Chesapeake Energy 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 | Letter to Shareholders

The theme of this year’s annual report,

“Bold Moves, Big Future,” could also ac-

curately describe Chesapeake’s history.

When Tom Ward and I co-founded the company

in May 1989, we had a bold idea — to take advan-

tage of the new technology of horizontal drilling

and apply that technology to fractured carbon-

ate reservoirs, a type of reservoir that today,

along with other tight rock formations, is called

unconventional. We followed with the equally

bold idea that land acquisition skills could even-

tually become a key competitive advantage in an

industry traditionally dominated by the geologi-

cal and engineering disciplines.

Since its founding 23 years ago on these two

bold ideas, Chesapeake’s innovative business

strategy and successful growth have been defined

by other bold moves, based on certain keen in-

sights, that have helped create a big future for

our company.

BOLD ACQUISITION GROWTH

In the depths of the oil and gas recession of early

1999, I developed the insight that U.S. natural gas

prices would likely move significantly and struc-

turally higher as electricity usage was likely to

increase at above average rates (because of the

growth of the Internet and the increasing size of

the average American home, among other fac-

tors). I realized a multitude of new natural gas-

fired power generation plants would need to be

built to meet this increased demand, but didn’t

believe the U.S. natural gas supply could keep up

with this increased demand. From 1999 to 2005,

that insight led the company to the bold moves of

acquiring as many natural gas assets as we could

and developing an organization capable of oper-

ating a large-scale drilling program.

In the beginning, we pursued this strategy

with limited financial resources amid a great

deal of industry, research analyst and investor

skepticism. Many observers of our company bet

that natural gas prices would increase to $3 per

thousand cubic feet (mcf) from $1 per mcf before

Chesapeake’s stock price would increase to $3

per share from $1 per share. Despite such skepti-

cism, we performed our research thoroughly and

were convinced the die was cast for U.S. natu-

ral gas prices to rise substantially. In fact, that is

exactly what they did, increasing from a low of

$1.67 per mcf in 1999 to a high of $13.91 per mcf

in 2005.

DEAR FELLOW

SHAREHOLDERS

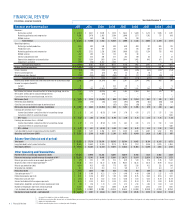

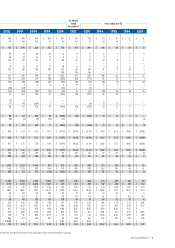

2011 Financial and Operational Highlights

Operating cash flow(2) increased 3% to $5.3 billion

Implemented and made significant progress toward the

company’s 25/25 Plan that calls for a 25% reduction in

long-term debt and a 25% increase in production over

the two-year period ending December 31, 2012

Announced discovery of the Utica Shale play in eastern Ohio

Significantly shifted drilling and completion capital to

liquids-rich plays

Monetized more than $7.0 billion of proved and

unproved properties including the complete exit from

the Fayetteville Shale in Arkansas

Made strategic investments in natural gas demand

creation initiatives

Average daily liquids production increased 72% from

50,000 bbls in 2010 to 87,000 bbls in 2011

Average daily natural gas production increased 9%

from 2.5 bcf in 2010 to 2.8 bcf in 2011

Proved natural gas and oil reserves increased 10% from

17.1 tcfe in 2010 to 18.8 tcfe in 2011

2011 reserve replacement reached 242% at a drilling

and completion cost on proved properties of only

$1.08 per mcfe(1)

Revenues increased 24% to $11.6 billion

Realized hedging gains were $1.6 billion

Adjusted ebitda(2) increased 6% to $5.4 billion