Circuit City 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Other factors that could contribute to or cause such differences include, but are not limited to, unanticipated

developments in any one or more of the following areas: (i) the effect on the Company of volatility in the price of paper

and periodic increases in postage rates, (ii) the operation of the Company's management information systems, (iii)

significant changes in the computer products retail industry, especially relating to the distribution and sale of such

products, (iv) the potential for expanded imposition of state sales taxes, use taxes, or other taxes on direct marketing

and e-commerce companies, (v) timely availability of existing and new products, (vi) risks involved with e-commerce,

including possible loss of business and customer dissatisfaction if outages or other computer-related problems should

preclude customer access to the Company, (vii) risks associated with delivery of merchandise to customers by utilizing

common delivery services such as the United States Postal Service and United Parcel Service, including possible

strikes and contamination, (viii) borrowing costs or availability, (ix) changes in taxes due to changes in the mix of U.S.

and non-U.S. revenue, (x) pending or threatened litigation and investigations and (xi) the availability of key personnel,

as well as other risk factors which may be detailed from time to time in the Company's Securities and Exchange

Commission filings.

Readers are cautioned not to place undue reliance on any forward looking statements contained in this report,

which speak only as of the date of this report. The Company undertakes no obligation to publicly release the result of

any revisions to these forward looking statements that may be made to reflect events or circumstances after the date

hereof or to reflect the occurrence of unexpected events.

Results of Operations

The Company had a net loss for the year ended December 31, 2002 of $58.9 million, after recording a

cumulative effect of change in accounting principle of $51 million, net of tax, to reflect the impairment of the entire

carrying amount of the Company's goodwill. The Company had net income for the year ended December 31, 2001 of

$653,000 and a net loss for the year ended December 31, 2000 of $40.8 million.

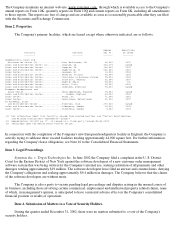

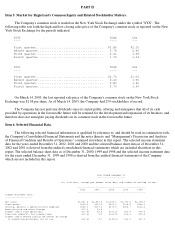

The following table represents the Company's consolidated statement of operations data expressed as a

percentage of net sales for the three most recent fiscal years:

2002 2001 2000

---- ---- ----

Net sales 100.0% 100.0% 100.0%

Gross profit 17.1% 17.9% 12.4%

Selling, general and administrative expenses 16.5% 17.6% 16.1%

Restructuring and other charges 1.1% 0.2%

Income (loss) from operations (0.5%) 0.2% (3.6%)

Interest expense 0.1% 0.1% 0.3%

Income taxes (0.1%) (1.5%)

Income (loss) before cumulative effect of change (0.5%) 0.1% (2.4%)

in accounting principle, net of tax

Cumulative effect of change in accounting principle, (3.3%)

net of tax

Net income (loss) (3.8%) 0.1% (2.4%)

NET SALES

Net sales of $1.552 billion in 2002 were $4.5 million or 0.3% higher than the $1.547 billion reported in 2001.

The continued weak worldwide economic environment has resulted in significantly reduced demand, particularly in the

technology sector. While sales to individual consumers showed growth, sales to business customers remained weak, as

the anticipated replacement cycle for PCs continued to be deferred due to declining capital expenditures. PC sales were

$350 million in 2002, representing 22.6% of the Company's net sales, which was largely unchanged from 2001. Sales

in North America decreased 1.9% to $964 million in 2002 from $983 million in 2001 primarily as a result of the

continuing economic slowdown in the United States. European sales increased 4.1% to $588 million in 2002 from $564

•

The Company maintains credit facilities in the United States and in the United Kingdom. If the Company is

unable to renew or replace these facilities at maturity, its liquidity and capital resources may be adversely

affected. However, the Company has no reason to believe that it will not be able to renew its facilities.