Circuit City 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. The Company is obligated under operating leases for the rental of certain facilities and equipment which expire

at various dates through 2013. The Company currently leases its New York facility from an entity owned by Richard

Leeds, Robert Leeds and Bruce Leeds, the Company's three principal shareholders and senior executive officers. The

annual rental totals $612,000 and the lease expires in 2007.

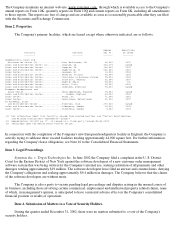

Following is a summary of the Company's contractual obligations for future principal payments on its debt,

minimum rental payments on its non-cancelable operating leases and minimum payments on its other commitments at

December 31, 2002 (in thousands):

After

2003 2004 2005 2006 2007 2007

---- ---- ---- ---- ---- ----

Contractual Obligations:

Maturities of long-term debt $1,250 $1,263 $1,250 $1,248 $1,261 $12,497

Payments on non-cancelable 5,948 5,583 5,569 5,278 4,569 8,454

operating leases

Purchase commitments 478 175 - - - -

------ ------ ------ ------ ------ -------

Total contractual obligations $7,676 $7,021 $6,819 $6,526 $5,830 $20,951

====== ====== ====== ====== ====== =======

Other Commitments:

Standby letters of credit $6,075 N/A N/A N/A N/A N/A

======

The Company's operating results have generated cash flow which, together with borrowings under its debt

agreements, have provided sufficient capital resources to finance working capital and cash operating requirements, fund

capital expenditures, and fund the payment of interest on outstanding debt. The Company's primary ongoing cash

requirements will be to finance working capital, fund the payment of interest on indebtedness and fund capital

expenditures. The Company believes future cash flows from operations and availability of borrowings under its lines of

credit will be sufficient to fund the Company's ongoing cash requirements.

The Company is party to certain litigation, as disclosed in "Commitments and Contingencies" in the Notes to

Consolidated Financial Statements, the outcome of which the Company believes, based on discussions with legal

counsel, will not have a material adverse effect on its consolidated financial statements.

Off-Balance Sheet Arrangements

The Company has not created, and is not party to, any special-purpose or off-balance sheet entities for the

purpose of raising capital, incurring debt or operating the Company's business. The Company does not have any

arrangements or relationships with entities that are not consolidated into the financial statements that are reasonably

likely to materially affect the Company's liquidity or the availability of capital resources.

Critical Accounting Policies and Estimates

The Company's significant accounting policies are described in Note 1 to the consolidated financial statements.

The policies below have been identified as critical to the Company's business operations and understanding the results

of operations. Certain accounting policies require the application of significant judgment by management in selecting

the appropriate assumptions for calculating financial estimates. By their nature, these judgments are subject to an

inherent degree of uncertainty, and as a result, actual results could differ from those estimates. These judgments are

based on historical experience , observation of trends in the industry, information provided by customers and

information available from other outside sources, as appropriate. Management believes that full consideration has been

given to all relevant circumstances that the Company may be subject to, and the consolidated financial statements of

the Company accurately reflect management's best estimate of the consolidated results of operations, financial position

and cash flows of the Company for the years presented.

Revenue Recognition and Accounts Receivable

. The Company recognizes sales based on the terms of the customer