Cogeco 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

considered satisfactory and contract negotiations are proceeding

in the normal course of business.

Information Systems

The Corporation has concluded a new agreement

commencing on September 1, 2003 for the continued use and

maintenance of the customer management system used in Ontario

and supplied by DST Innovis. The Corporation will continue to use

a different customer management platform in Québec and has

implemented substantial changes separately to that platform

rather than taking an integrated systems approach. These

developments bring more certainty and predictability of costs

to the customer management function in the medium term.

The current IT environment, combined with the extensive

reliance of the Corporation on its information systems for the

conduct of its activities and operation of its business, involves

significant risks of data loss and business interruption in the

event of major disasters, terrorist action, unauthorised access,

or malicious tampering. Insurance undertakers no longer provide

coverage for these risks under the existing insurance programs,

which are managed through internal controls, security and

disaster recovery plans and procedures. There is no assurance

that these plans and procedures will effectively prevent or limit

loss of data or business interruption in a particular event, or

that data or business recovery will take place as planned.

Labour Relations

The collective agreements in the Québec Division expired

on December 31, 2002, and negotiations for renewal terms are

under way. Approximately 27% of the Corporation’s aggregate

workforce is covered by these collective agreements. While labour

relations are considered satisfactory and negotiations are

progressing in the normal course, the impact of renewal terms will

not be known until negotiations are concluded. Management does

not expect any labour disruptions at this time. There are no

collective agreements in the Ontario Division.

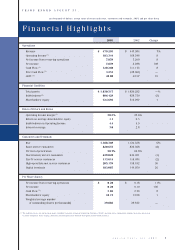

(2) Performance Highlights

In fiscal 2003, Cogeco Cable exceeded most of its financial

and customer additions objectives.

Customer Statistics

Basic service customer loss was 1.9% during fiscal 2003

compared to an initial target of 2.3% and the 4.8% loss during

fiscal 2002. Despite rate increases discussed further in the

“Revenue” section, these losses were lower than anticipated

owing to effective marketing and customer service, combined with

the continued success of service bundling. The installed digital

terminal base expanded by 26% with 183,087 digital terminals

in service as of August 31, 2003, exceeding the original target

of 170,000.

Subscriptions to the HSI service rose by 30%. HSI

customer additions were lower than anticipated due, in part,

to a slowing demand for HSI as the penetration rate increases.

Additionally, Cogeco Cable’s current strategy is to maximize

profitability per HSI customer by focusing its acquisition efforts

on the HSI Standard and Pro segments of the market. Unlike its

competitors, HSI Lite is only offered on a retention basis.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Cogeco Cable Inc. 2003 11

Cogeco Cable exceeded most

of its financial and customer

additions objectives.

2003 2002 August 31,

Actual Guidance Actual 2003 2002

Customer Statistics

Revenue generating units 1,188,369 64,011 58,000 41,405 NA NA

Basic service customers 820,657 (15,711) (19,000) (42,398) NA NA

HSI customers(2) 205,179 46,987 55,000 50,254 28.5 22.1

Digital terminals(3) 183,087 38,137 25,000 39,658 22.8 18.4

Bundled service customers(4) 288,080 46,394 NA 53,760 35.1 28.9

Net additions (losses) % of Penetration(1)

August 31, 2003

(1) As a percentage of basic service customers in areas served.

(2) 5,652 HSI Lite and 577 HSI Pro customers are included. Taking into account pending

orders, the number would amount to 210,974 compared to 164,318 a year earlier.

(3) 77% of terminals were purchased compared to 62% a year earlier.

(4) 48% of bundled service customers had the digital service compared to 44% last year.