Chesapeake Energy 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

total, the company now has more than 3,500 employees, of which

approximately 70% work in the company’s E&P operations and 30%

work in the company’s oilfield service operations. These people are

a highly valued (and much coveted) resource and we are proud they

have chosen Chesapeake as their professional home.

During the past eight years, we have invested more than $3 billion

in new leasehold and 3-D seismic data and now own the largest

inventories in the U.S. of onshore leasehold (8.4 million net acres)

and 3-D seismic data (11.6 million acres). As a result, we believe

Chesapeake has unparalleled opportunities for future value creation.

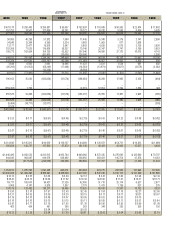

As to future drilling opportunities, we organize Chesapeake’s

drilling inventory by one of four play types: conventional gas resource,

unconventional gas resource, emerging gas resource and Appalachian

Basin gas resource. The company’s current leasehold and proved

undeveloped and unproved reserve totals by play type are set

forth below:

•2.8 million net acres in our traditional conventional areas (i.e.,

much of the Mid-Continent, Permian, Gulf Coast, South Texas

and other areas) on which we have identified approximately

2,700 drillsites, 1.0 tcfe of proved undeveloped reserves and

approximately 1.0 tcfe of unproved reserves;

•1.1 million net acres in our unconventional gas resource

areas (i.e., Sahara, Granite/Cherokee/Atoka Washes, Hartshorne

CBM, Barnett Shale and Ark-La-Tex tight sands) on which

we have identified approximately 14,000 drillsites, 1.3 tcfe of

proved undeveloped reserves and approximately 4.2 tcfe of

unproved reserves;

•1.2 million net acres in our emerging gas resource areas (i.e.,

Fayetteville Shale, Caney/Woodford Shales, Deep Haley, Deep

Bossier and others) on which we have identified approximately

2,000 drillsites, 0.1 tcfe of proved undeveloped reserves and

approximately 1.9 tcfe of unproved reserves; and

•3.3 million net acres in the Appalachian Basin, where our

play types range from conventional to unconventional to

emerging gas resource. On the significant Appalachian Basin

acreage base acquired from CNR in November 2005, we have

identified approximately 9,200 drillsites, 0.4 tcfe of proved

undeveloped reserves and more than 1.7 tcfe of unproved

reserves.

The company continues to actively acquire more acreage throughout

our operating areas with 1.4 million acres acquired in 2005, of which

almost 500,000 acres were acquired in the 2005 fourth quarter alone

through an aggressive land acquisition program that is currently

utilizing more than 900 contract landmen in the field.

THE COLUMBIA NATURAL RESOURCES

ACQUISITION At the end of the 2005 third quarter, we announced

the largest transaction in the company’s history – the acquisition of

Appalachian natural gas producer Columbia Natural Resources (CNR).

Through this transaction, Chesapeake acquired daily net production

of 125 mmcfe, an extensive 6,500 mile network of natural gas gathering

pipelines, and an internally estimated 3.0 tcfe of proved, probable and

possible reserves, comprised of 1.3 tcfe of proved reserves and 1.7

tcfe of probable and possible reserves. The purchase price was $3

“The company

continues to actively

acquire more acreage

throughout our

operating areas with

1.4 million acres

acquired in 2005, of

which almost 500,000

acres was acquired in

the 2005 fourth quarter

alone through an

aggressive land

acquisition program

that is currently

utilizing more than

900 contract landmen

in the field.”

CHK 2005 ANNUALREPORT 9