Cogeco 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MESSAGE TO SHAREHOLDERS

this problem, will be the defining factor in dealing effectively

with this illicit market segment. Decisive and sustained action is

required as black and blue markets are harmful to the Canadian

programming and distribution industries. In the interim, we must

plan while keeping in mind that major progress on this front may

require yet more time. Cogeco Cable actively enforces the

security of its network on an ongoing basis.

We continue to examine all aspects of our operations

to increase our efficiency in delivering our services at the lowest

possible cost. Since the year 1998, all our services have been billed

on a single invoice in most of the areas we serve. We continue to

seek more balanced affiliation terms with all program suppliers.

A number of Canadian program services, licensed during the first

rounds of specialty service licensing in Canada, which are now

very successful, well entrenched in the Canadian market and

controlled by large integrated broadcasting groups, continue

to benefit from protective regulatory measures that are no

longer justified. This has created a major imbalance between

programming services and broadcasting distribution services.

Whereas the distribution sector is extremely competitive and

exposed to market risk and consequently yields suboptimal

returns on investment, the Canadian programming sector is

protected by regulation from competition and market risk, and

enjoys superior returns on investment. This imbalance must be

addressed by the regulator, and we will continue to press for

prompt corrective action in this regard.

As the Telephone and Cable industries, including their

respective direct-to-home satellite services, compete, Canadian

consumers have a unique opportunity to enjoy advanced video

and Internet services of the highest quality and fast-paced

innovation unparalleled anywhere in the world. As competitors,

it is our duty to build the quality of life of our customers

first and foremost.

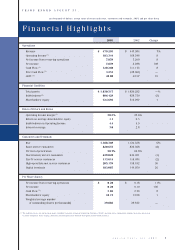

From an investment standpoint, we have been on a plan

to gradually reduce the sum of capital expenditures and deferred

charges as our network approaches its optimal state of being

87% two-way and broadband, in line with market potential,

with broadband being defined as 550 MHz and higher. The sum

of capital expenditures and deferred charges has come down

from a peak of $195 million in fiscal 2000 to $117 million this

year, slightly under generated Cash Flow of $120 million, thus

explaining the first occurrence of positive Free Cash Flow,

since fiscal 1996, of $3 million.

This pattern is attributable to two fundamental trends.

First, the sophistication of digital compression and multiplexing

techniques provides for greater carrying capacity in our existing

networks. This, in turn, reduces the need for further rebuild

activity, thus limiting capital expenditures. Second, with the

advent of the low cost Motorola DCT-700 all digital terminal

(around $100 CDN), more people will have access to our digital

services including VOD with lower terminal costs and much

reduced terminal-related deferred charges on Cogeco Cable’s

balance sheet! As a result, more people will be in a position

to use VOD and consume sophisticated digital services.

Management is currently analyzing a scenario to reap

bandwidth in an all-digital conversion scenario. This avenue,

while complex, appears promising.

As we continue to work on improving our Operating

Income margins and reducing our capital expenditures and

deferred charges, net earnings and Free Cash Flow should

continue to increase nicely. Our balance sheet continues to

improve as our ratio of Indebtedness to Operating Income

has been reduced from 4.9 to 4.4 at August 31, 2003.

We continue on our mission to tap a greater share of

the discretionary spending of the customers we serve, on home

information, entertainment and communications, adding more

services on top of basic video, such as digital services, including

VOD, and high-speed Internet. As regards telephony, we are still

on the lookout for an appropriate low capital cost solution on the

market with sufficient customer appeal. However, we have no

specific plans to launch cable telephony at this point in time, as

this solution and more workable regulatory interconnection rules

have not been forthcoming. The strength and sophistication of the

cable platform make it unparalleled in its ability to offer the full

bundle of complex services, interactive in real time, such as VOD

and eventually video telephony at attractive consumer prices,

on a single bill and, of course, a single wire. On our journey to

quadruple revenue in the medium term, the ARPU has risen

10.2% due to sales of high-speed Internet and digital services,

to reach $48 for fiscal year 2003. Cogeco Cable continues to

4Cogeco Cable Inc. 2003

We continue to examine

all aspects of our operations

to increase our efficiency in

delivering our services at the

lowest possible cost.