Chesapeake Energy 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

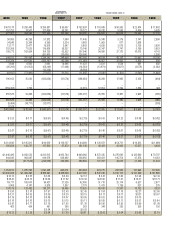

•Operating cash flow2

grew 73% from $1.4 billion to $2.4

billion;

•Net income per fully diluted common share increased 64%

from $1.53 to $2.51; and

•Total return to common shareholders reached 94%, improving

our total return to common shareholders to almost 2,300%

for the 13 years since our IPO in 1993.

As a result of our achievements in 2005, Chesapeake became

the second largest independent producer of U.S. natural gas and

the sixth largest producer overall. We produce roughly 2.5% of the

nation’s natural gas from our 30,000 wells. Moreover, we led the

nation in drilling activity last year, using an average of 73 operated

rigs and 66 non-operated rigs, or 10% of the nation’s drilling rig

fleet, to drill almost 2,000 wells. In 2006, we again expect to lead

the industry in drilling and also expect to increase our total production

by approximately 25% through the drillbit and through acquisitions.

In addition, we anticipate increasing the company’s net asset value

per share by a similar amount.

Chesapeake’s industry-leading drilling activity and consistent

annual production growth (typically exceeding 25%) require great

geological prospects and great people – assets that Chesapeake

fortunately has in abundance. In addition to more than doubling our

drilling backlog to 28,000 locations since the beginning of 2005,

we have also doubled our employee count to over 3,500. Most

industries (and often ours in the past) report with pride on being

able to reduce their employee head count each year. However, after

15 difficult years from 1985 to 2000, our industry is increasingly

short on human capital, especially for employees younger than 40.

We were early to recognize the importance of being a first mover in

attracting the human resources necessary to create long-term

shareholder value and we anticipate that we will continue hiring

aggressively in 2006.

CHESAPEAKE’S BUSINESS STRATEGY AND

NATURAL GAS FOCUS Chesapeake’s business strategy

is probably the easiest to understand among all large-cap public

exploration and production (E&P) companies. We grow onshore in

the U.S. through a balance of drilling and acquisitions, we regionally

consolidate to achieve economies of scale, we focus almost exclusively

on finding and producing natural gas and we work proactively to

mitigate risk. By executing this strategy effectively, Chesapeake

became America’s top performing stock during the past seven years.3

In addition to the simplicity of our business strategy, our early

recognition of evolving trends in natural gas markets and our

willingness to seize opportunities have distinguished Chesapeake

among its peers. Back in 1998 and early 1999, when natural gas

was exceptionally cheap (frequently selling for less than $1.25 per

mmbtu), most industry and government observers predicted that the

U.S. natural gas market would increase from 22 tcf to 30 tcf per year

by 2010 and that natural gas prices would remain low indefinitely.

After examining the fundamentals of the North American natural

gas market, we arrived at a very different conclusion and began

repositioning the company to pursue a contrarian strategy based on

the following beliefs about the U.S. natural gas industry beyond the

year 2000:

•production depletion rates would accelerate;

•finding, development and operating costs would increase;

•demand would gradually move away from more cost-sensitive

“Chesapeake’s business

strategy is probably the

easiest to understand

among all large-cap

public exploration and

production companies.

We grow onshore in the

U.S. through a balance

of drilling and acqui-

sitions, we regionally

consolidate to achieve

economies of scale, we

focus almost exclusively

on finding and pro-

ducing natural gas and

we work proactively to

mitigate risk.”

4 CHK 2005 ANNUAL REPORT