Cogeco 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Customer retention and increased

penetration of higher margin digital

and HSI services

Minimizing customer churn(1) reduces installation and

acquisition costs to win back customers. Our market research

reveals that customers are overwhelmed by the product offerings

available in the market place and that comparison between

competing services is difficult. Customers change service

providers primarily based on their value perceptions of competing

services. Therefore, efforts planned for fiscal 2004 to improve

our brand credentials include: more targeted and simplified

advertising campaigns, an enhanced customer retention strategy,

a heightened focus on superior execution at all customer contact

points and a continued investment in consumer research and

segmentation activities.

Improving our brand credentials should lead to greater

customer retention and increased penetration of digital and

HSI services. Increasing average revenue per customer results

in greater profitability since a portion of operating costs per

customer is fixed. To further maximize this profitability, Cogeco

Cable focuses on selling higher margin services. The strategy

for basic cable services is to defend the customer base and

grow penetration opportunistically. The plan of action for digital

services is to grow the digital base through customer acquisitions

and migration from the basic customer base. As well, we focus

on increasing the value per digital customer by upselling services

such as VOD. The strategy for HSI is to focus on the more

profitable HSI Standard and Pro segments of the market.

Currently, HSI Lite is only offered on a retention basis.

New and value added bundles

In line with its objective of offering customers more

choices at affordable prices, Cogeco Cable is in the process of

launching new services including:

• Smaller and more affordable digital theme packs in Québec

to better respond to the French language market demand.

• Increased flexibility in combining digital pick packs with

theme packs in Ontario. This change provides increased

choice as the customer selects his preferred channels

when ordering a pick pack.

• Additional enhancements to residential and commercial

HSI services.

• Digital terminals with PVR functionality and HDTV

tuning capability. The transmission of HDTV programming

is also planned for the Fall.

Retail rate increases

While broadcasting distribution and HSI services remain

fiercely competitive, management anticipates that the trend

towards rising and more consistent retail pricing will continue

in years to come as distribution undertakings are usually focusing

on fully recovering costs and improving balance sheets as opposed

to buying market share. Management believes this will provide

further opportunities for rate increases while keeping service

pricing competitive and reasonably affordable to customers.

Greater productivity through

continued process improvement

and cost control measures

Cogeco Cable intends to pursue process improvement

initiatives and tight expense control. We are continuously striving

to negotiate new sub-contractor, network affiliation, Internet

Protocol (IP) transport and other supplier agreements at lower

prices. We are constantly reviewing our processes to deliver a

higher quality service while achieving cost savings. The sections

“Operating Costs and Management Fees” and “Fiscal 2004

Financial Guidelines” discuss key initiatives implemented

by Cogeco Cable.

Targeted reductions in capital and

operating expenditures based on market

and consumer segment priorities

A capital committee, which includes the President and

CEO as well as certain Vice-Presidents, was established to review

investment strategy and capital allocation. Projects aligned with

our strategy and providing acceptable return on investment are

generally prioritized. Return on investment is assessed giving

consideration to expected incremental costs and revenue as well

as cost savings. Those analyses are completed on a case by

case basis and per system where applicable.

External growth through

attractively priced acquisitions

Cogeco Cable continues to seek out attractively priced

acquisitions of cable systems adjacent to its current geographical

coverage.

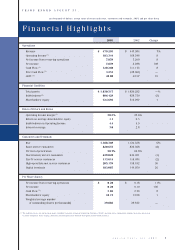

Successful implementation of the above strategic

imperatives will lead to improved profitability and reduced

Indebtedness as measured by the following financial metrics.

These metrics are discussed in more detail in the “Fiscal 2004

Financial Guidelines” section:

Cogeco Cable Inc. 2003 7

(1) Customer churn is defined as basic service disconnects during a period divided

by basic service customers at the beginning of the period.