Circuit City 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE

During the first half of 2002, the Company completed the transitional review for goodwill impairment required

by Statement of Financial Accounting Standards ("SFAS") 142. The review indicated that the entire carrying value of

the goodwill recorded on the Company's balance sheet was impaired as of January 1, 2002. Accordingly, the Company

recorded a transitional impairment loss of $68 million ($51 million net of tax or a net loss per share of $1.50) as a

cumulative effect of change in accounting principle in its statements of operations for the year ended December 31,

2002.

NET INCOME (LOSS)

As a result of the above, the net loss for 2002 was $58.9 million, or $1.73 per basic and diluted share, net

income for 2001 was $653,000, or $.02 per basic and diluted share, and the net loss for 2000 was $40.8 million, or

$1.19 per basic and diluted share.

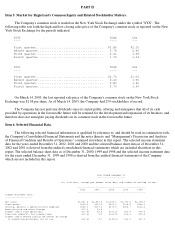

Seasonality

Net sales have historically been modestly weaker during the second and third quarter as a result of lower

business activity during the summer months. The following table sets forth the net sales, gross profit and income (loss)

from operations for each of the quarters since January 1, 2001 (amounts in millions) .

2002 March 31 June 30 September 30 December 31

---- -------- ------- ------------ -----------

Net sales........................................ $412 $364 $372 $403

Percentage of year's net sales ................... 26.6% 23.4% 24.0% 26.0%

Gross profit..................................... $74 $62 $63 $67

Income (loss) from operations.................... $1 $(14) $2 $4

2001 March 31 June 30 September 30 December 31

---- -------- ------- ------------ -----------

Net sales........................................ $406 $364 $371 $407

Percentage of year's net sales ................... 26.2% 23.5% 24.0% 26.3%

Gross profit..................................... $66 $61 $69 $80

Income (loss) from operations.................... $1 $(3) $1 $4

Financial Condition, Liquidity and Capital Resources

Liquidity is the ability to generate sufficient cash flows to meet obligations and commitments from operating

activities and the ability to obtain appropriate financing and to convert into cash those assets that are no longer required

to meet existing strategic and financing objectives. Therefore, liquidity cannot be considered separately from capital

resources that consist of current and potentially available funds for use in achieving long-range business objectives and

meeting debt service commitments. Currently, the Company's liquidity needs arise primarily from working capital

requirements and capital expenditures.

The Company's working capital was $133 million at December 31, 2002, up $30 million from $103 million at

the end of 2001. This was due principally to a $27 million increase in cash, a $12 million increase in accounts

receivable, a $6 million increase in inventories and a $4 million increase in prepaid expenses and other current assets

offset by an $18 million increase in amounts payable to banks.

The Company maintains its cash and cash equivalents primarily in money market funds or their equivalent. As

of December 31, 2002, all of the Company's investments mature in less than three months. Accordingly, the Company

does not believe that its investments have significant exposure to interest rate risk.

The Company's cash balance increased $26.5 million to $63.0 million during the year ended December 31, 2002.

Net cash provided by operating activities was $4.9 million in 2002, compared with $95.6 million in 2001 and $8.5

million in 2000. The decrease in cash provided by operations in 2002 was a result of changes in working capital that

used cash. Cash was provided by operations in 2001 by inventory reductions, decreases in accounts receivable and

receipt of a tax refund resulting from the loss recorded in 2000, offset by a decrease in accounts payable. Cash was