Circuit City 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 1. Business.

General

Systemax is a direct marketer of brand name and private label products, including personal desktop computers

("PCs"), notebook computers, computer related products and industrial products in North America and Europe. The

Company assembles its own PCs and sells them under the trademarks Systemax™ , Tiger® and Ultra™ . In addition,

the Company markets and sells computers manufactured by Hewlett-Packard Company, International Business

Machines Corp. and other leading companies. The Company features a broad selection of products, prompt order

fulfillment and extensive customer service. Computers and computer related products accounted for 90% of the

Company's net sales in 2002.

Systemax markets its products through an integrated system of distinctively branded, full-color direct mail

catalogs, proprietary "e-commerce" internet sites and personalized "relationship marketing" to businesses, educational

organizations and government agencies. The Company targets individuals at major accounts (customers with more than

1,000 employees), mid-sized accounts (customers with 20 to 1,000 employees), small office/home office ("SOHO")

customers, resellers and consumers. The Company's portfolio of catalogs includes such established brand names as

Global Computer Supplies™, Misco, HCS Misco™, GlobalDirect™, ArrowStar™, Dartek.com™, TigerDirect.com™,

06™ and Infotel™. The Company mailed approximately 106 million catalogs comprising 37 different titles in 2002.

The Company currently has sixteen e-commerce web sites and in 2002 generated over $258 million in internet-related

sales (16.7% of net sales).

The Company operates in nine locations in North America. North American operations accounted for 62% of net

sales in 2002. European operations, which represented 38% of net sales for 2002, are generated from nine sales and/or

distribution centers located across Europe: two in England and one each in Scotland, France, Germany, Italy, Spain, the

Netherlands and Sweden.

A large number of the Company's products are carried in stock, and orders for such products are fulfilled

directly from the Company's distribution centers, typically on the day the order is received. The strategic locations of

the Company's distribution centers allow next day or second day delivery via low cost ground carriers throughout most

of the United States, Canada and Western Europe. The locations of the Company's distribution centers in Europe have

enabled the Company to market into four additional countries with limited incremental investment. The Company

maintains relationships with a number of distributors in the United States and Europe that deliver products directly to

the Company's customers.

Recent Developments

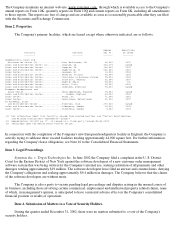

Goodwill Write-Off

Effective January 1, 2002, the Company adopted Financial Accounting Standards Board ("FASB") Statement of

Financial Accounting Standards ("SFAS") 142, "Goodwill and Other Intangible Assets", which establishes new

accounting and reporting requirements for goodwill and other intangible assets. SFAS 142 requires that goodwill

amortization be discontinued and replaced with periodic tests of impairment. During the first half of 2002, the

Company completed the transitional review for goodwill impairment required by SFAS 142. The review indicated that

the entire carrying value of the goodwill recorded on the Company's balance sheet was impaired. Accordingly, the

Company recorded a transitional impairment loss of $68 million ($51 million net of tax or a net loss per share of $1.50)

as a cumulative effect of change in accounting principle in its statements of operations as of January 1, 2002.

Other Charge

In the second quarter of 2002 the Company discontinued the development of internal-use order management

software that was being written. In connection with this decision, the Company recorded a pre-tax charge of

approximately $13.2 million. The Company determined that the software was unusable and filed a complaint in federal

court seeking restitution of all payments made to the software developers. (See Part I, Item 3. Legal Proceedings).

Mortgage Financing