes rapidly with relative ease if and

when necessary. Node splitting leads to further improvement in the quality and reliability of the network and of services

and allows for increasing traffi c of two-way services such as HSI and Telephony.

Cabovisão has implemented an infrastructure with 750 MHz capacity essentially in all its systems. In Portugal and in most

of Europe, PAL B and PAL G (Phase Alternated Line) television standards are used and each analog channel requires

7 MHz (PAL B is used up to 300 MHz) and 8 MHz (PAL G is used above 300 MHz) of bandwidth compared to 6 MHz in

North America, which uses the NTSC (National Television System Committee) standards. An infrastructure with 750 MHz

capacity in Portugal allows for the transmission of up to 83 analog channels.

KEY PERFORMANCE INDICATORS

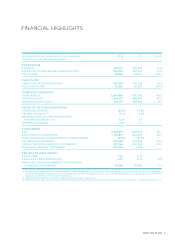

Cogeco Cable is dedicated to increasing shareholder value and consequently focuses on optimizing profi tability while

effi ciently managing its use of capital without jeopardizing future growth. The following key performance indicators are

closely monitored to ensure that business strategies and objectives are closely aligned with shareholder value creation.

The key performance indicators are not measurements in accordance with Canadian GAAP and should not be considered

an alternative to other measures of performance in accordance with GAAP. The Corporation’s method of calculating key

performance indicators may differ from other companies and, accordingly, these key performance indicators may not be

comparable to similar measures presented by other companies.

RETURN ON EQUITY

Return on equity is defi ned as net income divided by average shareholders’ equity (computed on the basis of the beginning

and ending balance for a given fi scal year). Return on equity measures the Corporation’s effectiveness in generating net

income on a given capital base from our shareholders. Cogeco Cable’s key goal in the coming years is to achieve a return

on equity of 10%.

OPERATING INCOME BEFORE AMORTIZATION GROWTH AND OPERATING MARGIN

Operating income before amortization excludes unusual items that are non-recurring revenue or expense items such as

restructuring charges. Operating margin is calculated by dividing operating income before amortization with revenue. Operating

income before amortization growth and operating margin are benchmarks commonly used in the telecommunications

industry, as they allow comparisons with companies that have different capital structures and are more current measures

since they exclude the impact of historical investments in assets. Operating income before amortization indicators assess

Cogeco Cable’s ability to seize growth opportunities in a cost effective manner, to fi nance its ongoing operations, and

to service its debt. Operating income before amortization is a proxy for cash fl ow generated from operations excluding the

impact of the capital structure chosen. Consequently, operating income before amortization is one of the key metrics used

by the fi nancial community to value the business and its fi nancial strength.